Bitcoin Rally During Q3, GBTC Continues To Struggle

Tevarak

No one seems to be talking about Bitcoin (BTC-USD) anymore. The largest cryptocurrency hasn’t moved much in the past three months after a wild first half of 2022. Remarkably, long-dated Treasuries were about as volatile as Bitcoin in the latter half September as the market grappled with intense uncertainty about what central bankers around the world will do next. Perhaps the latest hot coin is the 30-year British gilt!

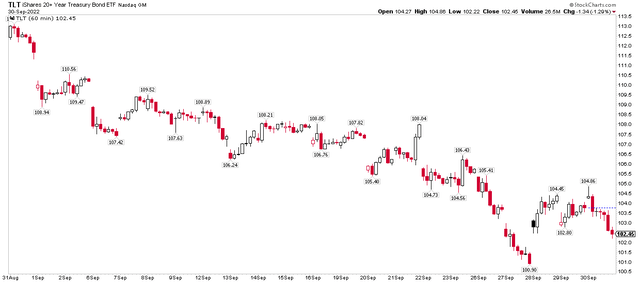

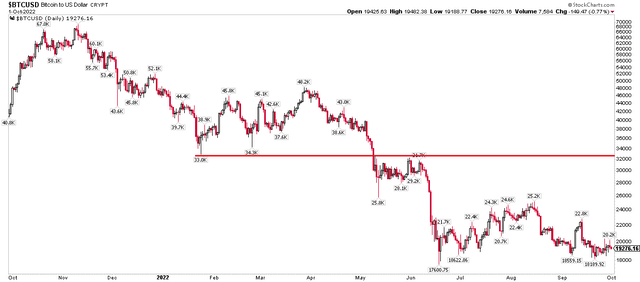

But seriously, since mid-June, Bitcoin’s price range is roughly $17,000 to $25,000. However, since September 14, BTCUSD has a low near $18,200 with a high around $20,400. In comparison, the iShares 20+ Year Treasury ETF (TLT) has a range of about 7% over this period.

Bitcoin hovers above its June low

TradingView

Long-term government bonds plunge as rates rise

Stockcharts.com

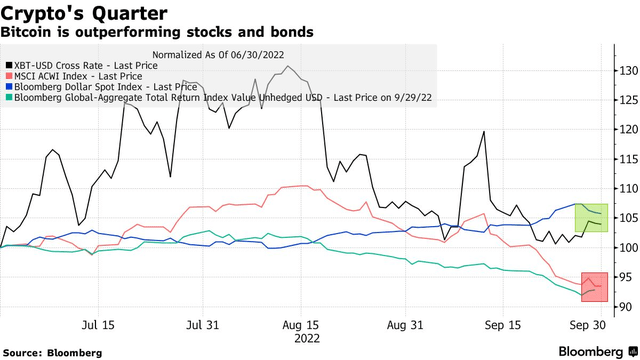

And would you believe that the world’s most important cryptocurrency outperformed global stocks and the US bond market during the third quarter? Bloomberg data shows that BTC-USD rose fractionally, almost matching the US Dollar Spot index’s 6% gain in the third quarter.

Bitcoin beats stocks and bonds in Q3

Bloomberg

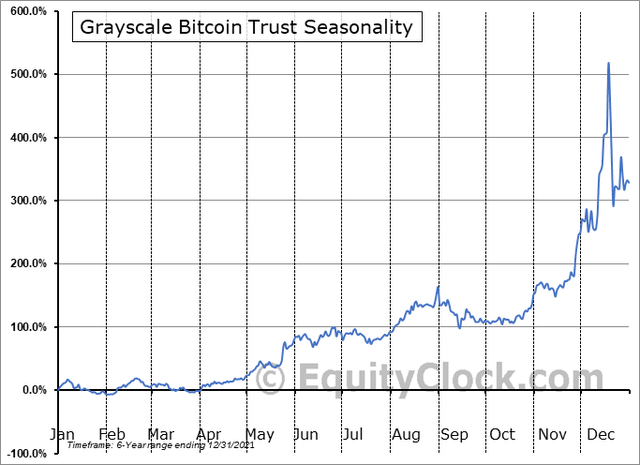

Is now a good time to load up on Bitcoin? If so, what’s a good way to play it? In accordance CoinDesk, Bitcoin has historically increased in value in eight of the last 12 Octobers, with an average gain of 12%. Also, historically, huge gains have been seen from mid-month to mid-December, according to seasonal data from Equity Clock. While any good technician will tell you that seasonality takes a backseat to price action, there’s something to keep in mind right now.

Bullish seasonal trends follow later this month

Stock clock

Price-wise, I think it makes sense to go long here with a stop below the June low of $17,600. But another way to play it to reduce the chance of another leg lower in the bear market stopping you out is to wait for a breakout above the August high of $25,200. Buying after a few days above this price level will take advantage of a possible bullish reversal.

However, I see resistance in the low-$33k area. So taking profits can be a sensible move. After all, the broader trend from the $69,000 peak nearly a year ago remains in place.

BTCUSD consolidates amid low volatility

Stockcharts, com

A popular (or now infamous) way to play Bitcoin is through Grayscale Bitcoin Trust (OTC:GBTC). The $12.4 billion AUM product is down a whopping 65% over the past year, while spot Bitcoin is lower by just 53%.

However, GBTC is not a cheap way to gain exposure to Bitcoin. The trust’s annual fee is 2%, but according to Grayscale, it is exclusively and passively invested in BTC, allowing investors to gain exposure to BTC in the form of a security while avoiding the challenges of buying, storing and holding BTC directly . Another option is the ProShares Bitcoin Strategy trust (BITO).

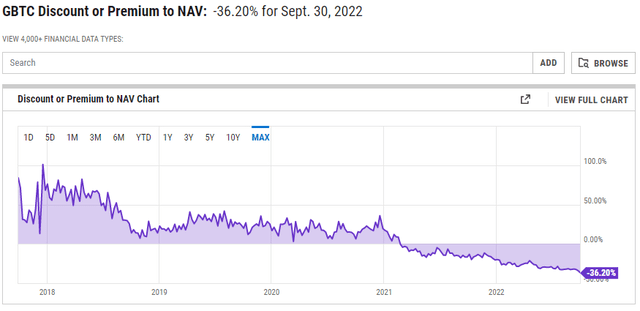

Luring risk-seeking investors to GBTC is undoubtedly a massive discount to its net asset value (“NAV”). At the end of September, the trust’s market price per share was $11.41, while the per share value of the holdings was $17.88. That more than 36% discount to NAV is the widest in GBTC’s history, according to data from YCharts. During Bitcoin’s heyday and the bull market in 2018 through much of 2020, GBTC traded at a significant premium to NAV.

GBTC’s Discount Widens: Value Trap?

YCharts

Recently, however, Grayscale announced that it would buy back up to $250 million in GBTC shares to buck the trend of a bigger and bigger discount. Another way the spread could collapse is if GBTC is converted to an actual exchange-traded fund (ETF), but there are no definitive signs that is actually on the horizon.

The bottom line

I think Bitcoin is interesting here with bullish seasonal trends coming and a possible base pattern. Going long here with a stop below the June lows could work or waiting for a breakout above $25k or so could be a good play.

However, I would caution against playing Bitcoin trends through GBTC. The foundation continues to trade at a bigger and bigger discount to NAV, and my fear is that it is a broken product. Go own Bitcoin through an exchange or with a large, reputable company to hold your tokens.