Bitcoin Rebounds Above $22K, Stocks Struggle After Fed Chair Powell Says Rates ‘Will Likely Go Higher’

Join the most important conversation in crypto and web3! Secure your place today

Bitcoin fell below $22,000 after US Federal Reserve Chairman Jerome Powell said in prepared remarks in his two days of biannual monetary policy testimony before Congress that inflation had remained unexpectedly high. But the largest cryptocurrency by market capitalization quickly recovered to trade above the threshold for much of Tuesday.

BTC was recently trading at around $22,060, down about 1.6% from the same time on Monday. Bitcoin has largely held above $22,000, even as a flurry of jobs and price indicators have re-raised inflation concerns.

“The latest economic data has come in stronger than expected, suggesting that the final level of interest rates is likely to be higher than previously expected,” Powell told the Senate Banking Committee on Tuesday. “If the totality of the data should indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

Ether (ETH), the second largest cryptocurrency, fell 1% in the last 24 hours to trade around $1,550. The CoinDesk Market Index, which measures the overall performance of the crypto market, was down 1.3% for the day.

Most other major cryptos were largely in the red, in line with stock markets, which also struggled with Powell’s comments. The S&P 500, Wall Street’s benchmark index for stocks, closed down 1.5% and the Dow Jones Industrial Average (DJIA) and tech-heavy Nasdaq Composite fell 1.7% and 1.2%, respectively. Prospects for a rate hike of 50 basis points (bps) instead of a more dovish 25 bps are now above 70%, about the opposite of the probability last week, according to the CME FedWatch Tool.

Prices are currently “the missing piece of the puzzle,” David Brickell, director of institutional sales at crypto-liquidity network Paradigm, wrote in a weekly newsletter. “Should they continue to reverse lower, conditions look ripe for a push higher, which would be painful for a market that remains under-positioned to risk.”

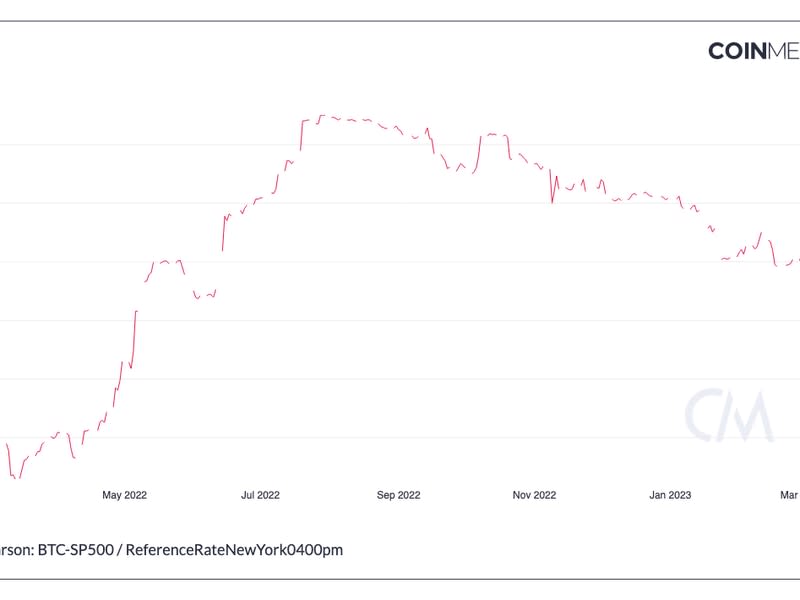

However, the correlation between crypto and stocks has been decreasing since the end of 2022, with the 90-day correlation coefficient of bitcoin and the S&P 500 currently reaching 0.38 – the lowest level since June 2022, Coin Metrics’ data showed. A coefficient of 1 means that the movements are perfectly synchronized, while a negative 1 indicates that they move in opposite directions.

Samir Kerbage, chief investment officer at crypto asset manager Hashdex, told CoinDesk in an interview that “a big move” in crypto prices could still occur if the Fed’s rate hike turns out to be “much different” than the consensus expectation. The 50 basis point increase for March is “still painful” for markets, he added.

Edward Moya, senior market analyst at forex market maker Oanda, wrote in a Tuesday note that while BTC was able to hold on to the lower bounds of its key trading range following Powell’s testimony, risk appetite across the board is “very vulnerable.”

“If this wave of risk aversion does not pass, cryptos may struggle to make new 2023 lows,” he wrote.