Bitcoin Price Prediction As BTC Explodes Past $24,000 – Is Another Bull Market Starting?

Bitcoin is on a roll as it explodes past the $24,000 mark, and investors are wondering if another bull market is beginning. After Bitcoin hit an all-time high in December 2017, it suffered a major crash and has struggled to regain its previous highs ever since.

However, recent events such as large companies investing in Bitcoin and institutional adoption have led to a surge in prices, leading many to speculate that a new bull market is on the horizon.

In addition, the recent establishment of a new unit by Bank of New York Mellon aimed at helping customers hold, transfer and issue digital assets has been seen as a significant contributing factor to the recent rise in the value of Bitcoin.

Let’s take a closer look at what’s driving Bitcoin’s rise and what analysts are saying about future price predictions.

Encryption in the crypto market amid adoption and strong US retail sales data

The global cryptocurrency market has witnessed a rise today, primarily due to the increase in institutional adoption and interest from significant companies. Investors have also been encouraged by the robust US retail sales data, which is seen as good news for earnings rather than a concern that it will add to rate hikes.

In addition, the launch of the non-fungible tokens (NFTs) protocol Ordinals in January 2023 has seen the average size of a Bitcoin block reach 2.5 gigabytes (GB) for the first time since the cryptocurrency’s founding in 2009, contributing to the market’s rise. trend.

As a result, the global crypto market capitalization has reached a new all-time high of $1.11 trillion, up 8.55 percent in 24 hours at the time of writing.

Bitcoin’s average block size shows a sharp increase

Bitcoin’s average block size has reached an all-time high, topping 2.5 gigabytes (MB) for the first time since the cryptocurrency’s creation in 2009. This is thanks to the implementation of the non-fungible tokens (NFTs) protocol Ordinals, which was introduced by software engineer Casey Rodarmor in January 2023.

The protocol has allowed Bitcoin network users to produce digital artifacts, including JPEG images, PDF documents, audio files, and video files. Block sizes increased by more than 2MB in the weeks following the launch of the protocol, indicating significant growth in Bitcoin’s network activity.

This highlights a remarkable development in Bitcoin’s growth, as it has the potential to stimulate network activity even without the traditional transfer of cash volume for financial purposes.

The US Dollar is losing its strength

The US dollar, which had risen to a near six-week high of 104.11 in the previous session, has started to weaken recently. Profit-taking after this week’s significant gains has sent the US dollar lower against a basket of currencies.

The dollar index and dollar index futures have fallen by around 0.2%. With positive indications of improvement in the US labor market and inflation, markets are uncertain where interest rates will peak this year. This has resulted in traders being wary of taking riskier bets on Asian currencies.

Weekly initial jobless claims in the US lower than expected, falling to 194,000

The US Labor Department released an update on Thursday that indicated there were 194,000 new claims for unemployment benefits in the week ending February 11. This reading is marginally higher than last week’s figure of 190,000; it is also equal to the 195,000 read from the previous week.

The report revealed that the preliminary seasonally adjusted unemployment rate was 1.2%, while the 4-week moving average was at 189,500, which represented a slight increase of 500 from the previous week’s adjusted average.

They also highlight that the seasonally adjusted figure for the number of people in employment in the US last week was 156,000 compared to last week’s revised figure of 146,000

Bitcoin price

Currently, the current live Bitcoin price stands at $22,974, having recorded a trading volume of $25 billion in the last 24 hours. During this period, the price of Bitcoin has increased by almost 4%. Notably, it retains its position at the top of CoinMarketCap, with a live market capitalization of $443 billion.

On a technical level, Bitcoin has surpassed a major double top resistance level at $24,300. With the current candles closing above this level, there is a greater possibility of a bullish trend continuation in BTC. The immediate resistance levels for Bitcoin are $25,450 and $26,000.

In the event of a bearish breakout below the $24,300 level, Bitcoin’s price could fall towards the $22,500 level, which is supported by an ascending channel.

However, the RSI and MACD indicators are in the buy zone and Bitcoin has also formed an ascending channel, indicating a strong likelihood of continued bullish trading above the $24,300 level.

Buy BTC now

Bitcoin Alternatives

CryptoNews Industry Talk has published a review of the top 15 cryptocurrencies to watch in 2023, with the aim of assisting with investment decisions.

In addition, there are other investment opportunities with the potential for high returns that may be worth considering.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

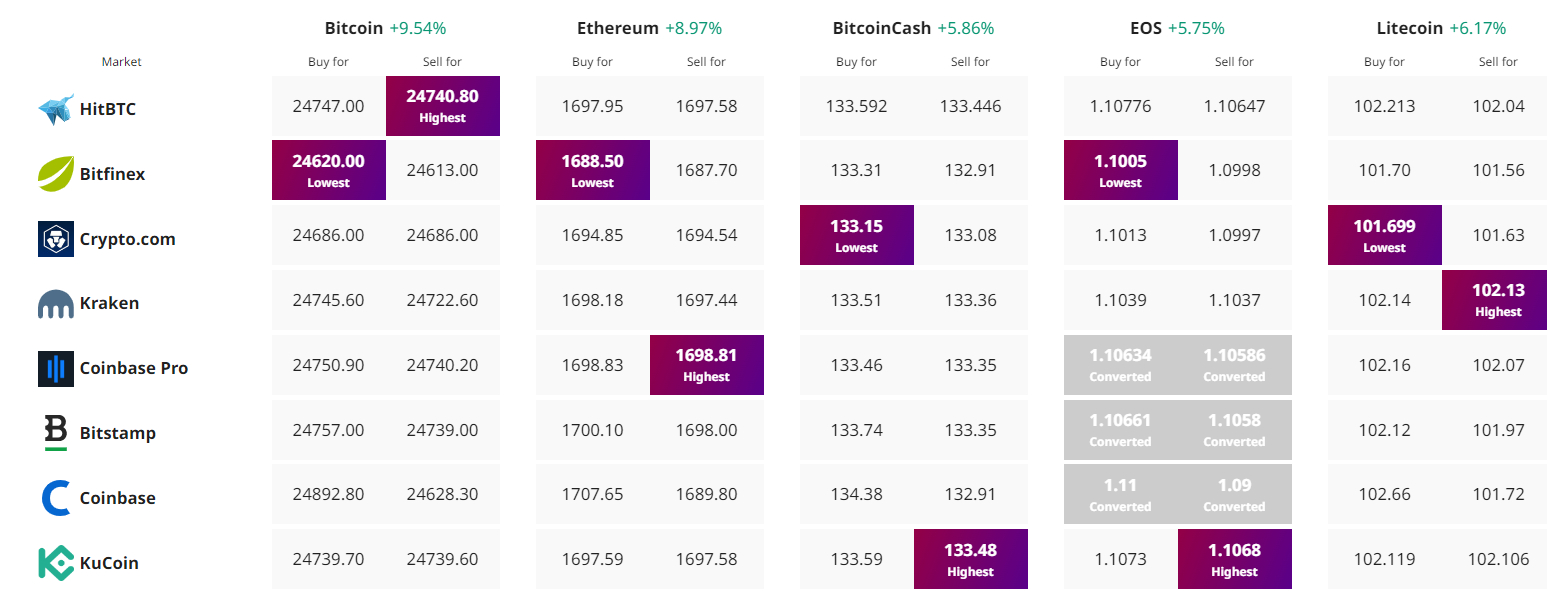

Find the best price to buy/sell cryptocurrency