Bitcoin Price Prediction When BTC Explodes 15% In 7 Days – Time To Buy?

With Bitcoin rising 15% in just seven days, many investors are wondering if now is the right time to buy. In this article, we will discuss the current state of the Bitcoin market and examine some Bitcoin price predictions for the future.

Let’s take a closer look at the main fundamentals of the cryptocurrency market that can affect the overall price movement.

Regulators are taking steps to regulate cryptocurrency

On February 15, the Securities and Exchange Commission introduced a new “custodian” regulation that will limit the ability of asset managers to invest clients’ funds in, among other things, cryptocurrencies. This proposal follows several recent measures taken by regulators to provide greater protection to investors in a market known for its high degree of price volatility.

Meanwhile, on February 13, the New York Department of Financial Services instructed cryptocurrency firm Paxos to stop issuing BUSD, a stablecoin, due to “unresolved issues” related to its association with cryptocurrency exchange Binance, which serves as the coin’s brand. Paxos will stop producing new BUSD tokens as of February 21, as instructed by the NYDFS in close cooperation with the company.

Despite repeated assurances from politicians and regulators to regulate the cryptocurrency sector, investors have returned to the volatile digital asset market, sending BTC/USD higher.

Bahrain Hotel now accepts cryptocurrency payments

According to a report by Arabian Business on February 13, Novotel Bahrain Al Dana has become the first hotel in the region to accept cryptocurrency payments. The report states that Novotel Bahrain Al Dana Resort and Eazy Financial Services have partnered to enable customers to settle their hotel bills using cryptocurrency. To facilitate service through the Binance app, the hotel will install custom terminals at its outlets.

Binance CEO Changpeng Zhao has recommended that cryptocurrency business owners consider moving to France, Dubai (UAE) and Bahrain, as these countries support Bitcoin. He believes that moving to a new country would not be a bad idea if you are passionate about your project.

In recent months, several hotels in the Arabian Peninsula, such as W Dubai – The Palm and Palazzo Versace Dubai, have followed the trend towards digitization of financial assets and have started accepting cryptocurrency payments.

The Central Bank of Bahrain has also approved this move, making Novotel Bahrain Al Dana Resort the first hotel in the country to accept cryptocurrency payments. This increased acceptance of digital assets among individuals and countries has contributed to the increase in the prices of leading cryptocurrencies such as BTC/USD.

CleanSpark acquires 20,000 latest generation mining machines

On February 16, Bitcoin mining company CleanSpark announced on its official blog that it had acquired 20,000 new mining rigs of the latest generation. According to the blog post, CleanSpark will spend $32.3 million on the machines after applying 25% off coupons, resulting in an average cost per terahash (TH) of $13.25. The Pro+ rigs, which are 22% more efficient than their previous versions, are expected to be delivered in batches between March and May.

CleanSpark expands its US mining operations with the acquisition of 20,000 additional Antminer S19j Pro+ machines for $43.6 million. This purchase could increase the company’s processing capacity by 37%. With this acquisition, the total number of miners purchased by the company during the bear market will be 46,500 units.

Taking advantage of the lower rig prices in the market, the company plans to increase mining capacity when the BTC/USD price recovers.

Bitcoin price

As of today, the live Bitcoin price is $24,460, with a 24-hour trading volume of $23 billion. Bitcoin is down almost 1% in the last 24 hours. It currently holds the top rank on CoinMarketCap, with a live market capitalization of $472 billion. The circulating supply of Bitcoin is 19,296,068 BTC coins and the maximum supply is 21,000,000 BTC coins.

The BTC/USD pair traded within a narrow range between $24,400 to $25,250 levels on Sunday. If the price breaks above the $25,250 level, it could potentially reach $26,000 or $26,450.

Bitcoin’s current support is at $24,300. If the price falls below this level, it could fall to $23,750 or even $23,300. A further drop could result in a breakout of the $23,300 level, which could send BTC towards the $22,850 mark.

Buy BTC now

Bitcoin Alternatives

CryptoNews has published a detailed review of the top 15 cryptocurrencies that investors should consider for 2023. The report is designed to help investors make informed investment decisions.

In addition to cryptocurrencies, there are other investment opportunities with the potential for high returns that investors may want to consider exploring.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

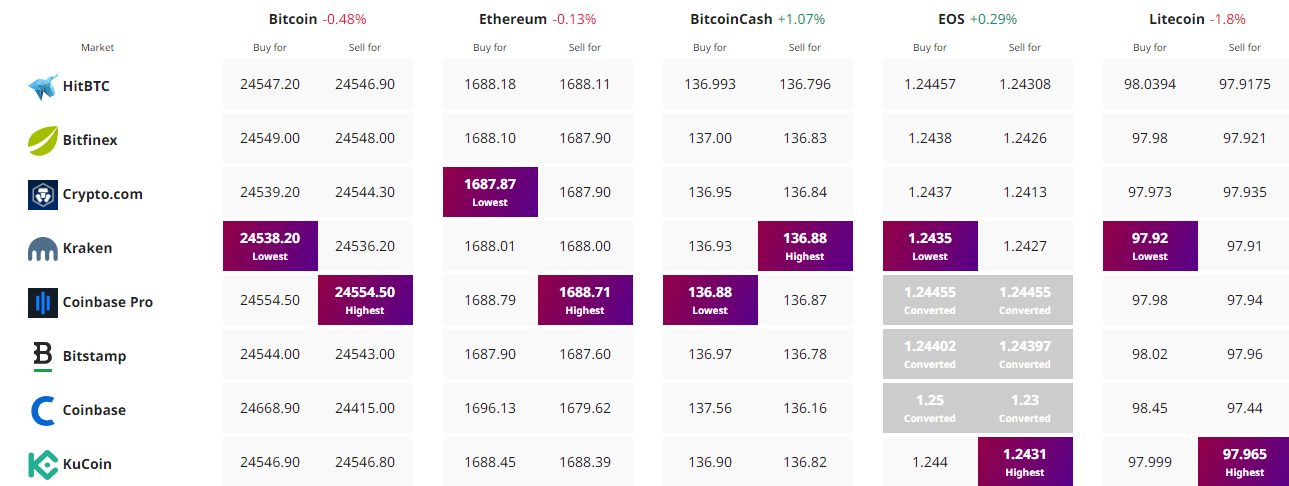

Find the best price to buy/sell cryptocurrency