Bitcoin Punks Exceeds 1,145 ETH in Daily Trading Volume as Bitcoin Ordinals Take Off

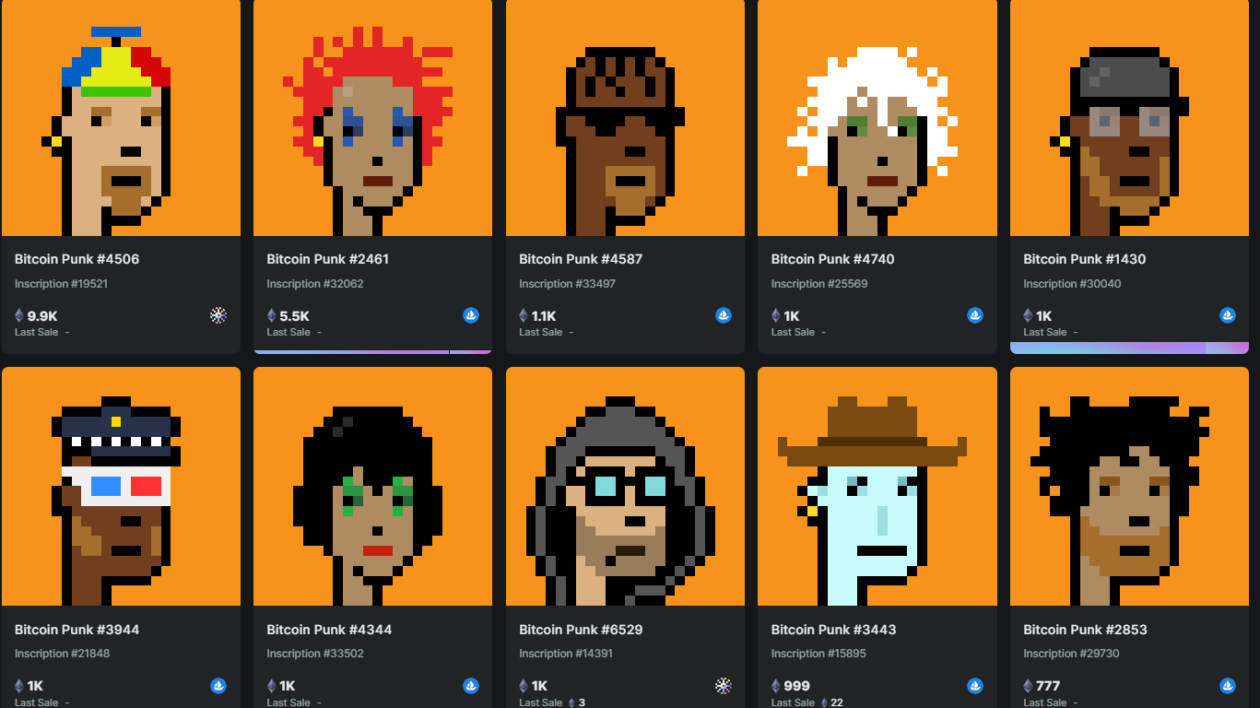

Image from Ordinals.Market

Bitcoin Punks, the Bitcoin-native spin-off of the popular CryptoPunks blue chip non-fungible token (NFT) collection, saw over 1,145 Ether in daily trading volume on February 28, according to data from blockchain analytics firm Dune.

Bitcoin Punks is the first collection of 10,000 NFTs on Bitcoin, which was uploaded from the original Ethereum-native CryptoPunks collection via the Ordinals protocol. Bitcoin Punks are 10,000 of the first 34,400 Ordinal inscriptions on the network, which could make them more valuable to collectors.

The surge in Bitcoin Punks sales occurred on the same day that Yuga Labs, the US-based company behind Bored Ape Yacht Club, announced plans to launch its first NFT collection on the Bitcoin network, TwelveFold.

Yuga’s announcement came a week after the Bitcoin network surpassed 154,000 subscriptions within a month of the launch of the Ordinals protocol. The network has over 228,000 inscriptions at the time of publication, according to Dune data.

“BTC now has an additional use case other than just being a currency. BTC is now a place where NFTs or “digital artifacts” can be created and stored on every single node on the Bitcoin network. The added benefit of having a bottom-solid use case of NFTs added to BTC will influence miner fees to increase as demand for network resources increases. IE: Rate/kb will go up, unless new ways to reduce costs come down,” wrote Yohann Calpu, Marketing Manager at NFT data aggregator CryptoSlam, to Discard.

Jonas Betz, a cryptoanalyst based in Germany, agreed that Ordinals could benefit the Bitcoin network.

“The use of Ordinals comes with an increased transaction volume on Bitcoin, which increases the reward for miners and can therefore help make the network stronger and more decentralized. Second, Ordinals can also increase Bitcoin adoption by appealing to a wider audience interested in NFTs and the wider digital art market. This could help increase demand for Bitcoin and potentially increase its price,” Betz wrote.

“But there is also a downside, as Ordinals divide the Bitcoin community. Many Bitcoin supporters are not in favor of a departure from Bitcoin’s original use case as a store of value and transfer medium. Ordinals can also consume more Bitcoin block space, making Bitcoin transactions more expensive, ” he added.

Kasper Vandeloock, CEO of quantitative trading firm Musca Capital, said Ordinals will be limited in use.

“There are many Bitcoin believers who are not fans of Ordinals, but I think it’s a wonderful thing. The more utility, the better, but I’m afraid it won’t have many uses. Something interesting about NFTs is The DeFi part of it is evolving, like being able to use NFTs as collateral and get loans,” Vandeloock wrote, adding that he “doesn’t expect it to be a big part of the Bitcoin network.”

Texas-based Bitcoin core developer Jimmy Song said Ordinals have a “unique” way of storing digital art. “The unique thing about these is that the entire jpeg file or image is stored in the transaction instead of it being a pointer to an image like in other chains.”

CryptoSlam’s Calpu agreed that Ordinals stand out from traditional NFTs.

“The great thing about Ordinals is that there are no other “coins” made for NFTs to be generated on BTC, unlike $XCP (counterparty) and $STX (Stacker) which Bitcoin maximalists called “shitcoins” and never became fully accepted.he wrote.

“How it does this is by using the op_return field, and having data ‘inscribed’ in it (via Taproot upgrade) that allows a single satoshi (smallest unit of BTC) to be used as the data-carrying vessel,” Calpu added to.

See related article: At least $577 million of Blur-linked NFT sales are wash trades, says CryptoSlam