Bitcoin regional supply shift shifts from US to Asia

The regional supply change of Bitcoin swings from the US to Asia. A clear transition can be seen as US federal regulators step up efforts to stop the industry.

Crypto companies aren’t the only entities leaving the US. Bitcoin investors also seem to be turning to Asia as Uncle Sam tightens the screws on digital assets.

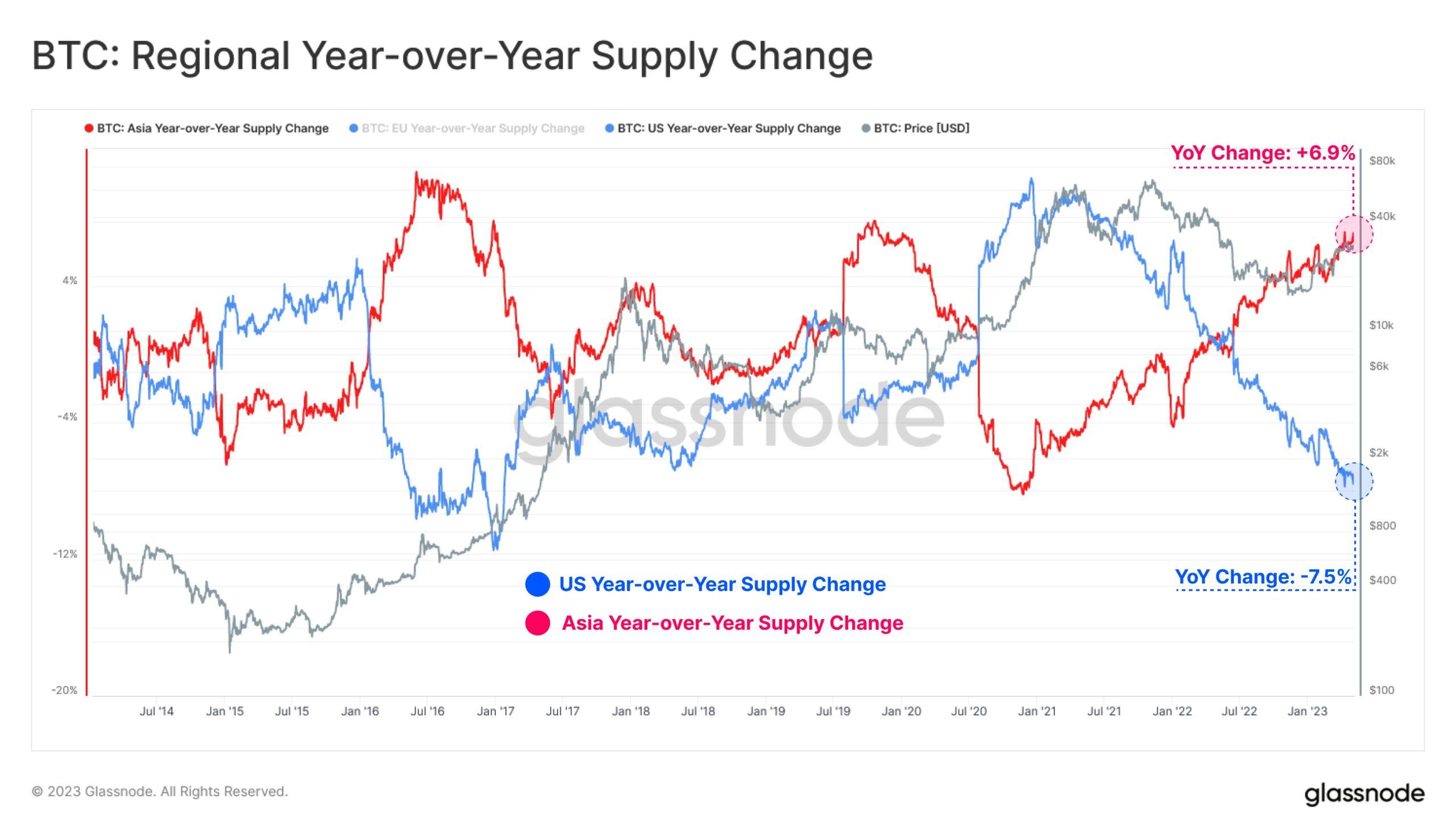

According to data from the analysis platform Glassnode in the chain, the regional supply change from year to year has formed a divergence. A dichotomy has arisen between the supply held according to business hours in the US and Asia, it observed on May 9.

The data suggests that “coins previously based in the US continue to be transferred to wallets in Asia,” Glassnode noted.

The contrast is strong. The year-over-year US supply change decreased by 7.5%, while the supply change in Asia increased by 6.9%.

Bitcoin Leaving American Shores?

The divergence began in the first half of 2022. Looking at the chart, it suggests that was around the time of the Terra/Luna ecosystem collapse. The dichotomy has accelerated since then and shows no sign of reversal.

The geographic shift in Bitcoin supply is likely a direct result of an attack on crypto exchanges and wallet providers in the US

The diagram can also symbolize a geographical policy shift. Over the past year, the US has become increasingly hostile to crypto, while Asia is opening up to the industry.

America’s largest crypto exchange Coinbase has signaled its intentions to move offshore. The decision comes after a threat of enforcement from the Securities and Exchange Commission.

Furthermore, Gemini has also stated that it will open an offshore exchange after regulatory scrutiny. Bittrex shut down its US operations in March and filed for Chapter 11 bankruptcy protection this week following SEC action in April.

On May 9, two of the world’s largest market players said they are halting US crypto trading plans. Jane Street Group and Jump Crypto cited regulatory uncertainty for their decisions, with the latter considering a move offshore.

Encryption of crypto mining

Pressure on US crypto mining companies is also likely to result in them moving to friendlier jurisdictions.

When China banned Bitcoin mining, America became the beneficiary, but this seems to be short-lived. The Biden administration has proposed a 30% energy tax on BTC miners making operations more expensive than they already are.

The net result is likely to be a wasteland of talent, technology, resource and digital financial innovation if Uncle Sam continues his war on crypto.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.