Bitcoin Realized Cap Vs. market value reveals change in safety flight dynamics

An analysis of Bitcoin Dominance (BTC.D) market capitalization and realized cap data by CryptoSlate suggests that users are increasingly using stablecoins, rather than BTC, as a safe haven.

Most people are familiar with market cap, which is calculated by multiplying the circulating supply by the current token price.

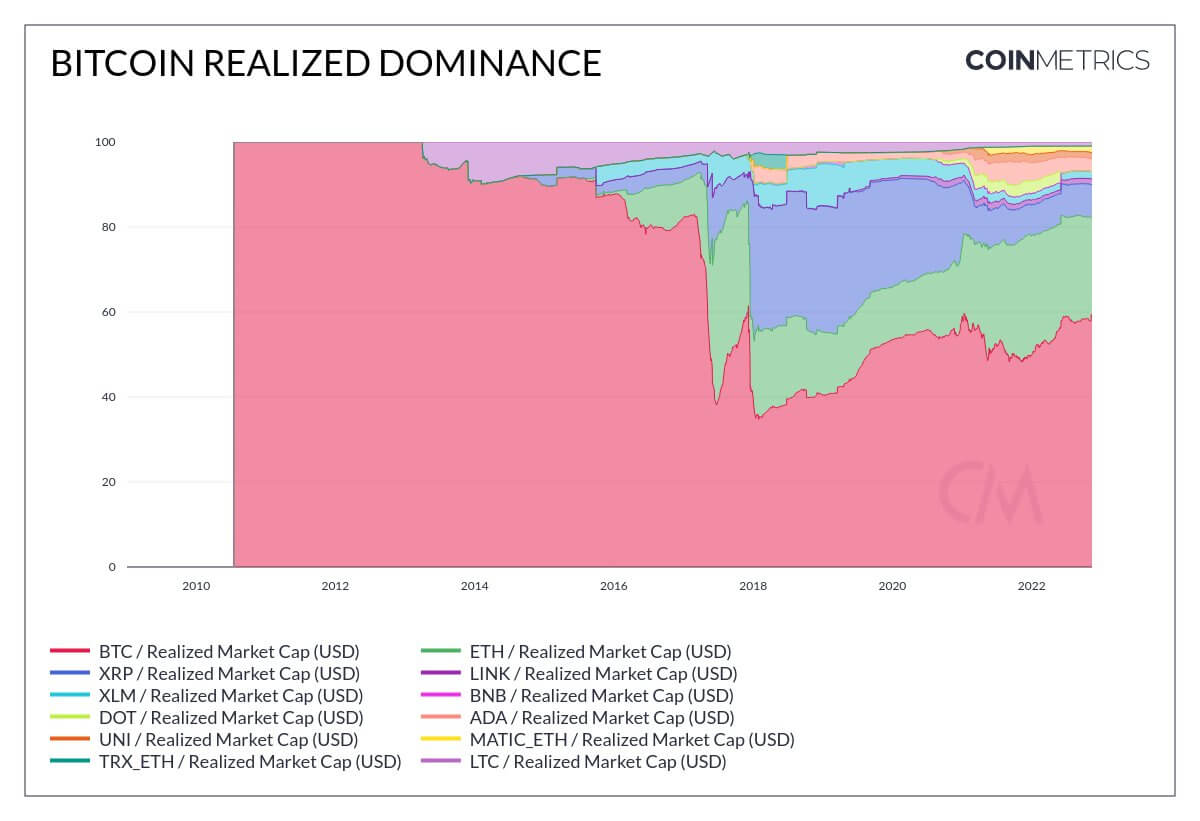

Realized cap is also a valuation, but differs from the market value by replacing the current token price with the price at the time the token last moved. This method is said to provide a more accurate measure of valuation as it considers and minimizes the effect of lost and unrecoverable coins.

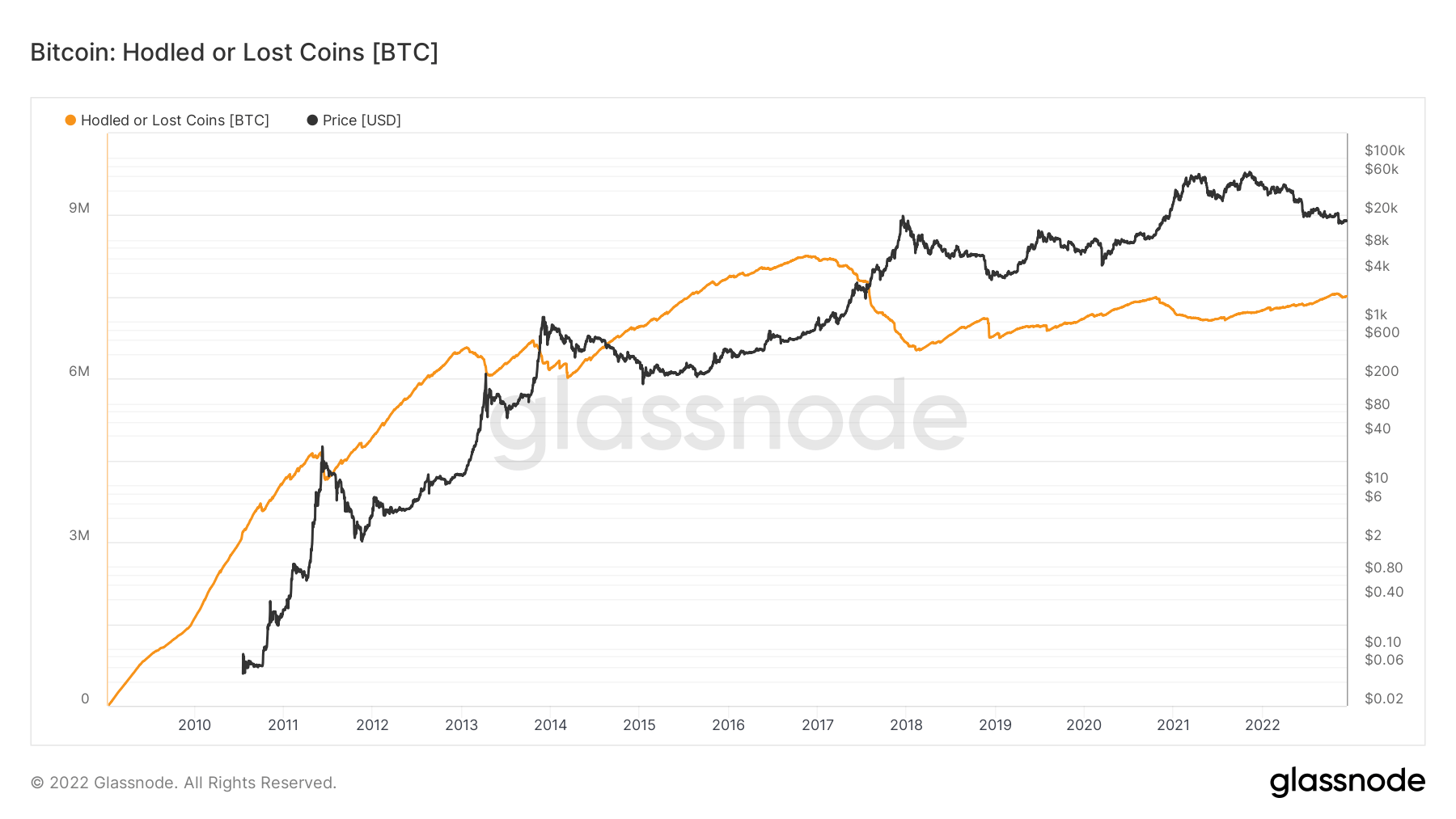

Glassnode’s estimated hodled or lost coins currently come in at around 7 million tokens, which represents a significant proportion of the circulating supply.

If a token has never moved, the realized price of that token is zero, and if a token has not moved for a long time, the impact is recorded at a much lower price than the current price. Therefore, active tokens make up the main part of the realized cap value, and provide a more comprehensive and representative figure in relation to market value.

However, realized cap does not distinguish between tokens that are lost/irretrievable and those that are in deep storage. Therefore, while it does not emphasize the impact of lost/unrecoverable coins, it is still not a perfect valuation measure.

Despite that, market value is much more used than realized cap. For example, in the calculation of BTC.D.

Bitcoin market dominance

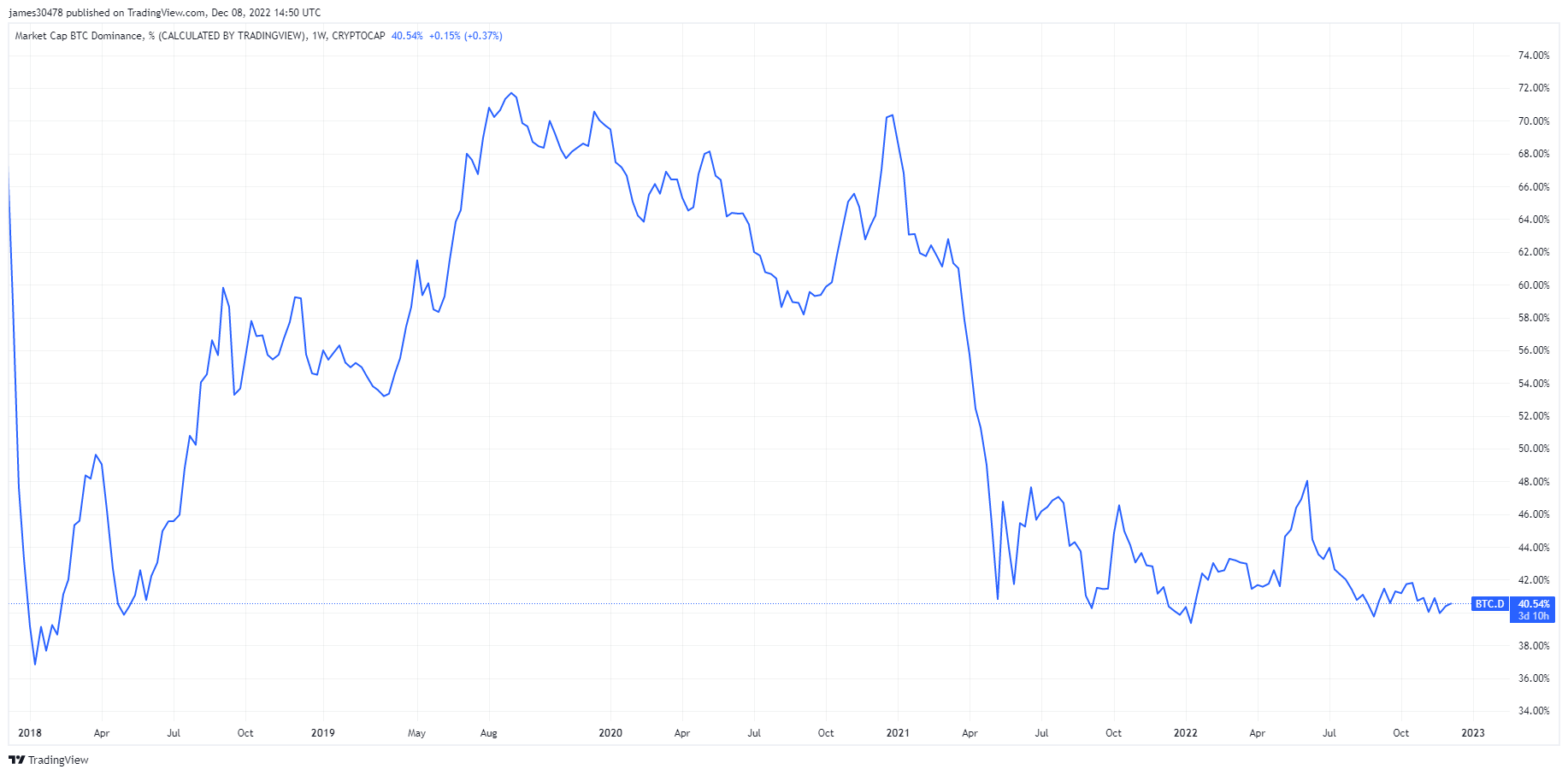

The crypto markets are now over a year since their market peak. During this time, BTC.D has been as low as 38.9%, peaking at 48.6% in June following the Terra implosion and subsequent flight to safety.

BTC.D is calculated using the total crypto market cap divided by Bitcoin’s market cap. Currently, Bitcoin dominance is at 40.7%, hovering near cycle lows.

In previous bear markets BTC.D has been much higher, with the bear in the previous cycle BTC.D now saw as high as 73.9%.

Using realized cap, rather than market cap, to calculate BTC.D gives a current figure of 60%, which is more in line with the expectations of the bulk of users who cycle into Bitcoin as a safety bet during a bear market.

However, similar to the market cap method for calculating BTC.D, the realized cap method also shows dominance with much higher percentages (than 60%) during previous bear markets, such as in 2015, when it was around 90%.

This raises questions about changes in market dynamics in 2022 versus 2015.

The rise of stablecoins

Stablecoins are designed to stay at a fixed value regardless of cryptocurrency price volatility. They provide a means to enter and exit positions while retaining capital in the cryptocurrency market.

BitUSD was the first stablecoin to hit the market, launching in July 2014. But it wasn’t until 2015, when Tether was launched, that stablecoins began to make their mark. Before Tether became popular, investors tended to cycle into Bitcoin during bear markets. But since around 2017 this has not been the case.

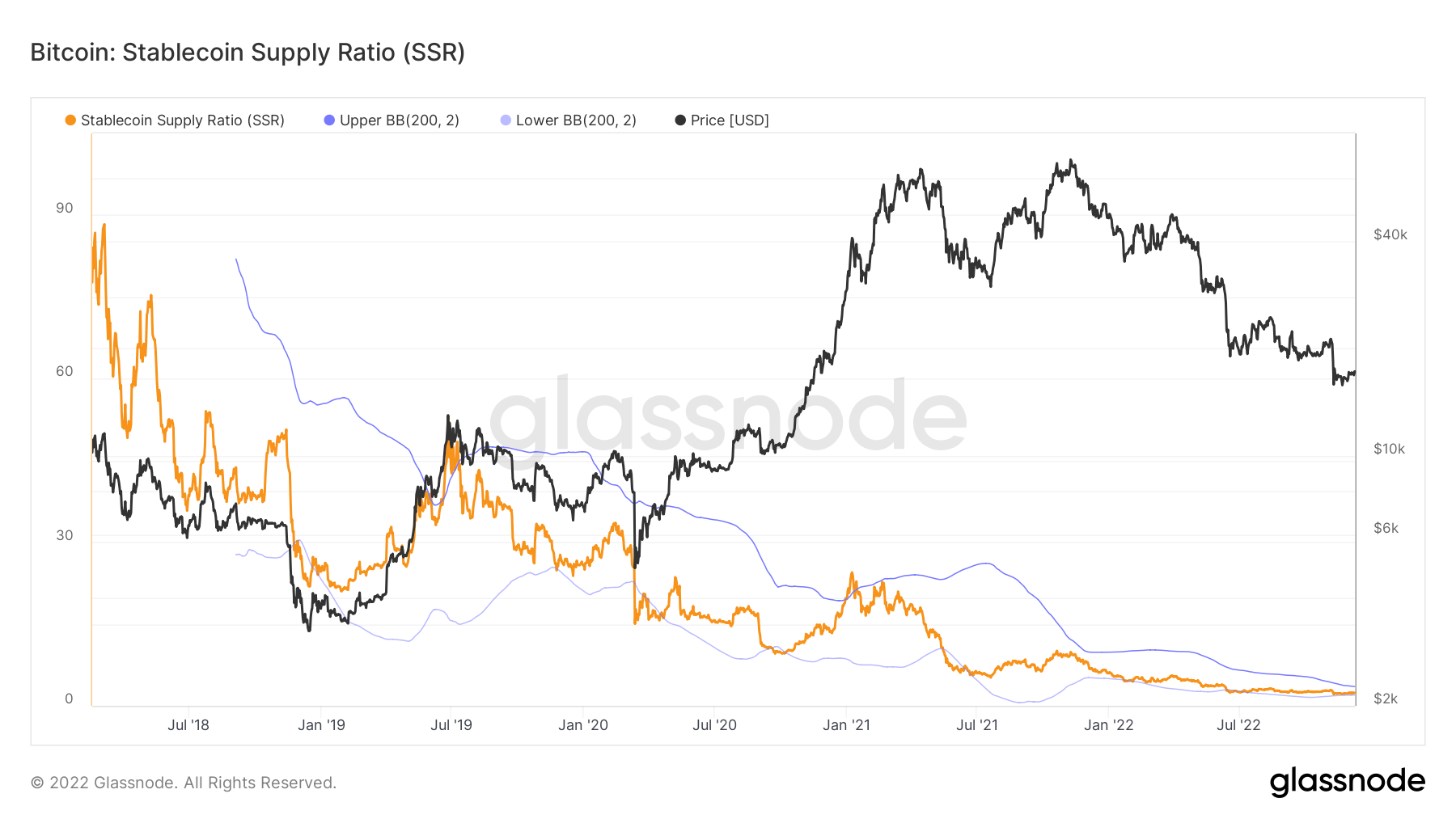

The chart below shows the Bitcoin:Stablecoin Supply Ratio (SSR) on a macro downtrend since 2018, giving a current ratio of approximately 2. This calculation illustrates the ratio of Bitcoin supply to Stablecoin supply, denominated in BTC.

When SSR is low, this indicates that the current stablecoin supply has high buying potential. In other words, a low SSR corresponds to a high proportion of sidelined stablecoins.

When taken in context with the trend of falling BTC.D, it suggests that stablecoins are becoming the best choice for safety flight.