Bitcoin Rises 81% YTD: Is The Rally For Real Or Just FOMO? (BTC-USD)

RichVintage/E+ via Getty Images

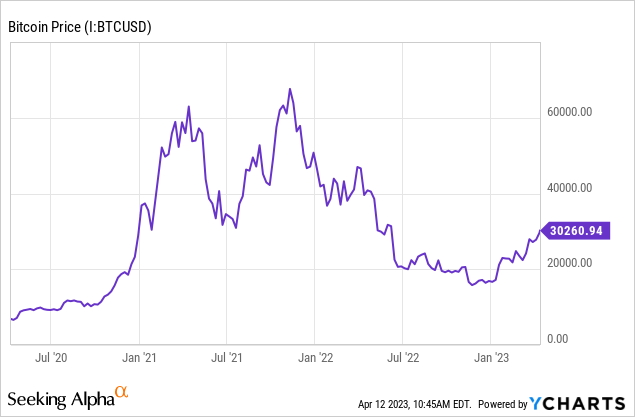

Bitcoin (BTC-USD) is now up over 81% for the year at the time of writing following a spate of high-profile bank failures. March’s chaos sparked intense investor interest in alternatives to the US banking system. Bitcoin’s rally has mirrored a broader explosion in investor risk appetite that has sent Apple (AAPL) up 29% without news, Tesla (TSLA) up 72%, and meme stocks like Carvana (CVNA), AMC Entertainment (AMC), and GameStop (GME) up anywhere from 30% to 100%. In less than 90 days, investor sentiment has swung from fear to unbridled greed.

Generally, when something increases that much in a short period of time along with other speculative investments, it is likely to turn! There are many warning signs that the broader risk rally is largely driven by FOMO. But there is more to the story of Bitcoin than just getting caught up in a speculative frenzy among investors? Of the reasons to buy Bitcoin, “because it’s skyrocketing” is probably one to avoid. However, there are some interesting developments below the surface that point to the fundamental value of Bitcoin increasing. There are some pros and cons to Bitcoin to weigh, and there’s an interesting legal situation that could offer big upside for investors in the popular Grayscale Bitcoin Trust (OTC:GBTC) too.

Arguments in favor of Bitcoin

1. Global adoption continues

Inflation in Argentina recently topped 100% annually, Bolivia is plagued by a huge dollar shortage and rumors of an impending currency devaluation, and inflation in Turkey is hovering around 50% annually. Also, Colombia and Brazil have both elected leftist governments in the past year, sending many of those with accumulated wealth to the exits. Bitcoin is an important check on the ability of governments to redistribute wealth by printing money. The more fear of this there is around the world, the more demand you can expect for Bitcoin at any given time. Aggregate market data shows steady usage for Bitcoin, with a record number of addresses now holding at least one coin. This has allowed Bitcoin to stage an impressive price rally after being in the dumps in late 2022 during the fallout of several alleged Ponzi-like crypto schemes that failed.

While many of the bets coming into Bitcoin are related to false rumors of new money printing in the US, Americans’ worst economic fears have been the daily reality of many Third World countries for the past 150 years. Wherever you are in the world, Bitcoin represents insurance against widespread currency depreciation.

Even Argentina has embraced crypto as their political situation has worsened, recently allowing Bitcoin futures to trade in Buenos Aires. The small Central American country of El Salvador has led the charge for Bitcoin adoption by making it legal tender. President Nayib Bukele’s authoritarian style attracted his share of controversy along the way. However, under his watch, murders in El Salvador fell by 57% in 2022 and are now at levels comparable to the United States. There, Bitcoin forms a nice supplement to the US dollar, which is used as currency in the country.

2. Bitcoin is insurance against government default

The market currently believes that the US central bank will succeed in bringing down inflation. We know this because the 10-year inflation breakeven for TIPS is about 2.3%. If later inflation becomes higher, you can buy TIPS and earn more than you can earn in US Treasuries. If inflation is lower, you will earn more by buying nominal government bonds. It is possible for inflation breakevens to be wrong – after all, they did not predict the rise in inflation in the 2020s so far.

Of course you can buy TIPS and earn more if inflation comes higher, but Bitcoin offers a hedge against a potentially more serious outcome, that is the Fed throwing in the towel and letting inflation rise to 20% per year or more effectively defaulting on the US Treasury debt and exiting the US dollar’s reign as the world’s reserve currency. Widespread vote buying and massive budget deficits are what got countries like Argentina and Turkey into so much trouble, and if the US were to repeatedly make the same mistakes that developing countries have, we would eventually get the results they have. Such a scenario would be an unmitigated disaster for the US economy, and I don’t think it will happen, but if it does, you’ll be glad you owned some Bitcoin, as people in the US would dump their savings held in dollars en masse for alternatives like crypto. For these reasons, Bitcoin has some insurance value against huge devaluations in the dollar.

For the record, after studying the situation thoroughly, I don’t think that will be America’s future. Replacing the patchwork system of state and local sales taxes with a 20% sales tax (as a national sales tax) would effectively fix deficits in government budgets, and could be coupled with modest tax cuts in income taxes. I firmly believe that the US would rather do this than descend into economic and political chaos, but you never know! That’s why Bitcoin is so attractive now, and why gold has held its appeal for thousands of years.

Arguments against Bitcoin

A couple of arguments worth discussing against buying Bitcoin here.

1. Will more crypto abuses be exposed?

Of course, the crypto world has had its own share of characters who have taken advantage of the lack of regulation in the space. These have nothing to do with Bitcoin, but they are part of the wider crypto world. Terra (LUNA-USD) co-founder Do Kwon was recently arrested in Montenegro for his role in the $40 billion collapse of TerraUSD and Luna coins. FTX CEO Sam Bankman-Fried recently had new charges added by US prosecutors for allegedly bribing Chinese government officials, in addition to the charges from the massive FTX implosion. Crypto mogul Changpeng Zhao has moved to Dubai (UAE) amid growing investigations in the US and other countries into Binance’s business practices. The UAE notably has no extradition treaty with the US.

Bitcoin’s early adoption was largely among nerdy libertarians, and the project’s success turned thousands of them into young multimillionaires. However, it wasn’t long before criminals, fraudsters and money launderers followed them into the crypto world looking to make a quick buck or circumvent the law. The number of investigations still pending and questions about the soundness of major crypto projects is a shoe that is going to drop for BTC at some point.

I would see it as a buying opportunity because there would be forced sellers, but this is not a risk you can completely ignore. I see the odds of all the “bezzle” being successfully rooted out of the crypto ecosystem as pretty low. Interest rate hikes are likely to reveal the rest in time. There’s simply no way of knowing how much crime still exists in crypto, and we’re less than a month away from two major crypto-focused banks closing their doors.

2. Bitcoin pays no interest

The clearest argument against Bitcoin now is that you don’t earn any interest on your money. Bitcoin has a negative real yield since the current inflation rate is 1.8% (this comes from mining). Next year, Bitcoin will undergo a halving which will bring the inflation rate down, but the US dollar is starting to offer interesting competition. If we assume inflation ticks down to 3% by the end of the year and the Fed keeps cash rates close to 5%, Bitcoin will have a similar rate of inflation but no interest. Many long-term comparisons of fiat currency vs. gold omits pure interest spread for fiat currency. However, choosing the wrong fiat currency has ended in disaster, as investors in China and Russia found out in the 20th century.

All things considered, I consider it a disadvantage that Bitcoin pays no interest when MMFs pay almost 5%. Through the 2010s and until 2021, this disadvantage did not really exist. If you believe in BTC for the long term, however, this makes it easy to be patient because you can get your money market fund savings and dollar cost averaging into Bitcoin over time.

3. Bitcoin has maniacal shareholders

This gigantic rally in risky assets has largely stemmed from a belief among speculators that the Fed is not serious about bringing down inflation. But historically, there is nothing unusual about a cash rate of 5% and an inflation rate of 3%. To the extent that BTC is tied to all the other speculative assets, short-term fortunes are likely to rise and fall with them. Put another way, it’s a risk when you put your money in the same place as hordes of reckless speculators. Sometimes they are right about the assets they choose, but often they distort prices with fear, greed and FOMO. The thing about Bitcoin is that it is clear that there is enormous value in its existence, but also a wide disagreement about what that value is. Bitcoin’s current market cap is just under $600 billion, which is about 50% greater than the value of JPMorgan Chase ( JPM ) but only about 1/5 the value of Apple.

What should be the value of a global system for storing, storing and sending wealth via the internet and outside the control of the central bank? That is essentially what Bitcoin is. There is huge disagreement about what the correct value is, but I would say that it is worth a lot.

GBTC: A way to buy Bitcoin with higher upside

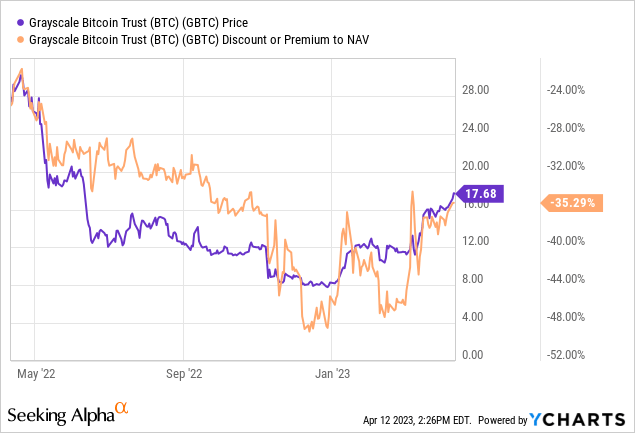

As part of this wide disagreement about the true value of crypto, the market tends to be less efficient than the stock market. For example, Bitcoin futures used to trade at a large premium to the underlying coin, while Grayscale Bitcoin Trust also traded at a large premium, and now trades at a large discount.

The discount is currently about 35% of the value of the underlying Bitcoin, which means you can get a 54% return if the underlying value can be realized. To calculate the return, you simply take the value of the NAV divided by the price you pay. In this case, 1/0.65= 1.54, or a return of $1.54 for every dollar you deposit.

So how would this happen?

Grayscale is currently locking horns with the Securities and Exchange Commission over converting their Grayscale Bitcoin Trust into an ETF. This will allow them to create and redeem shares until they have equalized the market value of the ETF with its net asset value. The SEC rejected Grayscale’s request, but has previously approved a Bitcoin futures ETF (BITO). Grayscale appealed the decision to a federal court in DC. This has been going on for over a year, but reporting from the Court of Appeal is that the judges appear to be open to the idea of allowing them to convert. I think Grayscale wins here.

Grayscales aren’t the most popular these days, and they’ve also come under tremendous activist pressure over the persistent discount in GBTC.

One way or another, I expect the billions in sequestered value to be unlocked from this fund. There is an administration fee of 2% per annum, but it will pay for itself well over a decade at today’s discount. This has been a trade that has been dead money for a while, but something will eventually unlock this.

The bottom line

The broader rise in risk assets is speculative and likely exaggerated. However, the fundamental case for Bitcoin is intriguing compared to other risk assets. Combined with a kicker of about 54% if GBTC is able to convert GBTC to an ETF, I think the risk/reward is good for a small to moderate investment in Bitcoin via GBTC. A decision in the case is expected sometime in the third quarter of this year.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Be aware of the risks associated with these stocks.