Bitcoin Price Prediction As Bulls Hold $20,000 Level – Where Is BTC Heading Now?

On Sunday, both Bitcoin and Ethereum saw a modest increase in value, with BTC surpassing $20,000 and ETH hitting the $1,400 mark. However, the decline in the US dollar, as a result of February’s labor statistics showing lower wage growth, may be responsible for this ongoing modest rise in crypto value.

In addition, the use of Ordinal, a Layer 2 solution, expands the use cases of the Bitcoin network beyond just BTC transactions. While there have been differing opinions on the use of Ordinal in the Bitcoin community, its growing popularity and potential impact on the Bitcoin network could be a game changer for BTC miners.

Ordinal’s ability to enable fast and affordable transactions could lead to increased use of Bitcoin and potentially reduce the load on the network. This could ultimately result in greater efficiency and profitability for BTC miners. This has been identified as one of the key factors that could help BTC regain its strength and increase in price.

Weaker US dollar boosts crypto market

The global cryptocurrency market has seen significant losses over the past week, with both Bitcoin and Ethereum losing nearly 11% of their value. However, the price decline began to slow as the US dollar weakened and Bitcoin began to recover some of its losses.

Interestingly, the weaker US dollar has been a critical driver behind the recent surge in the cryptocurrency market. Nevertheless, the labor data released for February indicated lower wage growth, suggesting a reduction in inflationary pressures. This could prompt the Federal Reserve to keep rate hikes modest, thereby reducing the appeal of the US dollar.

While the US economy quickly gained jobs in February, slower wage growth and higher unemployment rates have dampened expectations for a 50 basis point rate hike when Federal Reserve officials meet in two weeks.

However, given the ongoing regulatory concerns and recent market volatility, it remains uncertain how the cryptocurrency market and the US dollar will perform in the coming weeks.

Silicon Valley Bank’s liquidity crisis raises fears of contagion in the financial markets

Silicon Valley Bank (SVB), a large financial institution that caters to venture capital firms, has been hit hard by a liquidity crisis. The bank’s problems have raised fears of contagion in financial markets and sparked concerns about the potential impact on the wider economy.

It is worth noting that the bank, headquartered in Santa Clara, California, offers a range of financial services to venture capital firms and their portfolio companies. SVB is known for its expertise in the technology sector and has played an important role in the growth of the venture capital industry in Silicon Valley.

However, recent reports have highlighted the bank’s financial problems, with insiders reporting a “severe liquidity problem” at the institution. The reports suggest that the bank has struggled to maintain its funding levels, leading to concerns that it may not be able to meet its obligations.

It should be noted that news of SVB’s liquidity crisis has sent shockwaves through the cryptocurrency market, with prices of major digital assets falling. The crypto market, which has been on a bull run for the past month, has been hit hard by the news, with Bitcoin and Ethereum losing significant value.

The focus will be on how SVB and other financial institutions react to the crisis and whether the fallout can be contained. However, the crypto market, like other financial markets, will be closely watching developments in the coming weeks as investors look for signs of stability and a return to normality.

SEC Rejects VanEck’s Bitcoin Trust Proposal: Impact on BTC

It is worth noting that the Securities and Exchange Commission (SEC) has once again rejected VanEck’s proposal to create a spot Bitcoin trust that would allow investors to trade Bitcoin on regulated exchanges. This decision marks nearly 20 similar denials over the past six years, as the SEC has hesitated to approve such applications.

SEC rejected VanEck's proposal to list a #Bitcoin ETF for the third time. pic.twitter.com/cnCLVt3TnS

— CryptoCurrency News (@CryptoBoomNews) March 11, 2023

The SEC cited concerns over market manipulation, liquidity and valuation in rejecting VanEck’s proposal. However, the commission also noted that there is still a lack of transparency and regulation in the cryptocurrency market, making it difficult to ensure that investors’ interests are protected.

The rejection of VanEck’s proposal is likely to have a negative impact on Bitcoin’s price in the short term, as it reduces opportunities for investors to invest in the cryptocurrency through regulated channels. It also highlights the regulatory challenges that cryptocurrencies continue to face in the United States.

Bitcoin price

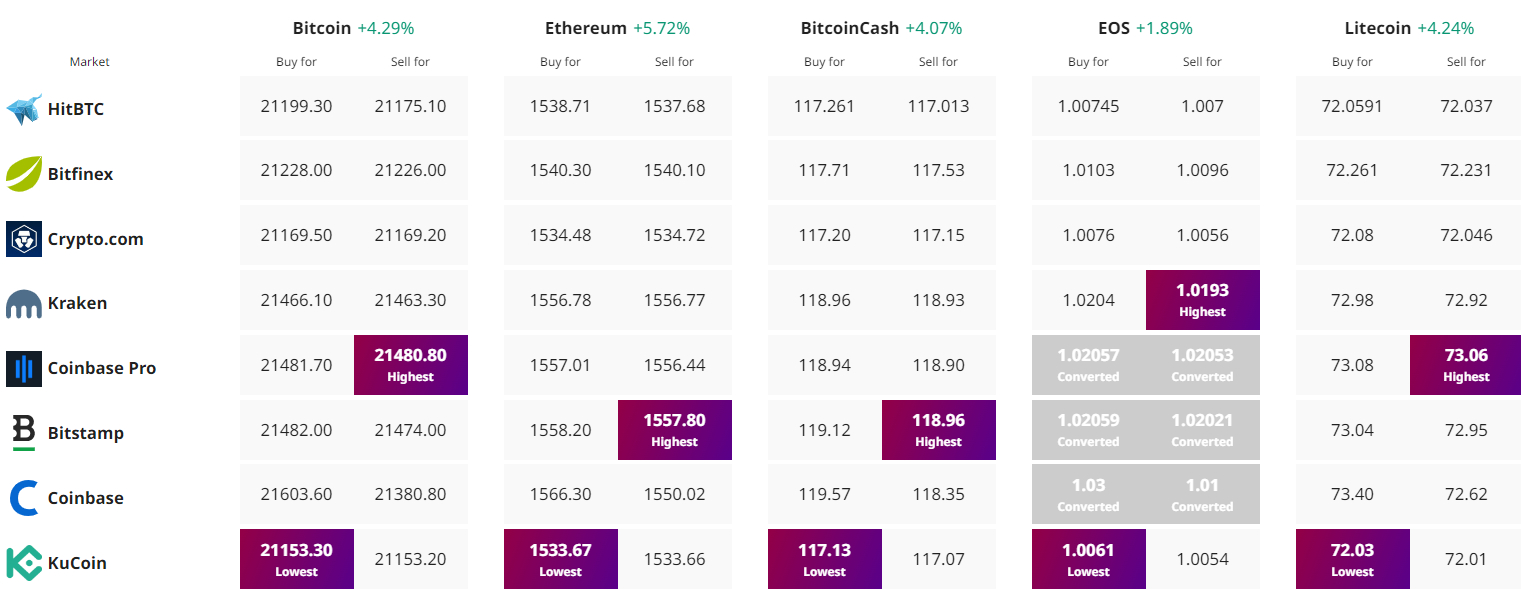

Today, the live Bitcoin price is $21,515, with a 24-hour trading volume of $22.8 billion. Over the past 24 hours, Bitcoin has gained 5.00%. It currently holds the top spot on CoinMarketCap, with a live market cap of $415 billion.

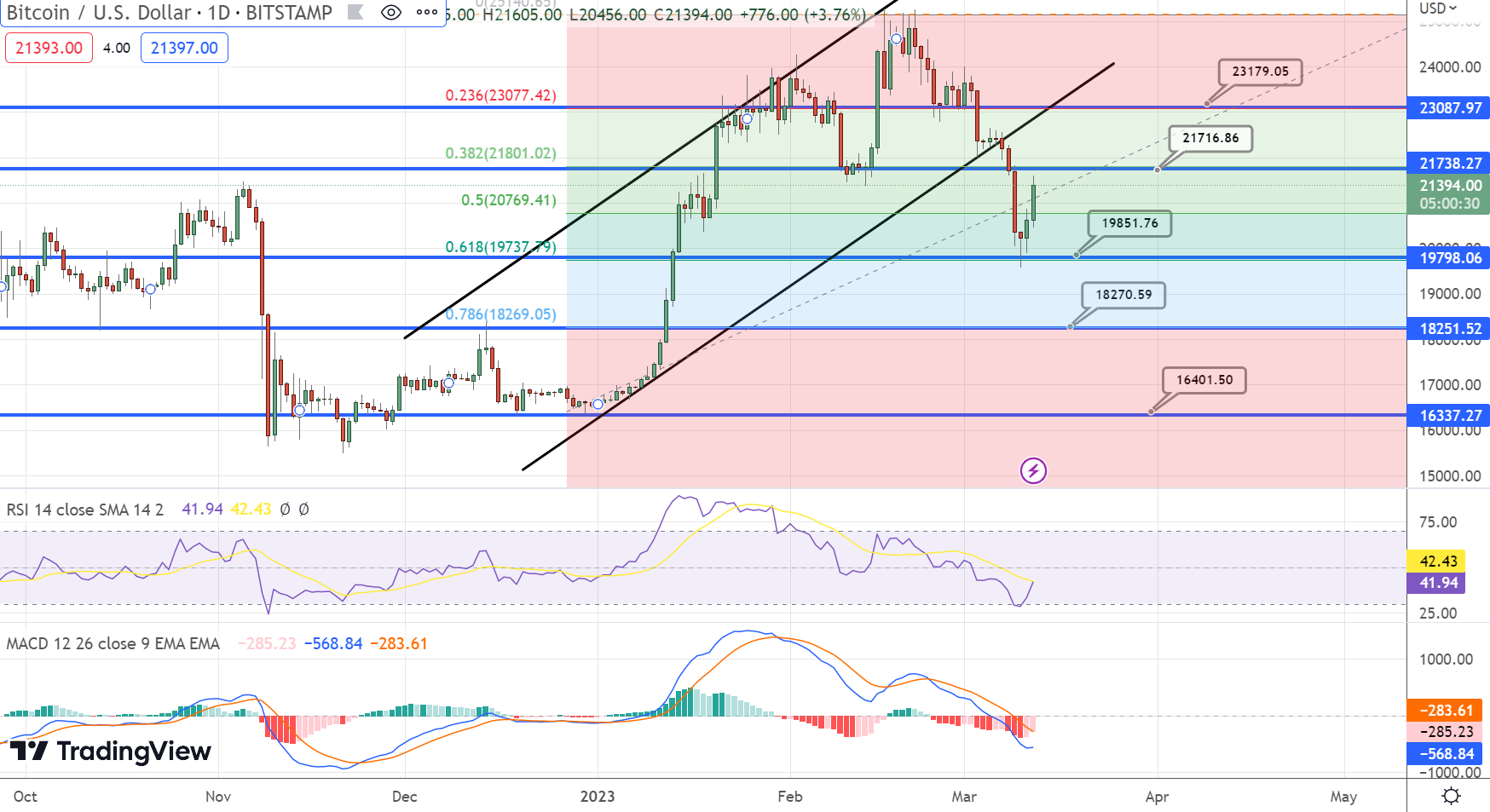

Bitcoin has bounced off the $19,850 support level. If it had broken below this level, it could have triggered selling pressure and led to a further decline towards the $16,400 level.

On the other hand, the first hurdle for Bitcoin is at the $21,700 resistance level. If Bitcoin breaks above this level, it could trigger buying pressure and potentially push the price towards the $23,175 level.

If the bullish momentum continues, there is a chance that Bitcoin could even reach the $25,150 mark.

Buy BTC now

Top 15 Cryptocurrencies to Watch in 2023

Take a look at Industry Talk’s handpicked list of the top 15 altcoins to watch in 2023, curated by Cryptonews. The list is regularly updated with fresh ICO projects and altcoins, so remember to check back often for the latest developments.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

Find the best price to buy/sell cryptocurrency