Bitcoin Price Prediction As $10 Billion Weekend Volume Comes In – Where Is BTC Heading Now?

Bitcoin’s price prediction has been a hot topic among investors and traders as weekend volume surpassed $10 billion. The market is showing mixed signals, with some indicators pointing to a bullish trend, while others point to a bearish scenario.

As investors keep a close eye on the market, various factors, including economic data, government regulations and industry developments, could affect the direction of BTC’s price in the coming days.

Dismissed: Civil Complaint Against Bitcoin Bull Michael Saylor

Michael Saylor, a prominent Bitcoin advocate and chairman of MicroStrategy, has won a civil lawsuit against him, according to a recent filing with the US Securities and Exchange Commission. The lawsuit, filed by the District of Columbia Attorney General’s Office in August 2022, accused Saylor of violating the False Claims Act and failing to pay personal income taxes on more than $25 million.

The court rejected the allegation that Saylor and MicroStrategy conspired to violate the act, but the charge that Saylor committed tax fraud remains. A status conference is scheduled for March 10, 2023, with the final outcome of the case still unknown.

The dismissal of the civil complaint against Michael Saylor could have a positive impact on the reputation of the Bitcoin and crypto market, as it removes the negative press associated with the accusations against one of its prominent figures.

However, the ongoing charge against Saylor for tax fraud remains, and depending on the outcome, could have a negative impact on his credibility and reputation in the crypto community. Overall, the impact on the crypto market is likely to be minimal.

Coinbase Exec Suggests Institutions Consider Alternative Cryptocurrencies

Coinbase’s head of institutional research, David Duong, stated in a live stream with crypto analyst Scott Melker that institutional investors may be more interested in crypto assets beyond Bitcoin and Ethereum than previously thought.

Duong noted that nearly half of all institutional flows on Coinbase are directed toward assets other than Bitcoin and Ethereum. He also mentioned that current market conditions are uncertain due to macro factors and seasonality, leading to potential crypto decorrelation from other risk assets.

The fact that institutional investors are increasingly showing interest in altcoins beyond Bitcoin and Ethereum suggests that the crypto market could see increased diversification in the coming months. This can have a positive impact on the overall market as it can lead to increased demand for altcoins, which in turn can increase their value.

However, it is important to note that Bitcoin and Ethereum remain the main focus of institutional investors, and any major market movements in these assets could still have a significant impact on the crypto market as a whole.

Bitcoin price

As of now, Bitcoin is trading at $22,360 with a 24-hour trading volume of $12.8 billion, having decreased by 0.50% in the last 24 hours. Bitcoin remains at the top of the CoinMarketCap rankings, with a live market cap of $431 billion.

Based on technical analysis, there is a possibility that the BTC/USD pair may break the symmetrical triangle pattern at the $23,250 level. If this happens, it could expose the BTC price to the support zone of $22,046. In the event of a further breakdown below this support zone, BTC could fall to $21,450.

In addition, the appearance of a bearish engulfing candle indicates a significant selling bias in the BTC/USD pair. However, if the candles manage to close above this level, there could be potential for a bullish rejection towards $22,800 or even higher, with a potential target of $23,750.

Buy BTC now

Bitcoin Alternatives

Investors looking to buy Bitcoin may want to consider exploring other options that offer greater short-term growth potential. Cryptonews has conducted an in-depth analysis of the top 15 cryptocurrencies that investors should consider for 2023. Click the link below to learn more.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

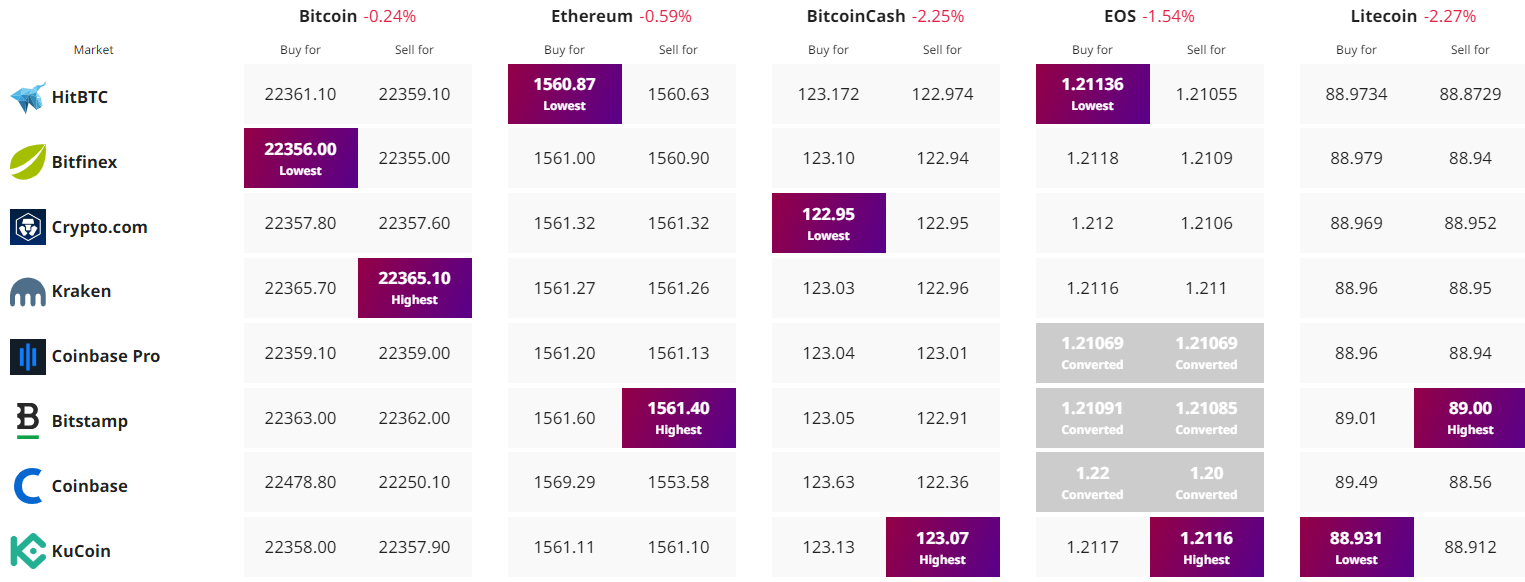

Find the best price to buy/sell cryptocurrency