Bitcoin ready for fireworks? Long positions See Uptick this 4th of July

Bitcoin seems to form a new area around its current levels as the cryptocurrency moves between the $ 18,600 and $ 21,000 range. BTC’s price has seen some improvement during today’s trading session and may experience some volatility due to US Independence Day, July 4th.

Related reading | Solana (SOL) has been stuck below $ 33 in recent days as bearish pressure remains intact

At the time of writing, Bitcoin is trading at $ 19,500 with a profit of 4% over the last 24 hours.

Data from analyst Ali Martinez indicates an increase in Bitcoin holdings from addresses by 100 to 10,000 BTC. These whales have added over 30,000 BTC to their holdings.

In addition, Martinez registers over 40,000 BTC leaving crypto exchange platforms. The smaller Bitcoin offers available at these venues, the less it can be sold on the market.

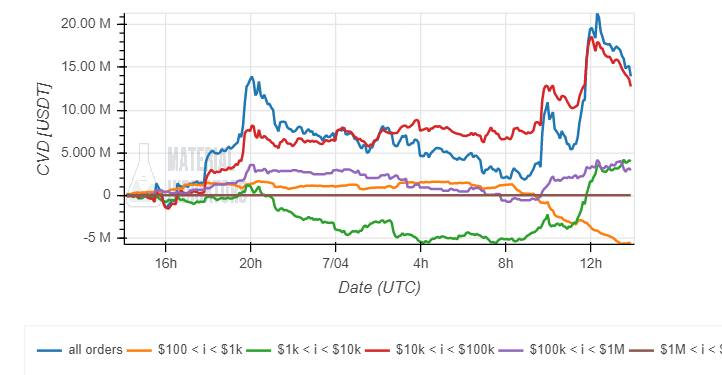

This market dynamic was translated into this weekend’s price action. In addition, material indicators poster an increase in buying pressure from investors with a large bid (purple in the figure below) that coincides with short-term whale accumulation.

These whales have been the “most influential” over BTC’s price action and may suggest more gains. Material Indicators also registered bullish momentum on this weekend’s price action.

In fact, it seems that every class of investors except retailers and massive whales with over $ 1 million in bidding orders are buying into BTC’s price action, as shown in the chart below.

Additional data provided of Santiment registers a huge increase in the number of long positions across stock exchange platforms. This coincides with the US holiday, but it’s not necessarily good news for these operators:

In the early hours 4th July 2022 in the US, there has been a massive increase in #longs on exchanges in the last hour. Trade optimism often correlates with holidays, which means that there must be a greater degree of caution when whales punish the overzealous.

What causes pain in the Bitcoin market

There are some indicators of possible bullish price action in the short term, but the rise in long positions deserves warnings. The macroeconomic outlook seems less optimistic and may mean more pain for Bitcoin and other cryptocurrencies.

Trading desk QCP Capital claims that their bullish outlook is “declining” in light of the US Federal Reserve’s (Fed) intentions to curb inflation in the country. The financial institution has raised interest rates for that purpose and has created chaos across global markets.

Initially, some experts believed that the Fed would try to make a “soft landing” and bring down inflation without hurting the economy. This possibility may have been ruled out as the Fed is between a rock and a hard place. QCP wrote:

Fed Governor Williams stated “the need to get real interest rates above zero”. This means that the Fed is likely to ignore the risk of recession and will continue to raise interest rates aggressively to reach the target of 3.5% -4% by year-end.

Related reading | TA: Bitcoin remains in a downward trend, which could lead to a sharp upside

On top of the above, financial institutions have reduced liquidity outside global markets while shrinking their balance sheets. This only signals several disadvantages for the crypto market.

8 / Remember that the cryptoox cycle was driven by balance expansion. A contraction of this scale will certainly have a dampening effect on prices.

– QCP Capital (@QCPCapital) July 4, 2022