Bitcoin Price Prediction As $20 Billion Trading Volume Comes In – Where Is BTC Heading This Weekend?

As Bitcoin’s price continues to fluctuate, with new highs and lows being reached on a regular basis, investors and traders are keeping a close eye on the market to try to predict where the price of BTC may be headed next.

Recently, a trading volume of $20 billion has come into play, adding to the speculation about what the future may hold for Bitcoin. With all of this in mind, many are wondering where Bitcoin is headed this weekend, and what factors could be driving the price movements.

In this article, we will take a closer look at the current state of the Bitcoin market and explore some possible predictions for where the price may be headed in the near future.

Bitcoin Hashrate Hits Record High of 400 EH/s Amidst Bull Market

Since the beginning of this year, the Bitcoin hashrate has been steadily rising. At the beginning of this week, the network saw an addition of 40 exahashes per second (EH/s), bringing the hash rate to a peak of 350 EH/s.

However, just hours after the mining difficulty was adjusted on March 23, the hash rate soared to unprecedented levels.

According to data from Mempool, the Bitcoin hash rate hit a new all-time high of 400 EH/s between March 23 and 24. This development means two things: an increase in the security of the network and the confidence of the miners in the long-term profitability of Bitcoin.

With the recent rally, miners who have been an integral part of the network since its inception have continued to show their support for the leading cryptocurrency.

In addition, the Bitcoin mining difficulty has reached an all-time high of 46.84 trillion, a 7.5% increase from previous levels that corresponds to the progressive increase in hash rate during this period.

How an increase in Bitcoin hash rate and mining difficulty can affect the price of BTC

A higher hashrate means that there are more miners on the network, increasing the competition to mine new blocks and earn rewards. This could lead to a more secure and stable network, which could improve investor confidence in Bitcoin and potentially drive up its price.

Furthermore, a higher mining difficulty means that it is more difficult for miners to mine new blocks, which can lead to a decrease in the supply of Bitcoin. Since Bitcoin’s supply is limited, any decrease in supply could potentially increase its price.

Bitcoin price

The current market price of Bitcoin is $27,530, with a 24-hour trading volume of $14 billion. Over the past 24 hours, Bitcoin has experienced a decline of over 0.50%. With a live market cap of $532 billion, Bitcoin remains the number one cryptocurrency on CoinMarketCap.

According to technical analysis, the BTC/USD pair is currently showing a choppy trend. However, there is a possibility that it could face resistance at the $28,950 level.

If the BTC/USD pair is able to break through the $28,950 resistance level, it could potentially lead to an increase in Bitcoin’s value, with the price reaching $29,200 or even $30,700.

On the other hand, if there is a bearish trend, the support levels around $26,600 and $25,200 are expected to provide strong support for Bitcoin’s price.

Buy BTC now

Top 15 Cryptocurrencies to Watch in 2023

To stay informed about the latest ICO projects and altcoins, it is recommended to regularly check the curated list of the top 15 cryptocurrencies to watch in 2023, as compiled by the experts at Industry Talk and Cryptonews.

This list will provide valuable insight into emerging cryptocurrencies and trends in the crypto market, helping investors and enthusiasts stay ahead of the curve.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

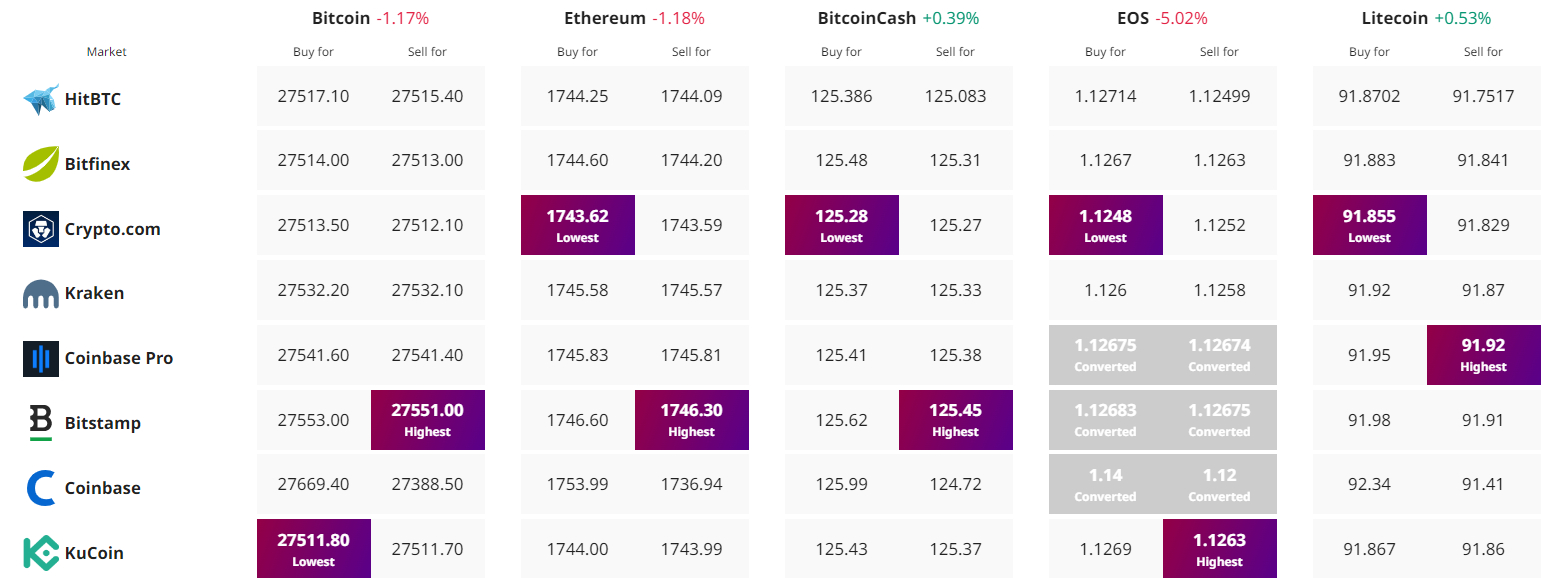

Find the best price to buy/sell cryptocurrency