Bitcoin Rally as Stock Market Tanks After Hot US Retail Sales

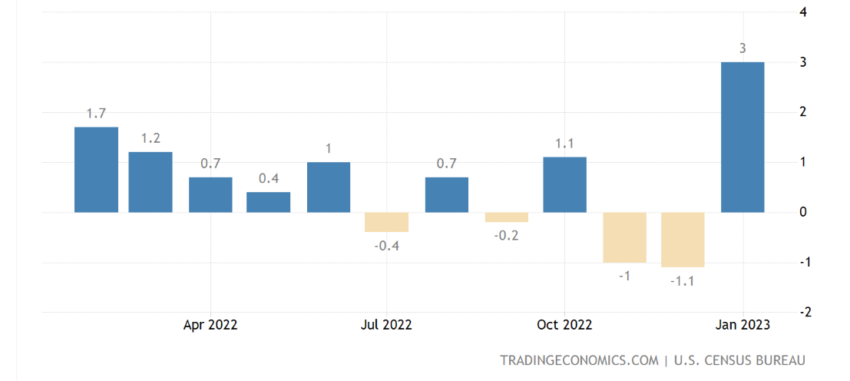

U.S. retail sales rose 3% in January 2023 to $697 billion, beating analysts’ 2% estimates and beating December sales by 4.1%, as healthy demand and CPI point to rising inflation.

Rising retail sales suggest healthy demand for electronics sales, which rose 3.5%, and food and beverages, which were up 7.2%. Excluding the volatile auto and gasoline sectors, retail spending rose 2.6%.

Bitcoin breaks away from stock market amid recession fears

Healthy demand for non-essentials can drive additional spending and increase prices, especially in the presence of a strong labor market with multi-decade high employment levels.

Yesterday’s January CPI report revealed that the core CPI, excluding food and energy costs, rose to 0.4% last month. This figure complicated the inflation narrative, which suggested that disinflation in other sectors of the economy pointed to the success of the Fed’s tightening policy.

Now, with higher retail sales and higher CPI, the Federal Reserve is likely to raise interest rates above 5% at the March 2023 Open Markets Committee meeting.

After yesterday’s CPI numbers, stock markets were choppy, with the Dow Jones Industrial Average closing up 156 points, the S&P 500 remaining flat, while the Nasdaq closed down five-tenths of a percent after initial losses. After the sales figures were released, the Dow Jones Industrial Average fell 135 points, while the S&P 500 fell 4%. The technology-heavy Nasdaq fell 0.2 percent.

Breaking the correlation with the stock markets, Bitcoin fell below $22,000 after the CPI numbers before rising to an intraday high of around $22,275.

Today’s retail sales numbers saw the asset rise by about 4% on the day to change hands at about $22,660.

Consumers will spend until inflation bites, says analyst

The pivot from e-commerce to brick-and-mortar stores and increased travel in the wake of the Omicron Covid-19 strain has driven spending, said Dana Telsey, managing director of Telsey Advisory Group and retail research analyst. She noted that discretionary spending would moderate due to inflation, as the prices of necessities eat away at the incomes of average American consumers.

Macquarie global fixed income and currency strategist Thierry Wizman told Bloomberg that positive sales numbers are fluctuations, not trends, and that markets are misinterpreting them.

According to Wizman, consumers spent in October and November 2022 because they fear inflation will devalue their money, and any boon in January does not necessarily indicate consumer confidence that a recession will be avoided.

A recent poll suggested that half of Americans are in a worse financial position than a year ago, the highest proportion since 2009.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.