Bitcoin Price Prediction As Recession Fears Rise – Can BTC Reach $100,000 After Bear Market?

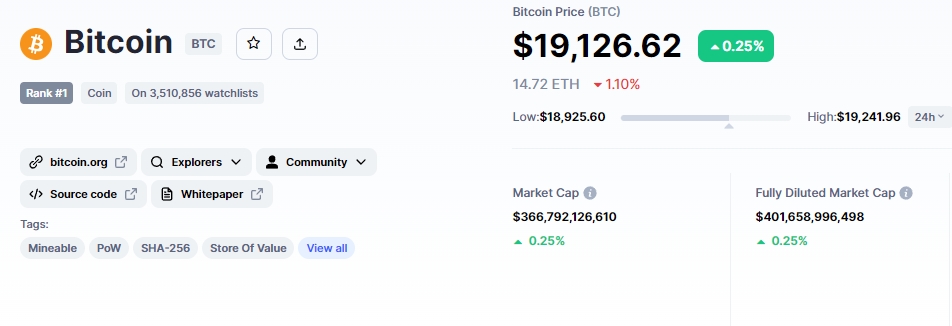

Over the past few days, the Bitcoin price barely recovered from the $19,000 level, mostly maintaining a narrow range. On October 12, BTC barely moved, rising around 0.25% in 24 hours.

Concern about a recession among investors is comparable to that expressed in 2020 when 75% of respondents expressed concern about a slowdown at the height of the epidemic.

Even in the midst of a severe economic downturn, a well-thought-out plan can greatly improve one’s ability to make sound financial decisions.

Advisor Authority Poll signals recession fears

According to Nationwide’s annual Advisor Authority survey, released on Monday, investors and advisors are concerned about the current macroeconomic situation. As a result, their optimism has dropped considerably.

Investor confidence over the 12 months has fallen from 49% a year ago to 39%. Equally gloomy, financial advisers and experts’ optimism is 48%, down 15% from 2021. While 54% of investors expect greater volatility over the next 12 months, fears of a recession are 20% higher.

It is frightening to see that 75% of investors are worried about a recession, just as they were in 2020 at the height of the epidemic. Advisors and financial experts are even more anxious, with 82% expecting a recession in 2022, up from 77% in 2020.

Therefore, investors are moving away from crypto and stocks and towards safe assets due to the fear of a recession.

IMF downgrades economic forecasts

On Tuesday, the IMF cut its forecast for global economic growth in 2023, citing Russia’s protracted war with Ukraine, widespread inflationary pressures and rising interest rates that are pushing up borrowing rates for businesses and consumers as reasons.

The International Finance Agency for 190 countries has cut its global growth forecast for 2019 to 2.7% from 2.9% in July.

The International Monetary Fund (IMF) has not revised its growth forecast for 2022, which remains at a modest 3.2%, but is still less than half the 6% growth in 2018.

According to the IMF Chief Economist Pierre-Olivier Gourinchas,

More than a third of the global economy will contract this year or next, while the three largest economies – the US, the EU and China – will continue to stall.”

According to the IMF’s forecast, more than a third of the world’s economy will experience two consecutive quarters of negative growth in the coming year. The US and China, the world’s two largest economies, are both experiencing weak growth, and major European economies are also facing economic headwinds. The US and its Western allies have imposed crippling sanctions on Russia over Russia’s eight-month war in Ukraine.

The International Monetary Fund has lowered its growth forecast for the US economy this year from 2.3% to 1.6% due to economic uncertainty and significant increases in consumer prices. As for the US, the IMF predicts a meager 1% increase for 2019.

The International Monetary Fund estimates a global increase in consumer prices of 8.8 percent in 2019, up from 4.7 percent in 2021.

Is volatility on the way? Inflows to Bitcoin Exchanges are skyrocketing

Since “whales” have apparently transferred a large amount of Bitcoin to discover exchanges, this situation may soon change. CryptoQuant, a well-known cryptocurrency analysis platform, reports a dramatic increase in deposits to spot markets.

The majority of these transactions come from “whale” addresses that own hundreds to thousands of Bitcoins and have sent them to cryptocurrency exchanges.

A comment from a CryptoQuant analyst reads as follows:

It seems whales want lower Bitcoin prices. By transferring from wallets that have from 100 to 1000 Bitcoin in large quantities to the spot exchanges a while ago, the price can be pushed down more and there can be a distribution to different wallets.

But on the downside, I expect the negative scenario and am cautious.

Bitcoin Price Prediction – Can BTC Reach $100,000 After Bear Market?

According to Bloomberg Intelligence Senior Commodity Strategist Mike McGlone, the Bitcoin price prediction is bullish and it will reach $100,000 by 2025, and the cryptocurrency market will thrive as a “revived bull market.”

In his opinion, Bitcoin’s dramatic reversal is just beginning, McGlone claims. This bear market reflects the highest inflation rate in four decades.

On Wednesday, the current Bitcoin price is $19,145.43, and the 24-hour trading volume is $27.28 billion. CoinMarketCap currently ranks first, with a live market cap of $367 billion.

Technically, Bitcoin, the leading cryptocurrency, is trading sideways in a narrow trading range of $25,666 to $18,630. On the weekly time frame, Bitcoin has repeatedly tested the triple bottom support at $18,650, but has yet to break below it. Bitcoin has formed a Doji on the weekly timeframe, and spinning candles support investor indecision.

Given the stronger than expected economic events in the US, the Fed may raise interest rates in the coming months. With an interest rate hike, we could see further decline in Bitcoin demand, eventually breaking below the triple bottom support level of $18,630 and pushing BTC towards $12,835.

Conversely, dovish Fed policy and once the economy is out of recession, BTC may show some recovery.

In this case, increased BTC demand could push the price up to a major resistance level at $25,666. Above this, the previously broken uptrend line could provide further resistance near $32,330. That said, Bitcoin has the potential to reach $100,000, but this unlikely to happen anytime soon.

Alternative cryptos – IMPT

With more than $3.6 million raised since October 03, the ongoing Impact Project (IMPT) token sale has garnered a lot of attention.

The Impact Project is an Ethereum-based carbon credit marketplace, making it a potentially profitable investment opportunity for ESG investors or anyone looking for the massive price increases that can accompany a new coin’s initial listing. In addition, the Impact Project will provide users with tokenized NFT carbon credits as an incentive (for purchasing from green retailers).

According to the IMPT white paper, this addresses a number of issues currently plaguing the carbon credit market. These include selling credits twice, overcalculating credits, and failing to retire credits properly.

Visit IMPT today

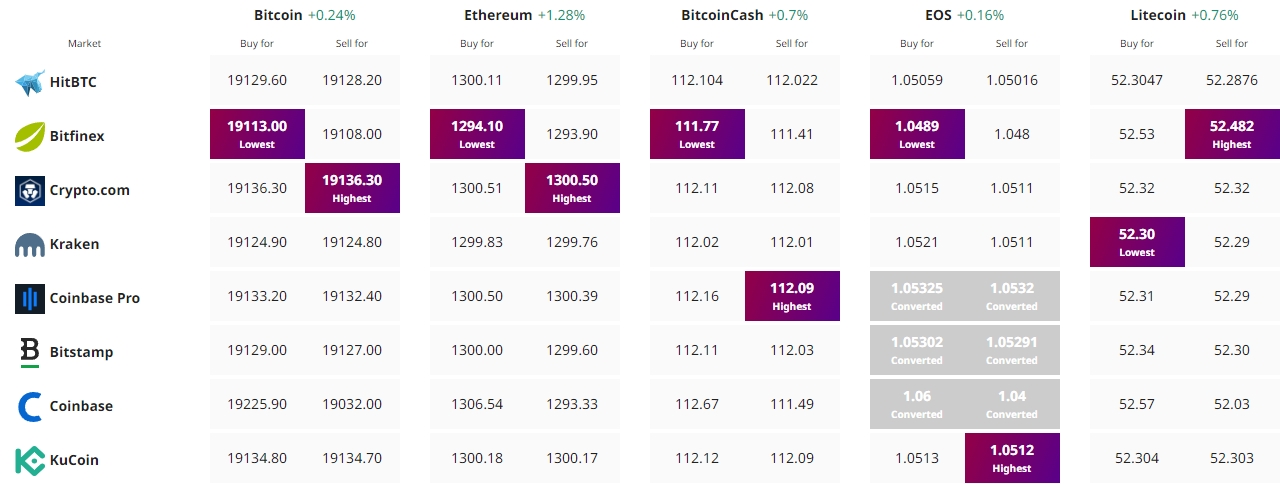

Find the best price to buy/sell cryptocurrency: