Bitcoin Price and Ethereum – Will October be a Bullish Month?

Bitcoin, the leading cryptocurrency, is currently trading at $20,140.48, up 0.09%. Although Bitcoin’s price is still well above $20,000, cryptocurrency values fell sharply today.

However, Ether, the symbol associated with the Ethereum blockchain and the second largest cryptocurrency, is trading at $1,358.95 and is up 1.00%. Dogecoin is up 6.80% to $0.06 today, while Shiba Inu is pumping almost 2.20% to $0.000011.

That means a change in a pattern can signal a trend reversal, and October could be a bullish month for cryptocurrencies.

Will October be a bullish month?

Justin Bennett, a well-known cryptocurrency trader, has just released his Bitcoin (BTC) playbook for the month of October, along with a set of market analysis.

As long as $18,700 holds, this is my #Bitcoin playbook through October.

The analyst predicts that the flagship cryptocurrency will stay above $18,700 throughout the coming month.

Based on past performance, October could be a good month to invest in Bitcoin. Cryptocurrency market watchers have noted that October is usually a good month for the currency. Due to growth from the previous year, in early November it reached an all-time high of approximately $66,000.

Galois Capital, a cryptocurrency hedge fund known for correctly predicting the collapse of Terra’s algorithmic stablecoin UST, tweeted:

The meme was quickly adopted by other accounts with significant followings as well.

The October effect can drive an uptrend in Crypto

Although the term “Uptober” is relatively new, it became popular during last year’s record-breaking boom. However, conventional wisdom predicts that October and November will be good months for cryptocurrencies, especially Bitcoin.

Bitcoin’s October performance has been positive eight times out of the past 12 months, and BTC has shown positive performance in eight of the past twelve years, with an average return of around 30%. So far, 66% of the investments made in October have made a profit.

According to Coinglass data, October has historically been a positive month for the most popular cryptocurrency in terms of monthly returns.

Contrary to popular belief, the “October effect”, which predicts that October will be a losing month, only applies to traditional stock markets.

October is particularly important for cryptocurrency because Satoshi Nakomoto, the project’s pseudonymous founder, published the project’s white paper for the first time on October 31, 2008.

October offers the highest returns in crypto

Cryptocurrency strategist James Altucher, the host and creator of InvestAnswers, believes that as the final quarter of the year officially begins, October will traditionally be a strong month for Bitcoin.

James Altucher said:

“Let’s look at how October measures up against other months in Bitcoin’s history. Here you can see that September is red. August is like breakeven. But October is the third best month historically. And that’s why many refer to it as Uptober.”

Based on the historical returns for October, he believes Bitcoin could reach $26,000 in the next four weeks.

According to James, October had the third highest average monthly return. He believes that October is historically the third best month. As a result, many refer to it as Uptober.

Crypto Community is bullish on Ethereum in October

Many cryptocurrencies are trading in the green on their daily and weekly charts. It also includes Ethereum (ETH), one of the largest tokens, which has led the crypto community to predict that the market will continue to rise by the end of October.

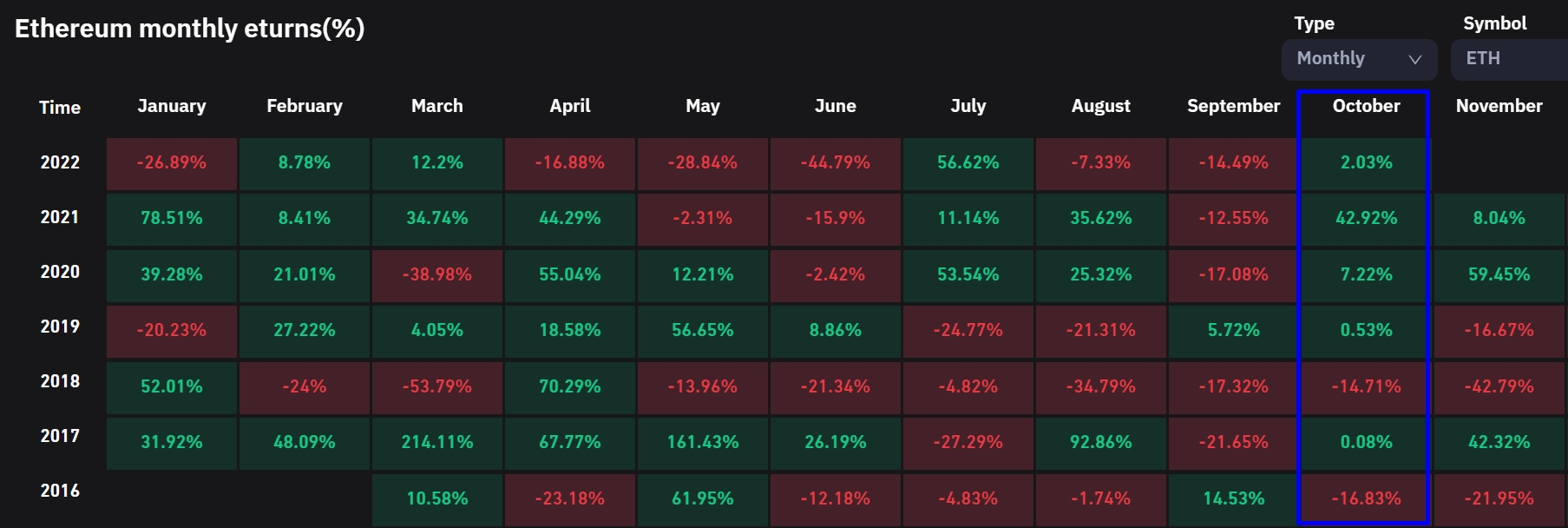

According to Coinglass data, the Ethereum price has historically performed exceptionally well in October.

Community votes on CoinMarketCap predicted that Ethereum’s token would trade at an average price of $1,578 on October 31, 2022, according to the latest data obtained on September 27 using the platform’s ‘Price Estimates’ tool.

Notably, the cryptocurrency community’s forecast for Ethereum’s price, which received 2,244 votes, is an increase of 13.34%.

Bitcoin Price and Technical Outlook

Bitcoin is currently trading near the psychological level of $20,000. In my previous Bitcoin update, I mentioned that the BTC/USD pair had formed a descending triangle pattern, extending significant resistance near $20,478.

Bitcoin failed to break above the trendline resistance and is now heading south to cross below the 50-day moving average and provide immediate support near the $20,000 psychological level in this case.

Leading technical indicators such as RSI and moving average convergence and divergence (MACD) are above 50 and 0, still indicating a buying trend. However, the “hanging man” candlestick pattern signals the chances of a bearish correction today.

On the downside, Bitcoin’s immediate support level remains at $20,000, with $18,650 as an immediate support level below this level.

Ethereum Price and Technical Outlook

ETH is currently consolidating in a narrow trading range of $1,300 to $1,400, possibly awaiting a strong fundamental to trigger a breakout. On the technical side, the ETH/USD pair is trading marginally higher after recovering from the $1,300 psychological support level.

On the daily time frame, a small ascending triangle pattern provides immediate resistance near the $1400 level. Ascending triangle patterns are highly likely to break out on the bullish side, so the odds of an ETH’s bullish bias remain high.

As a result, a positive crossover above $1,400 could clear the way for an uptrend to extend to $1,575 or $1,650. If the price of ETH continues to rise, it could reach $1795 per coin. Support, however, remains near $1,300 and $1,227.

New Altcoin News

In addition to leading cryptocurrencies, new altcoins are making headlines. IMPT, a new protocol, is being developed to help businesses and people track and control their carbon footprint. The protocol is designed to reward and motivate users for their participation.

IMPT is on pre-sale and it is showing a tremendous performance, having raised more than $1.4 million in just four days after the pre-sale.

Alongside, Tamadoge is also in the spotlight, having gained more than 300% from its record low of $0.01683. The first Tamadoge NFTs are now available on OpenSea, along with 100 ultra-rare Tamadoge Pets.

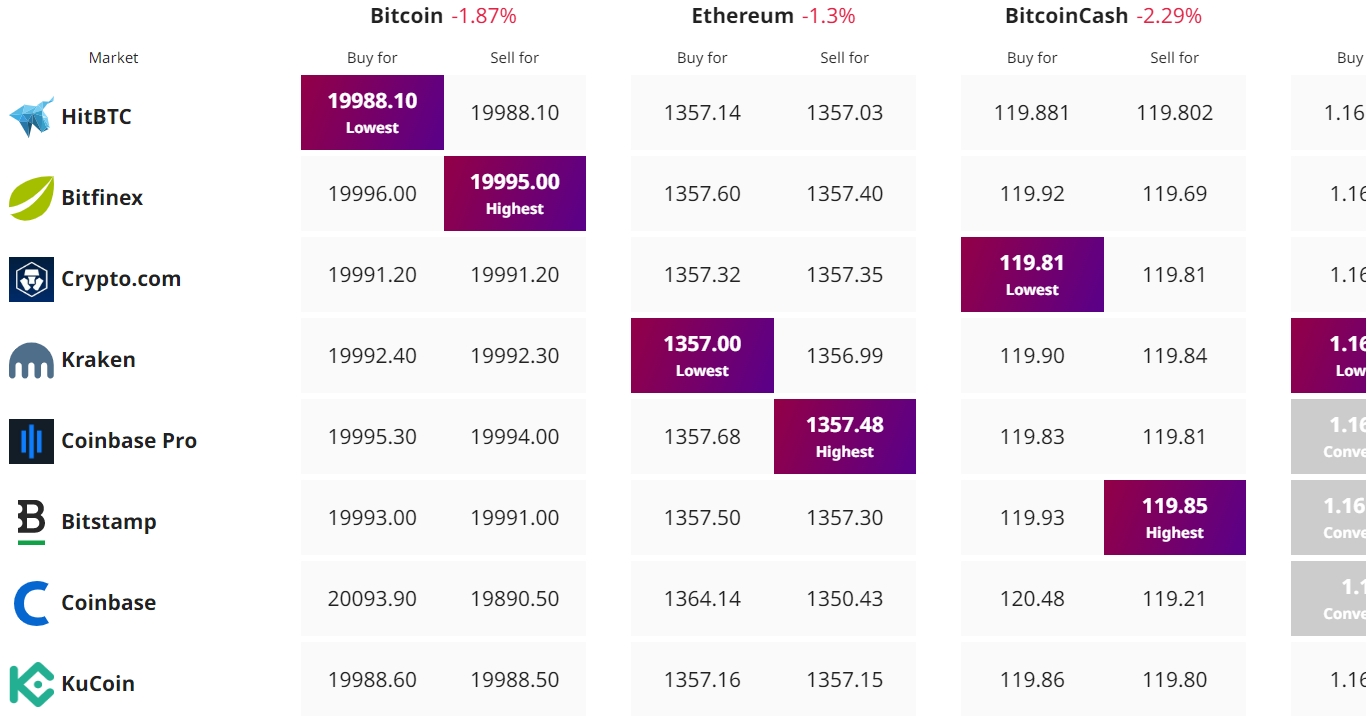

Find the best price to buy/sell cryptocurrency: