Bitcoin Price Prediction As Bulls Hold BTC Above $23,000 – Where Is The Next Target?

With Bitcoin’s price currently hovering around $23,000, there is uncertainty among traders and investors about the direction of the next move. As the market undergoes a period of consolidation, analysts and experts are making predictions about the future of Bitcoin’s price.

In this article, we will delve deeper into the current state of the market and examine several factors that may have an impact on the movement of Bitcoin’s price in the near future. We will explore various scenarios and provide insight into what traders and investors can expect in the coming days and weeks.

Bitcoin Bearish Market Slows Down – What Does This Mean for BTC Prices?

A few days ago, Bitcoin (BTC) appeared to be in a price RSI divergence pattern, which was a sign of relative trend weakness for the bears and would lead to a retracement. The retracement is now complete, but the bears are also showing signs of weakness.

While Bitcoin exchange flows have leaned towards the bears in recent days, the selling pressure has been steadily downward. According to Glassnode alerts that track daily flows in the chain, Bitcoin’s net flows on February 24 were -$29.5 million. Although there has been a return of overall selling pressure, it has subsided around the time of publication.

The majority of Bitcoin purchasing power comes from addresses that own 1,000 – 10,000 BTC, which accumulated at press time. This is significant, as this address category controls the majority of BTC in circulation. However, a bullish trend has yet to begin because addresses with more than 10,000 BTC have contributed to selling pressure.

It will be interesting to see if the bulls are prepared to take over the next few days and weeks. The current value of 1, 10 and 100 BTC can be found using a Bitcoin Profit calculator. In addition, it is worth noting that open interest has decreased in recent days, and a major shift in demand for derivatives may be on the horizon.

The IMF warns investors about the potential risks of cryptocurrencies

The International Monetary Fund (IMF) Executive Board considers the use of crypto-assets a threat to the global monetary system, with potential implications for monetary policy, capital flow management and budgetary concerns.

In light of this, the IMF recommends that member countries take the necessary measures to address the growing popularity of cryptocurrencies. The board discourages the use of digital coins as official tender by governments, pointing to recent examples of El Salvador and the Central African Republic’s adoption of Bitcoin.

The IMF’s concerns about the use of cryptoassets reflect broader debates about the role of digital currencies in the global economy. As cryptocurrencies continue to gain mainstream acceptance, it will be important for governments and international organizations to assess their impact on the monetary system and to develop appropriate policies to mitigate potential risks.

It is important to have a strong macroeconomic policy, credible institutions and a sound monetary policy framework. The International Monetary Fund (IMF) recognizes the importance of these factors and will continue to provide guidance and advice in these areas.

However, the IMF has issued a warning that the growing use of cryptocurrencies poses a significant risk to the global monetary system. The use of digital assets has the potential to undermine monetary policy, circumvent capital flow management and raise tax concerns.

The IMF advises against governments declaring cryptocurrencies as legal tender, despite recent examples of El Salvador and the Central African Republic adopting Bitcoin as official currency. The IMF’s cautious stance on cryptocurrency could lead to greater scrutiny and regulation, which could affect the use and value of Bitcoin and other digital currencies.

Block’s Q4 Bitcoin Revenue Down, But Shares Jump 7%: The Story Behind It

Block, a multinational digital conglomerate founded by Jack Dorsey and formerly known as Square, has reported $1.83 billion in bitcoin revenue from its Cash App payment service in Q4 2022. This is down from the roughly $2 billion reported in last year’s fourth quarter, which the company attributed to the downturn in the crypto market.

Despite the decline in bitcoin revenue, Block’s stock rose roughly 7% after reporting positive overall financial results. In the fourth quarter of 2021, when BTC reached an all-time high of nearly $70,000, the total amount of bitcoin sold to customers was higher at $1.76 billion.

Cash App, Block’s peer-to-peer payment software, generated over $7 billion in BTC revenue and $156 million in BTC gross profit in 2022, down 29% and 28% year-over-year, respectively. Bitcoin gross profit in Q4 2022 was $35 million, a decrease of 25% from the previous quarter.

Block explained that the year-over-year drop in revenue was due to a decrease in the total dollar amount of bitcoin sold to customers, which is accounted for as bitcoin revenue. Bitcoin gross margin in the quarter was 2% of bitcoin revenue.

The decline in bitcoin revenue is attributed to the crypto market crisis last year, when Bitcoin started trading at around $47,000 in 2022 and ended at around $16,500, representing a 65% decline.

Potential impact: The decline in bitcoin revenue reported by Block (formerly known as Square) may have an impact on the value of Bitcoin. This news could indicate to investors that the demand for Bitcoin is decreasing, which could lead to a decrease in its price. Additionally, since Block is a major player in the cryptocurrency industry, its financial performance could affect market sentiment and investor confidence in Bitcoin and other digital currencies.

Bitcoin price

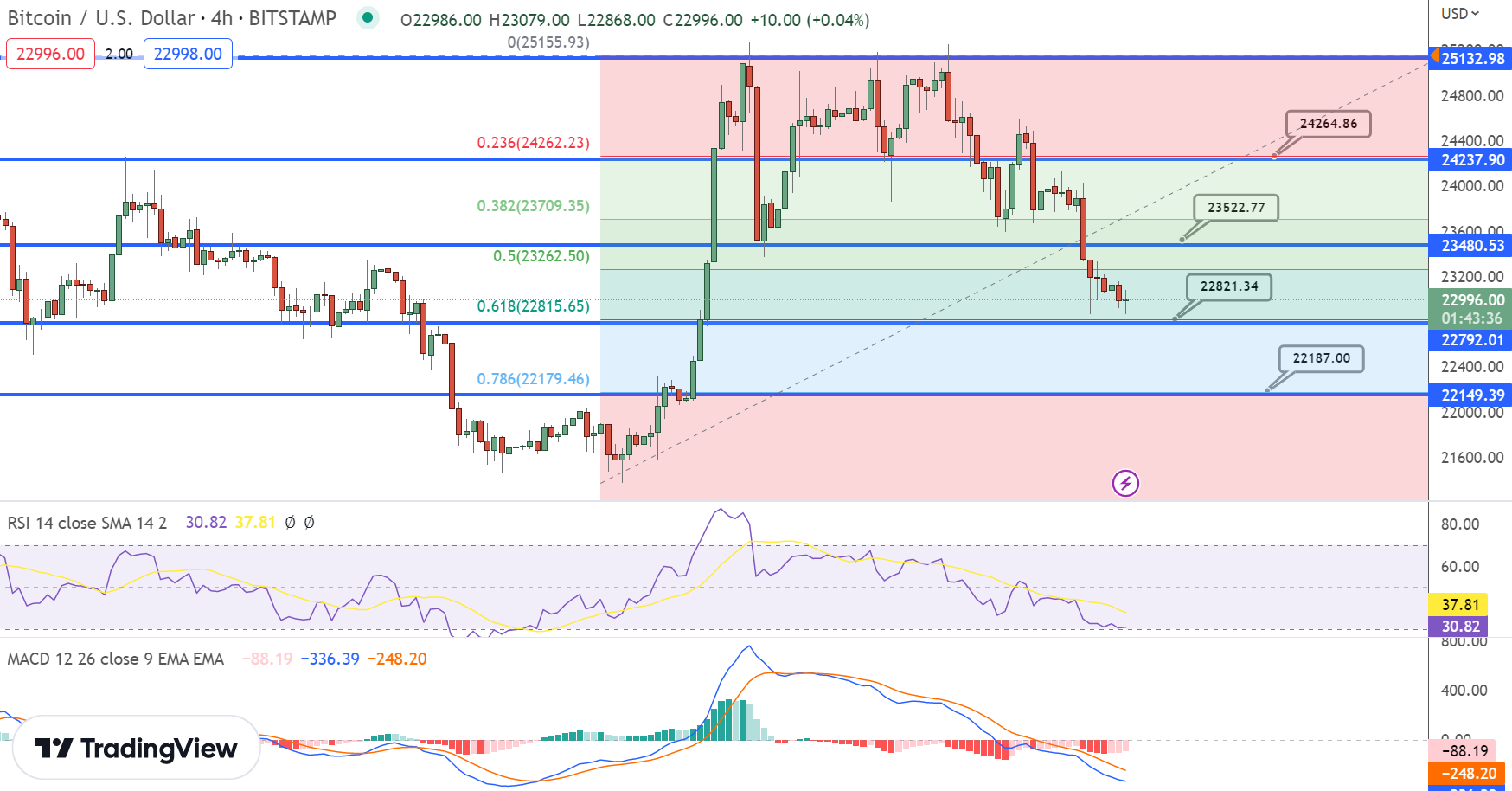

Bitcoin is currently trading at approximately $23,000, with a 24-hour trading volume of $18 billion and an increase of 0.50% in the last day. The immediate support level for Bitcoin is at $22,800 and if the BTC/USD pair breaks below this level, it could potentially expose the price of BTC to the next support area at the $22,150 level.

Bitcoin Price Chart – Source: Tradingview

The resistance level for Bitcoin remains at around $23,500. However, since the BTC/USD pair has entered the oversold zone, there is a possibility that BTC may bounce off and break through the $23,500 resistance level, potentially leading to a price of $24,250 .

Buy BTC now

Bitcoin Alternatives

Investors looking to buy into Bitcoin may want to consider alternatives with more room for short-term growth. Cryptonews has released an in-depth analysis of the top 15 cryptocurrencies that investors may want to consider for 2023. Click below to find out more.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

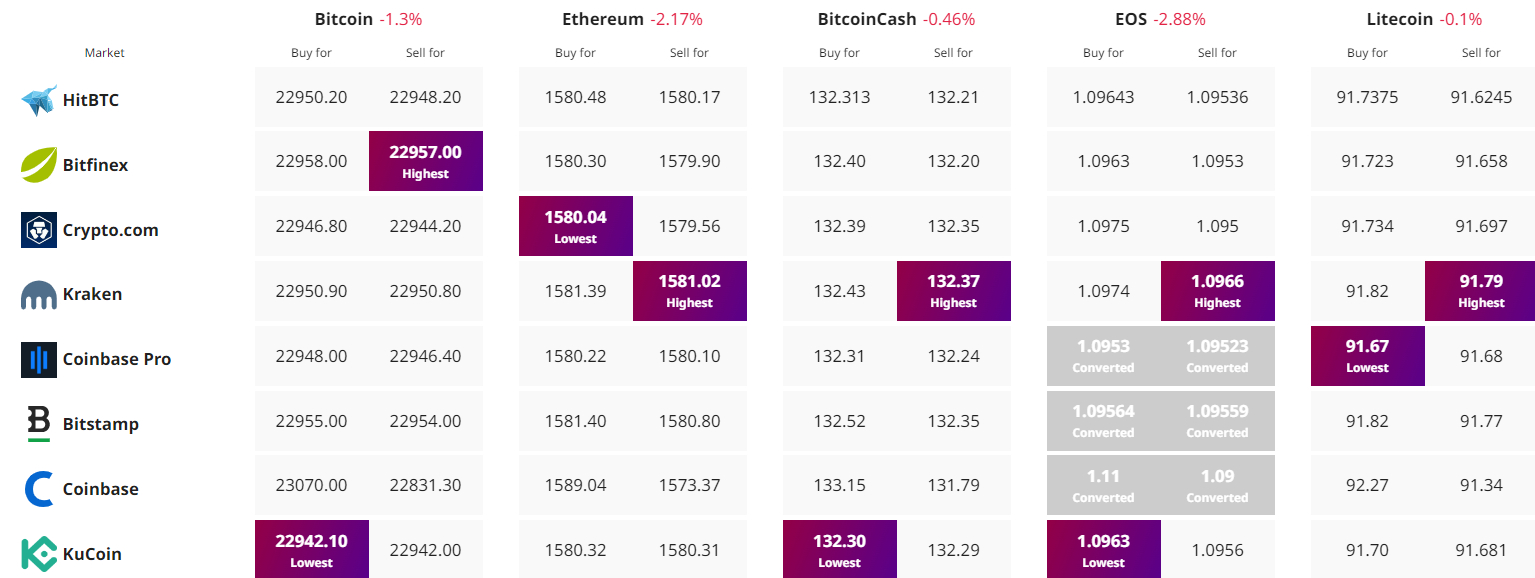

Find the best price to buy/sell cryptocurrency