Bitcoin Rainbow Chart updated with new lower band after second breach

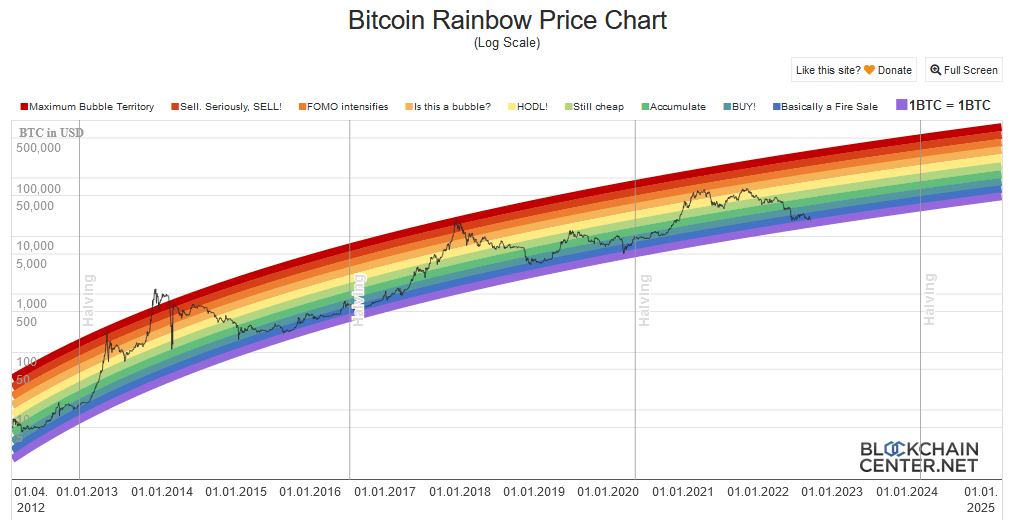

The infamous Bitcoin Rainbow Chart has been updated to include a new lower band called “1BTC = 1BTC.” The chart reflects PlanB’s stock-to-flow model in terms of sentiment, with bands indicating when to buy and sell Bitcoin.

“The original Rainbow Chart is dead. Long live the Rainbow Chart with the new indigo ribbon!”

Twitter account @rohmeo_de commented that the new indigo band “was always missed.” Its inclusion now accounts for the fall in 2020, which saw the Bitcoin price break the previous low band.

In November 2013, BTC broke the upper band before returning within the parameters, only for another upper break to occur in January 2014.

However, citing the bearish macro backdrop and invalidation of the Stock-to-Flow predictive pricing model, @omgbruce mocked the update, suggesting it was a desperate attempt to stay valid.

Lol!! 😂 rainbow 🌈 chart just updated a lower bound called 1 #btc = 1 #btc 🫣https://t.co/T1hnYlQlGK

— Bruce (@omgbruce) 19 September 2022

Bitcoin Rainbow Chart

The Bitcoin Rainbow Chart documents the BTC price logarithmically across ten bands, indicating different stages of sentiment. The general idea is that price will move between bands and indicate possible calls to action, such as selling during a red-hot market.

As with all predictive price models, the price should not break the upper or lower bands. Otherwise, the calculations deriving the positions of the bands must be invalid or at least incomplete.

The creators caution that the chart is not investment advice, past performance does not indicate future performance, and the chart is a fun way to look at long-term price movements.

Before the addition of the new low, the “1BTC = 1BTC” band, “Basically a Fire Sale” was the previous band low.

September 19 sees Bitcoin dive into the new “1BTC = 1BTC” band amid a weekend selloff that has continued into Monday. At 08:00 UTC, the bulls entered $18,200 to stop the slide, sending BTC to $18,800.

Since then, there have been two more tests of $18,800 resistance, with bulls thus far failing to break through.

With macro factors weighing heavily on the crypto markets, the likelihood of a return above $20,000 in the near term is low.

The revised Rainbow Chart has a floor price of around $16,900.

Stock-to-Flow (S2F) becomes invalid

Plan B’s S2F model predicts the price of Bitcoin based on the current production rate. That assumes a $100,000 BTC price between now and May 2024.

Despite recent deviations, the model saw a significant deviation around June, leading some to call the model invalid, even harmful, due to the false sense of hope price predictive models can provide.

In response, Plan B recently took to Twitter, saying he believes S2F is still valid and expects it to be back in line before the next halving.

People ask if the S2F model is still valid. I think it is. We can go technical on autocorrelation and cointegration, but the key is IMO that the BTC price is not more/less than in 2011, 2013, 2017. IMO the S2F model is valid and I expect a pullback above the S2F model value before the halving in 2024. pic.twitter.com/fbjskn5LFH

— PlanB (@100trillionUSD) 12 September 2022