Bitcoin Rises Above $27k, Liquidates $200M

Bitcoin (BTC) rose to a nine-month high above $27,000 and has liquidated more than $200 million from short sellers, according to available data.

Over the past 24 hours, BTC is up 4.24% to $27,470 at the time of writing, according to BeInCrypto data. This continued its positive price trend over the past seven days, increasing by approximately 37% and 13% over the past month.

After mainly trading around $20,000 to $24,000 in February, BTC fell below $20,000 in early March after USD Coin (USDC) depegged. However, the recent collapse of several crypto-friendly banks in the US has pushed more investors into Bitcoin.

The head of research at MatrixPort, Markus Thielen, told BeInCrypto that the BTC price rose due to the rescue package for depositors issued by the US government last week on Sunday and as regional bank stocks fell before the market opened the following Monday. Thielen added that if BTC can sustain its current run, the next target will be $28,000 or $30,000.

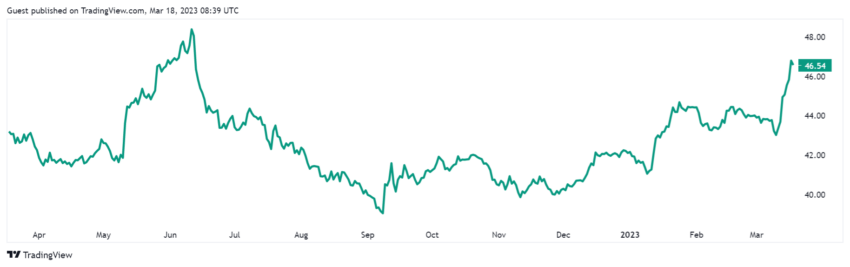

BTC dominance rises to 9-month high

Bitcoin’s dominance has also climbed to a nine-month high of 46.54%, according to Tradingview data. The last time BTC dominance reached this high was in June 2022.

Generally, BTC’s dominance tends to rise during market volatility as it is mainly considered a more stable asset than rival cryptocurrencies.

Meanwhile, Bitcoin has outcompeted traditional assets such as gold, the NASDAQ and the S&P 500 in the current year. In 2023, BTC has grown by more than 50%, while the best-performing traditional asset is the NASDAQ, which is up around 20%.

Over 200 million dollars in liquidations

While the market is all green due to the recent increase in Bitcoin value, traders who have short positions against Bitcoin and other cryptocurrencies are in the red. Coinglass data shows that $227 million of positions have been liquidated in the last 24 hours, affecting 66,373 traders.

Bitcoin accounts for most of the liquidation, with $108.06 million worth of BTC positions liquidated. The most important is a short position of $4.74 million against BTC on BitMEX.

Top 10 assets return an average of 3%

Other digital assets on the top 10 crypto assets list posted an average increase of 3% over the past 24 hours, according to BeInCrypto data.

During the reporting period, Ethereum rose 5.24% to $1,815, while BNB increased 3.07% to $343. Cardano, XRP and Polygon increased by 4.44%, 3.04% and 3.63% respectively.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.