Bitcoin Price Prediction When BTC Loses the $22,000 Level – Where is the Next Support?

The price of Bitcoin has been volatile for the past couple of weeks. After breaking through $23,000, the cryptocurrency has lost significant value and is currently trading at around $21,800.

The price can fluctuate somewhat over time, and it’s a good idea to have some Bitcoin left in your portfolio, ready to buy back when the price goes down.

SEC Launches New Regulations to Crack Down on Cryptocurrency Practices

The US Securities and Exchange Commission (SEC) has recently announced new rules aimed at cracking down on fraudulent and deceptive cryptocurrency practices. These new regulations are a response to the growing popularity of digital assets and the potential risk they pose to investors.

In recent years, cryptocurrency has emerged as a popular form of investment, with many individuals eager to take advantage of the potential returns. However, the lack of oversight in the industry has made it a prime target for fraudsters looking to take advantage of unsuspecting investors.

To address this issue, the SEC has introduced new regulations aimed at increasing transparency and accountability in the cryptocurrency market. The regulations will require cryptocurrency exchanges and other platforms to register with the SEC, provide regular reports on their operations and implement measures to protect the assets of their customers.

In addition, the SEC will crack down on Initial Coin Offerings (ICOs), which are a popular way for companies to raise money by issuing new digital assets. The new regulations will require companies to provide detailed information about their operations, finances and risks associated with their offerings. The SEC will also monitor these offerings to ensure that they are not fraudulent and that they comply with all applicable securities laws.

Kraken Crackdown: What you need to know

The recent announcement by the Securities and Exchange Commission (SEC) to file securities violations against the cryptocurrency exchange, Kraken, has raised concerns among crypto industry leaders. This decision has heightened fears about the agency’s stance on regulation.

The Securities and Exchange Commission (SEC) has been paying attention to staking, a process in which individuals offer a portion of their cryptocurrency holdings, such as Ethereum, to organizations in return for significant profits. These borrowed assets are then used to validate cryptocurrency transactions.

Companies like Kraken simplify the staking process for regular users by pooling assets and facilitating staking so they can make money.

In conclusion, the SEC’s new regulations on cryptocurrency practices are a sign that the government is taking the issue of digital assets seriously and is committed to protecting investors. While the regulations are a positive step, it is up to individuals to be vigilant and do their own research before investing in digital assets.

The UoM Consumer Confidence Index surprises to the upside in February, coming in at 66.4

In addition to SEC and Crypto regulations, the stronger US dollar is also adding downward pressure on Bitcoin. One of the reasons behind the strong US dollar is the release of UoM Consumer Confidence.

Consumer confidence in the US improved in early February with the University of Michigan’s (UoM) Consumer Confidence Index rising to 66.4 from 65 in January. The US Dollar Index, a measure of how much the dollar is falling against other currencies, has held up on a daily basis near 103.50 and improved slightly to cloud near 103.

This led to a movement in the markets this month, with inflation expectations rising to 4.2%. This reading was better than the market had expected as the reading came in at 65%.

Bitcoin price

Bitcoin is the most popular cryptocurrency and the live Bitcoin price today is $21,654.63 with a 24-hour trading volume of $31.7 billion. The current coin market cap for BTC is 1, with a live market cap of $417 billion.

Technically, the price of BTC/USD trading is extremely bearish at the moment. The price is at $21,600, and has just dropped below the 61.8% Fibonacci retracement, which means it could be headed for a drop down to $20,000 soon.

Analysis of historical data shows that resistance for Bitcoin is expected to remain close to the $22,300 or $22,775 average. The RSI and MACD are in a sell zone, so we could see BTC fall to $21,100 and $20,500 before further bearish price action.

Buy BTC now

Bitcoin Alternatives

Cryptocurrencies and related ICOs are creating a lot of buzz around the world. To help you make investment decisions, CryptoNews Industry Talk has reviewed the top 15 cryptocurrencies to watch in 2023.

There are other options to consider if you are looking for an investment opportunity with a high return potential.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

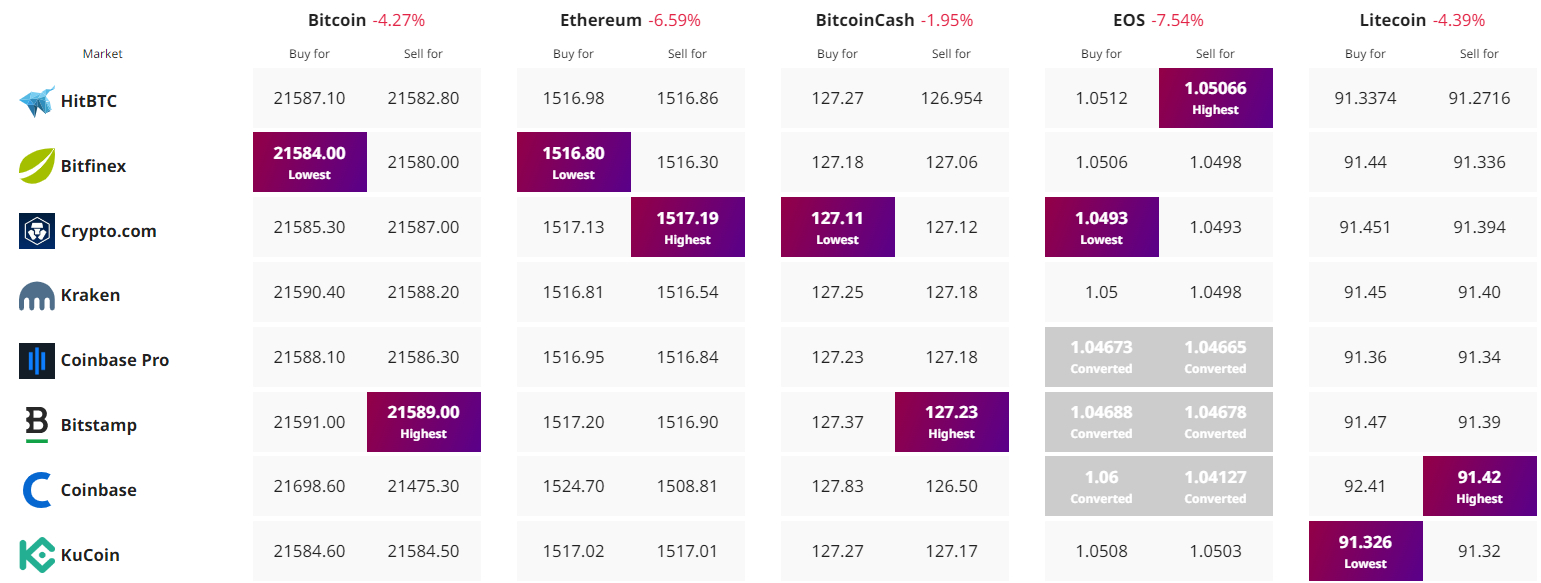

Find the best price to buy/sell cryptocurrency