Bitcoin price can never go back to the previous cycle decline

Bitcoin price hit a new 2023 high today and an analyst lays out his case for why BTC won’t go back to cycle low again.

Momentum on bitcoin and the crypto market is increasing despite an ongoing war against crypto in the US.

As another US banking crisis begins to unfold, financial regulators are scrambling to patch the holes in the leaky vessel. Part of their strategy is to attack one of the few viable alternatives – cryptocurrencies.

This has been evident this year with several major enforcement measures against the industry’s largest players. However, Bitcoin and crypto markets have been resilient so far in 2023.

One analyst believes that Bitcoin prices will never return to their previous low cycle. This was just below $16,000 in late November after the FTX collapse. Since then, the asset has risen around 80% to today’s intraday high.

Bitcoin Halving Narrative Strengthening

On March 30, analyst Jesse Myers presented his case on why he thinks Bitcoin prices are unlikely to be this low again.

He added that most people miss the bottom because they freeze and watch it go by. This was in November 2022 when crypto markets crashed to a four-year low.

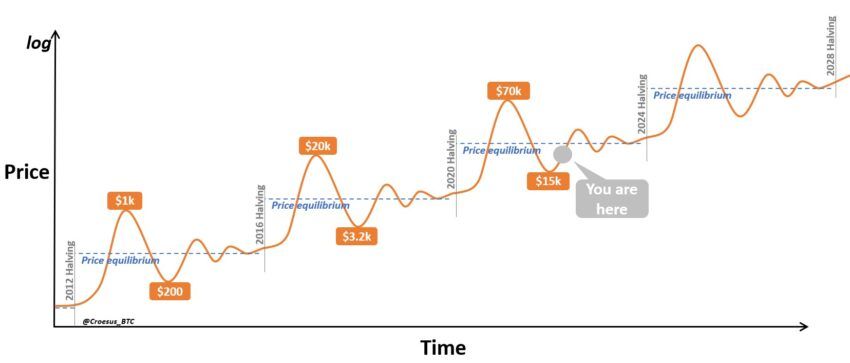

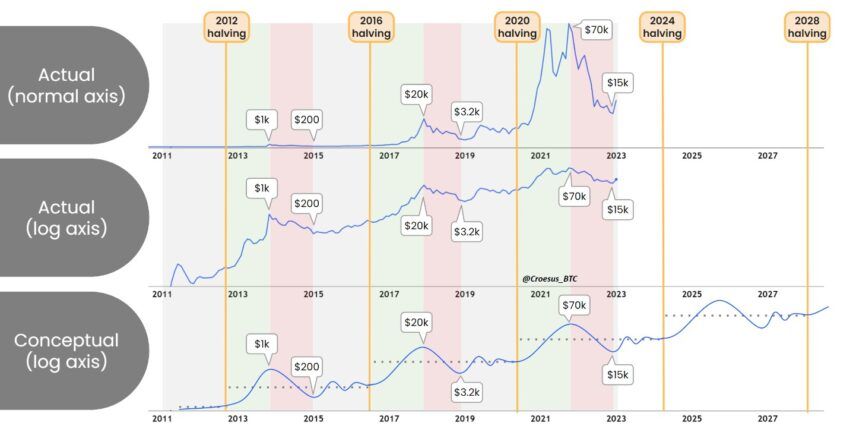

Furthermore, we are still below the ‘price equilibrium’ at the current level.

The Bitcoin halving narrative has been proven in the last three major cycles. A bull market has followed each halving event, and history seems to be repeating itself.

“This is the result of a supply shock that raises Bitcoin’s price balance between supply and demand.”

The analyst said there is a lot of noise in this price action. “This is a new free market asset that is starting up from nothing to become a major player in the global asset landscape,” he added.

Beneath that noise lies the halving narrative, with the next event about a year away.

BTC loses $29,000

BTC hit its highest price in nine months during the early morning hours of March 30. As a result, the top-ranked cryptocurrency by market cap briefly topped $29,000 before retreating slightly.

At press time, BTC was trading at $28,621, after a daily gain of 3.7%.

Furthermore, the Bitcoin Fear and Greed Index has moved back into ‘greed’ territory with a value of 60 today.

The $30,000 zone is the next heavy resistance, so it may well reach it just before the market correction.

Disclaimer

In line with Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.