Bitcoin Price Prediction As ARK Invest’s Cathie Wood Praises BTC Despite Bear Market – Here’s Where BTC Is Heading Now

After the bearish breakout of the ascending channel on December 12, the Bitcoin price prediction turned bearish. It supported Bitcoin near the $17,000 level and now, after a bearish breakout, the Bitcoin price is vulnerable to the $16,750 level.

Ark Invest CEO Cathie Wood recently tweeted her admiration for Bitcoin’s resilience, noting that the flagship cryptocurrency “didn’t skip a beat” amid a recent crisis.

She goes on to say that Bitcoin’s “transparency” and “decentralization” are reasons why disgraced FTX founder Sam Bankman-Fried didn’t care about it. He was helpless, said the well-known investor.

The latest tweet from Wood is a response to Ark Invest, the investment management firm she runs.

This week, the market’s attention is focused on the high-impact economic events coming out of the US. Let’s take a look.

Upcoming FOMC on the Docket

Market participants are concerned about the next Federal Open Market Committee (FOMC) meeting and policy discussions on December 13. The above is because Bitcoin’s price still has a strong correlation with stocks. As a result of the market’s reaction to the news, the upcoming CPI reporting event may result in increased volatility for BTC/USD.

The US central bank will raise interest rates on 13 December. It follows a series of 75 basis point rate hikes throughout the year. The interest rate increase tomorrow is expected to be smaller than previously.

Because the head of the US central bank has indicated that the Fed will scale back interest rate increases in December, the market expects a lower interest rate increase. If the news of tomorrow’s rate hike is less than what came before it, the crypto market could see a relief rally.

If the interest rate hike is 50 basis points or less, the global financial and cryptocurrency markets will experience a slight to moderate recovery in relief. But if interest rates rise by more than 50 basis points, all prices will fall significantly more. The release of inflation rates will also affect the price of BTC/USD.

Bitcoin Smart Contract functionality

The non-profit DFINITY Foundation created the Internet Computer (IC), the first web-speed, internet-scale public blockchain. IC’s mainnet announced its integration with Bitcoin, bringing groundbreaking smart contract functionality to the world’s leading cryptocurrency.

The Internet computer can now act as a Bitcoin Layer 2 by allowing smart contracts to hold, transfer and receive bitcoin without the use of blockchain bridges or other intermediaries. It provides a secure foundation for various DeFi and Web3 apps that want to code Bitcoin.

The integration of the Internet computer with Bitcoin also provides threshold ECDSA bridges, a more secure alternative to centralized bridges (Elliptic Curve Digital Signature Algorithm).

The ECDSA solution enables Internet Computer’s canister smart contracts to execute Bitcoin transactions without the need for an intermediary or bridge. It enables IC developers to write native Bitcoin code and provides a trustless foundation for Bitcoin-based DeFi applications.

The integration benefits BTC/USD because the price increased after the announcement.

Bitcoin Sinks Like “Anyone Who Could Go Bankrupt Has Been Bankrupt”

Arthur Hayes, the former CEO of crypto derivatives platform BitMEX, believes that the worst is over for Bitcoin this cycle. That’s because the “biggest, most irresponsible entities” have used up the BTC supply.

On December 11th, podcaster and cryptocurrency advocate Scott Melker stated, “looking forward, pretty much everyone who can go bankrupt has gone bankrupt.”

Hayes clarifies his position by saying that because BTC is the “reserve asset of crypto” and the “most untouched asset and the most liquid”, centralized lending companies (CELs) often call in loans before selling them when they experience financial difficulties.

In a blog post published on December 10, Hayes made a similar argument. He stated that due to the credit crunch, massive physical bitcoin sales are still taking place on exchanges, with trading firms and CELs trying to avoid insolvency and liquidate their holdings.

He believes that the Fed will activate the printing press, causing BTC/USD and all other risky assets to rise.

Now let’s look at Bitcoin’s technical aspects.

Bitcoin price

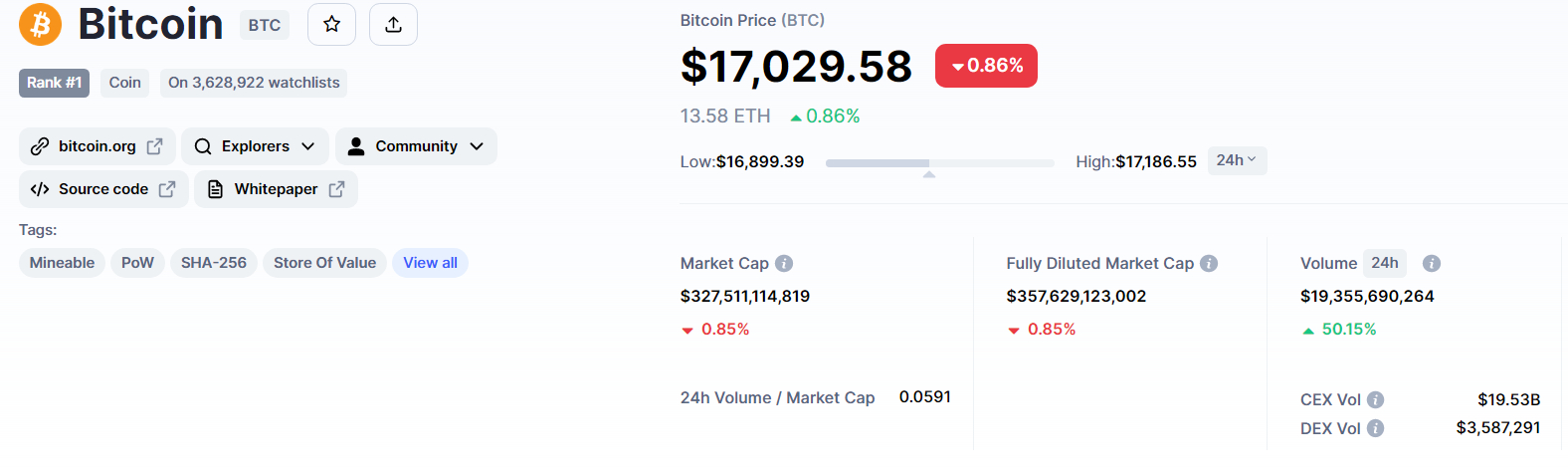

Bitcoin’s current price is $17,035, and its 24-hour trading volume is $19 billion. BTC price has lost over 0.50% since yesterday.

On the technical front, Bitcoin has broken through an upward channel at $17,000, and candle closes below this level suggest that the selling trend may continue.

On the downside, BTC may fall until it reaches the next support area at $16,750, and below that is the next support at $16,365.

A bearish crossover below the 50-day simple moving average (SMA) reinforces the bearish bias, suggesting that BTC could move towards $16,750.

Dash 2 Trade (D2T) – Pre-sale in the final phase

Dash 2 Trade is a trading intelligence platform based on Ethereum that provides investors with real-time analytics and social trading data to help them make better trading decisions. It will go live in early 2023 and the D2T token will be used to pay monthly subscription fees on the platform (there are two subscription levels).

The pre-sale for Dash 2 Trade, now in its fourth and final phase, has already raised more than $9.5 million. It has also announced listings on Uniswap, BitMart and LBANK Exchange for early next year, suggesting that early investors will soon be able to lock in some profits.

Visit Dash 2 Shop Now

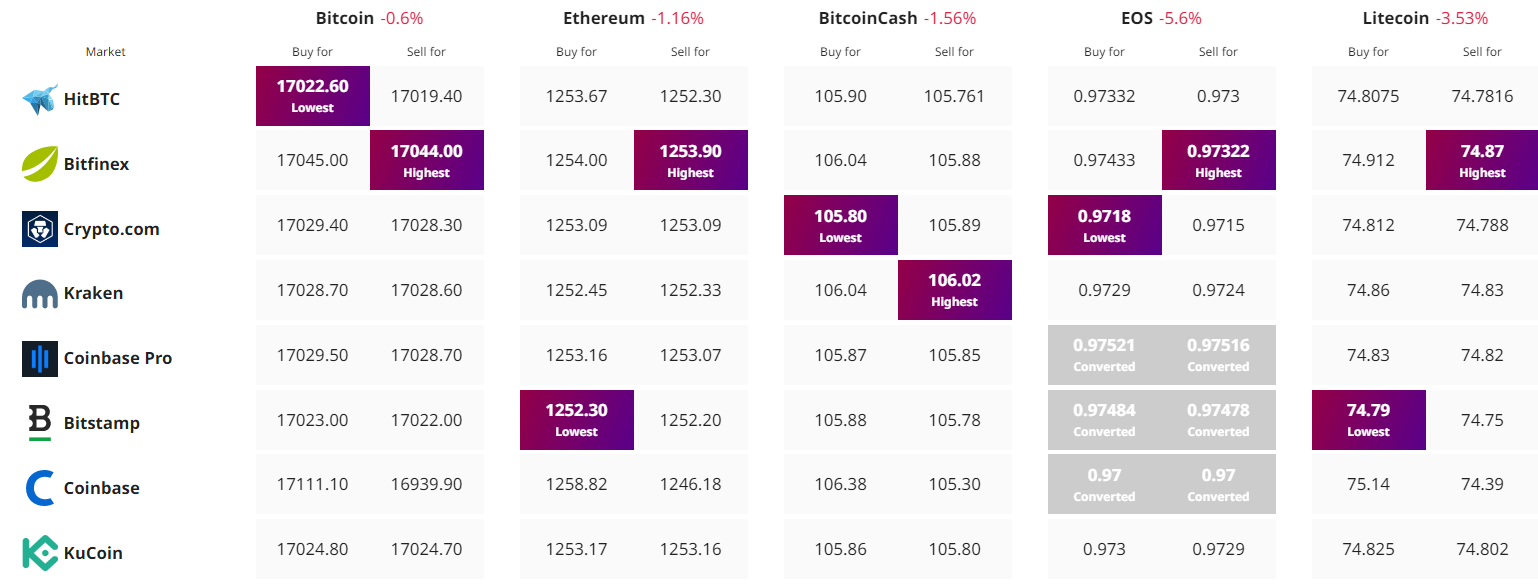

Find the best price to buy/sell cryptocurrency