Bitcoin price prediction as BTC prepares for 30% rally

During the European session, Bitcoin is trading slightly bearish amid a bearish correction after completing a 61.8% Fibonacci retracement at the $21,000 level. After hitting its highest levels in six weeks on October 28, the leading cryptocurrency lost about $800, or 2%.

At press time, Bitcoin was trading at roughly $20,200, showing more consolidating trading behavior than a major correction.

Tech Companies Fall 20%, Push BTC Price Lower

Tech companies saw a significant 20% decline in after-hours trading as a result of Amazon missing earnings expectations. Over $230 billion was wiped off Amazon’s market value after the market closed, the biggest decline in history.

CEO Andy Jassy said in the company’s third quarter earnings release,

“There’s obviously a lot going on in the macroeconomic climate and we want to balance our investments to become more streamlined without jeopardizing our major long-term, strategic commitments.”

Amazon’s decline this year is an indication of the precarious situation that tech titans around the world have found themselves in, but it has not led to similar actions in the cryptocurrency markets.

Meta has also been hit hard, with its share price falling below $100 this week, bringing it back to 2015 levels.

According to Alex Krueger, an economist, trader and entrepreneur, this is a dramatic shift from late 2021, when Netflix’s stock price fell in line with the company’s poor results.

Is The Correlation Between Bitcoin And US Stocks Fading?

The price of Bitcoin (BTC) is closely related to the value of stocks, especially the value of technology stocks. On a daily time frame, the correlation between Bitcoin, the most valuable cryptocurrency by market capitalization, and the S&P 500, which has a high-tech component, reached 0.73.

Over the past week, there has been a departure from the typical locking movements of Bitcoin and stocks, with Bitcoin rallying as equity markets cooled. But with a fall in tech stocks, Bitcoin also suffers, resulting in a fall in BTC price.

Bitcoin price prediction as BTC prepares for 30% rally

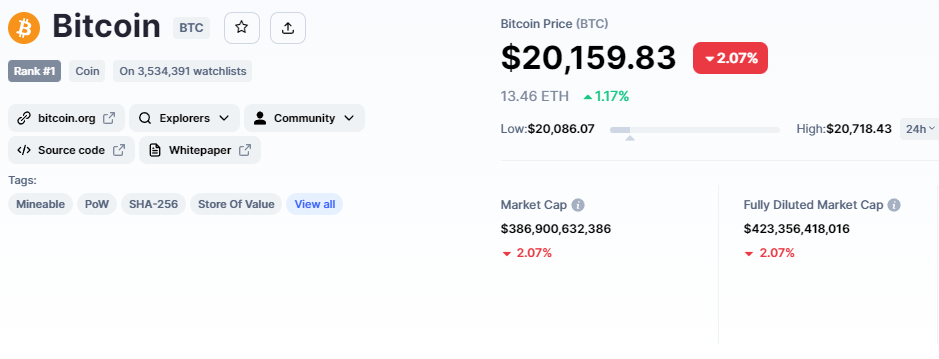

The current Bitcoin price is $20,159, with a 24-hour trading volume of $47 billion. Bitcoin has fallen by more than 2% in the last 24 hours. CoinMarketCap is currently first, with a live market cap of $386 billion, down from $388 billion during the Asian session.

Bitcoin’s uptrend appears to be weakening as it fails to break through the major resistance level of $21,000. Unsurprisingly, sellers are entering the market, causing a bearish correction and possibly profit-taking before the weekend.

At $21,000, Bitcoin has completed a 61.8% Fibonacci retracement, and candles closing below this level cause a bearish correction. RSI and MACD entered the overbought zone, causing a bearish correction.

In contrast, the 50-day moving average suggests buying above $19,600. As a result, a break of the 61.8% Fibo level has the potential to extend the buying trend to $21,900. If the current uptrend continues, Bitcoin could reach $22 500.

On the downside, Bitcoin’s immediate support level remains near $19,900. Today, investors can seek a buy position above $19,900 and vice versa.

Alternative – Dash 2 Trade Presale

Dash 2 Trade is an Ethereum-based platform that aims to provide real-time analytics and social trading signals to its users; the amount raised so far is a significant vote of confidence in the platform. Following the pre-sale, the company intends to launch its platform in the first quarter of 2023, with the D2T token expected to be listed on multiple exchanges.

In less than a week, the Dash 2 Trade presale has raised over $3 million, putting it on track to be one of the biggest token sales of the year.

During the Dash 2 Trade presale, you can still buy D2T tokens for $0.05 USDT.

Visit Dash 2 Trade now

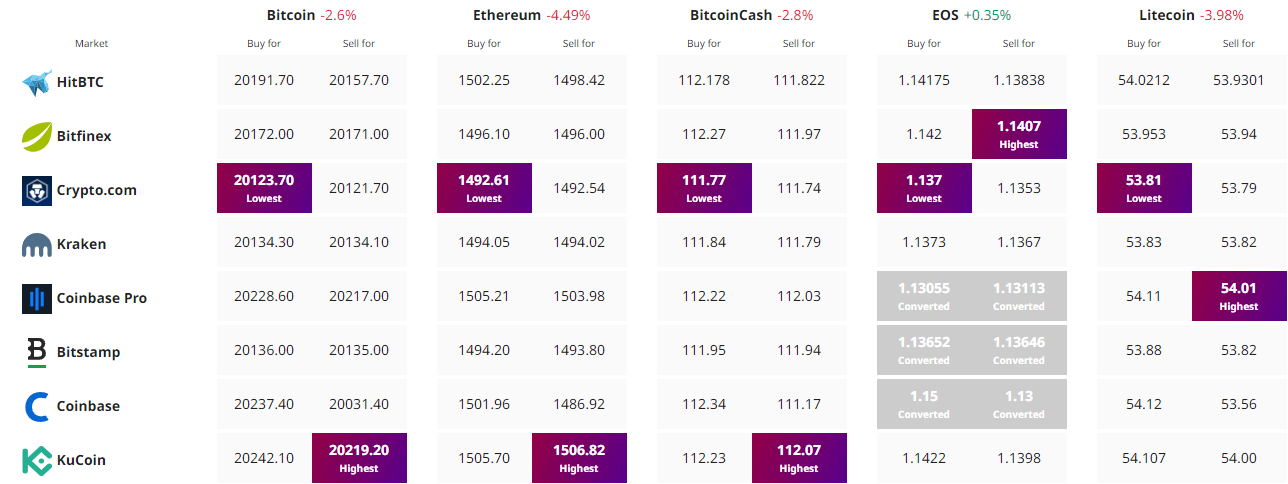

Find the best price to buy/sell cryptocurrency