Bitcoin price faces tough resistance despite chart recovery

Bitcoin price continues to witness strong resistance around the $19,400 mark. In the last 24 hours, the coin has weakened by 2.9%. At the beginning of this month, the Bitcoin price had staged a brief recovery, but it was met with selling pressure.

After the coin started hovering near the $18,000 price mark, this level attracted buyers on the chart. Shortly after that, BTC moved up the chart two weeks ago. The technical outlook of the coin indicated that the bears had not given up yet.

The bulls could return to the chart if the coin breaks past its immediate resistance mark. Buying power was lower on the chart and only an increase in buying power could move BTC up.

If the bulls manage to stick around for the next few trading sessions, BTC could move above the $20,000 price mark. The chance to rally near the $22,000 price level also cannot be called impossible once the bulls have cleared the $20,000 level.

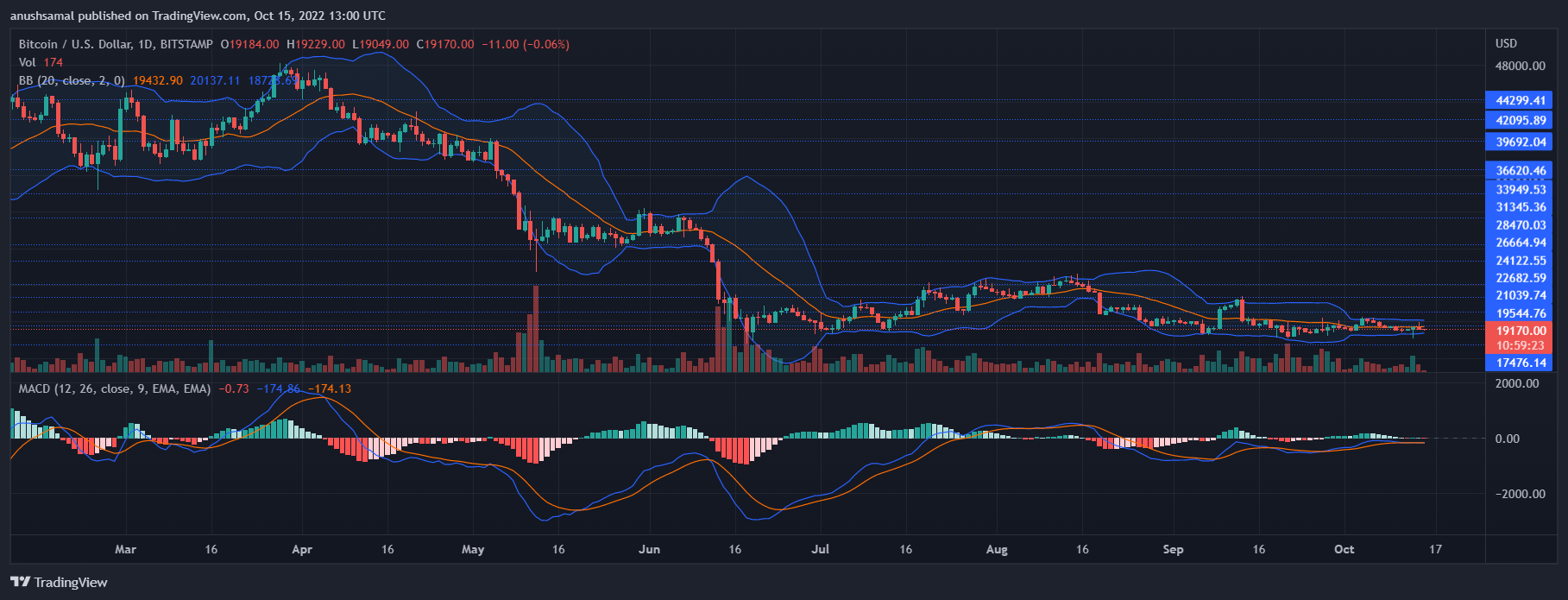

Bitcoin Price Analysis: One Day Chart

BTC was trading at $19,190 at the time of writing. The coin had witnessed significant resistance at the $19,400 price mark. Moving beyond this level will help the coin gain momentum to move near the $21,000 resistance mark.

Once the Bitcoin price touches the $20,000 level, the bulls could help BTC rally further. On the other hand, the support for BTC was at $18,000 and a fall from that would push the coin to $17,400. If buyers do not re-emerge in the next few trading sessions, a drop to the $18,000 price zone seems likely.

During the last trading sessions, the amount of traded Bitcoin fell, indicating a decrease in buying pressure.

Technical analysis

The coin showed that as it struggled to overcome the immediate resistance, buyers began to lose confidence and sellers took over. The Relative Strength Index was parked below the halfway line, which meant that buying strength remained low on the chart.

If buyers pick up the pace, Bitcoin could challenge its next price resistance level. In line with the same reading, the price of the asset was below the 20-SMA line and it was an indication that sellers were driving the price momentum in the market at the time of writing.

At the time of writing, BTC was dominated by the sellers. The coin started showing a sell signal, indicating that it could be possible for the price to fall further.

Moving Average Convergence Divergence shows price momentum and direction, MACD underwent a bearish crossover and started showing small red histograms, which were sell signals.

Bollinger Bands show the volatility of the asset. The bands had completely narrowed, indicating explosive incoming price action.