Bitcoin ready for mining, relief summer still in play?

Bitcoin has been able to revive in recent weeks. The $25,000 barrier was recaptured by Bitcoin prices just two days ago, marking the first time since June 13.

Bitcoin ready for new rally

In June, Bitcoin had its biggest monthly decline since 2011, falling over 37.3% to a final value of $19,925. Since then, it has partially recovered its value and today saw its first test of $25,000.

Bitcoin continues to rule the charts despite being down 46.5% from its previous peak, but its dominance has dropped to just under 40% as opposed to more than 50% a few months ago.

BTC/USD trades slightly below $24k. Source: TradingView

However, Bitcoin has fluctuated relatively peacefully horizontally for the past two weeks between $22,500 and $24,500. At the same time, recent weeks have seen a significant improvement in both commodity prices and stock markets. As a result, the overall financial markets are experiencing the expected summer rally.

Since sentiment had reached a state of severe panic in mid-June as a result of financial markets’ steep, month-long decline, sentiment among participants has improved sharply during the recent recovery. This in itself is a well-known bear market pattern. However, it will not be known whether and how the bears will return until around mid-September.

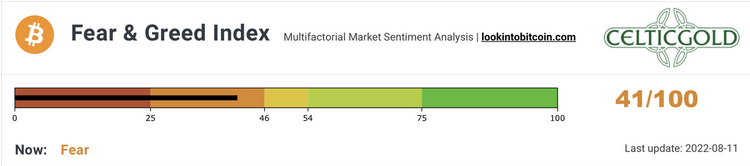

Over the past four weeks, the Crypto Fear & Greed Index has made remarkable progress. The mood is nevertheless largely fearful. Fear still pervades the cryptocurrency industry seven months after the devastating selloff.

Crypto Fear & Greed Index, as of August 11th, 2022. Source: Lookintobitcoin

The feeling of being defeated also permeates the wider picture. There are several excellent contrarian opportunities in this setup.

Overall, it remains a contrarian buy signal due to the fearful mindset.

Sharp falls in financial markets would be extremely damaging to keeping the current administration in office given the midterm elections on November 8 in the United States. As a result, only a slight decline in financial markets in September is more likely. The markets can then rise from the lowest levels until the US election.

Since November 2021, the stock and cryptocurrency markets have been under intense pressure for several months, but a broad rally has now been ongoing for just over four weeks. The Nasdaq Composite, which is heavily weighted toward technology, has risen more than 20% from its June 16 low as a result of this procedure, adding more than $420 billion to its market capitalization. This will mean that the bear market is officially over.

Related Reading: Bitcoin Price Trading Just Above $24,000, Could It Be Targeting $27,000?

Featured image from Getty Images, chart from TradingView, and Lookintobitcoin