Bitcoin Price and Ethereum – US CPI figures in the news

During the early Asian session, major cryptocurrencies traded in the negative as the global crypto market cap fell 0.05% the previous day to $918.19 billion. In the last 24 hours, the total crypto market volume fell 9.88% to $44.13 billion.

The total volume in DeFi was $2.40 billion, accounting for 5.44% of the total 24-hour volume in the crypto market. The total volume of all stablecoins was $41.54 billion, accounting for 94.13% of the total 24-hour volume of the crypto market.

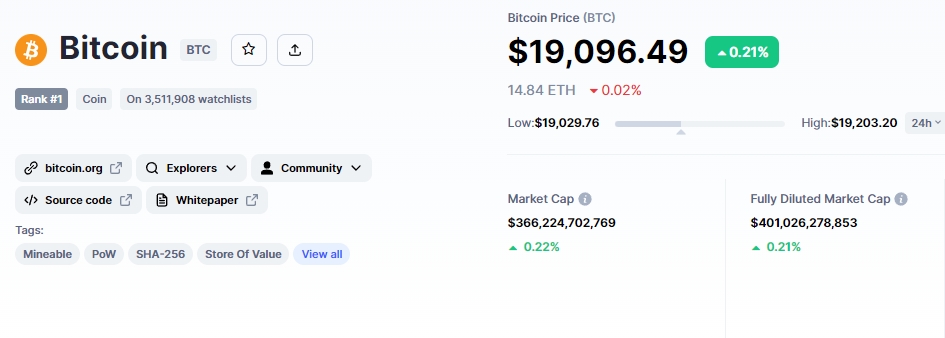

Bitcoin, the leading cryptocurrency, has gained 0.21% after losing more than 6% in the past seven days. Ethereum, on the other hand, is still trading below $1,300 (the psychological level), after losing nearly 6.19% this week.

Top Altcoin Winners and Losers

Huobi Token (HT), Terra (LUNA) and OKB (OKB) continued to be the top performers in the Asian session. Huobi’s price has risen by more than 12% to $7.31, while Terra’s price has risen by 5.06% to $2.68. In contrast, OKB rose 1.65% to $16.68.

TerraClassicUSD price has remained bearish, falling 22.36% to $0.0455 in the last 24 hours. Trading sentiment in the cryptocurrency market is slightly negative, and digital assets are struggling to rise.

As a result, we have a good opportunity to enter positions, especially given how oversold the markets are.

Cryptocurrency News Highlights

Here are some of the events that stood out in the crypto news section:

US dollar on the way up

The US Dollar Index (DXY) has moved to 113.20 after breaking a five-day rally with small losses the previous day. The US dollar index against the other six major currencies was flat on Thursday, ahead of the release of crucial US consumer price index (CPI) data for September, failing to justify recent hawkish Fed plays and upbeat Fed governor comments.

The dollar retreated after minutes from the latest Federal Reserve meeting revealed some dovish undertones. In the minutes of the meeting, it was noted that some people talked about the need to reduce the pace of further tightening to reduce the threat to the US economy.

However, the Fed maintained its plan to raise interest rates in an attempt to slow inflation.

US PPI figures

The dollar gained ground against most cryptocurrencies after news that US producer prices rose more than expected in September.

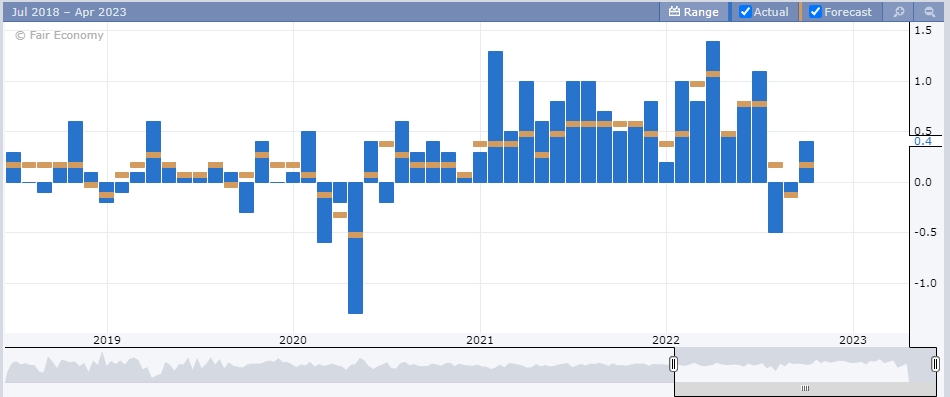

PPI for final demand rose 0.4%, more than the 0.2% increase economists had forecast. PPI rose 8.5% year-on-year in September after rising 8.7% in August.

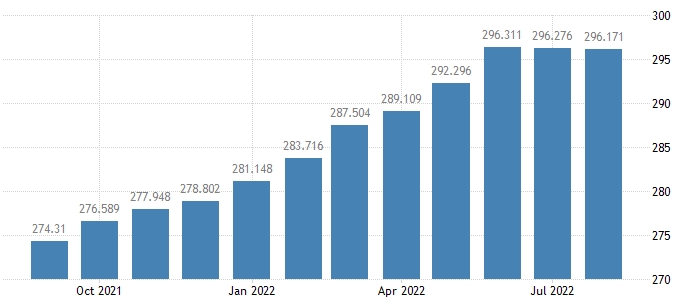

US CPI figures ahead

US inflation eased for the second consecutive month in August 2022, falling to 8.3% from 8.5% in July, but still above market expectations of 8.1%. The US CPI came in at 296.17 in August, slightly below last month’s reading of 296.28 and above the 295.53 that was expected by the market.

The latest Consumer Price Index (CPI) report for September will be released by the US Bureau of Labor Statistics (BLS) on Thursday, October 13 at 8:30 a.m. ET. As for the core data (ex-food and energy) for the CPI, the consensus forecast is for it to print at 0.4% m/m, 6.5% y/y, while the headline CPI is forecast to come in at 0.2 % m/m , 8.1% y/y.

What effect will stronger US economic numbers have on the cryptocurrency market?

The cryptocurrency market may take a bearish turn with higher US CPI numbers. That’s primarily because the U.S. Federal Reserve closely monitors economic statistics such as inflation, labor force, GDP and other events to determine its upcoming policy.

The improved economic data will persuade Jerome Powell and the rest of the FOMC to raise interest rates. As a result, investors can shift their investments away from risky investments such as cryptocurrency, currency and stocks and towards safe haven investments such as gold and government bonds.

Bitcoin price prediction and technical outlook

The current Bitcoin price is $19,094.36, and the 24-hour trading volume is $25 million. Bitcoin has increased by 0.23% in the last 24 hours.

CoinMarketCap now ranks first, with a live market cap of $366 billion. It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,177,593 BTC coins.

On October 13, the Bitcoin price prediction remains bearish, although it finds immediate support near $18,857. Closed Doji and spinning candlesticks above this level are likely to fuel Bitcoin’s uptrend. As shown in the 4-hour chart above, the Relative Strength Index (RSI) has entered the oversold zone, indicating that sellers have been exhausted and buyers are on the horizon.

They are simply waiting for a glimmer of hope, such as a weaker US CPI, before taking advantage of the opportunity.

On the upside, Bitcoin’s immediate resistance remains at $19,295 and $19,550, which has been extended by the 50-day moving average. A bullish crossover above the 50-day moving average could push the price of bitcoin up to $20,470.

Ethereum price prediction and technical outlook

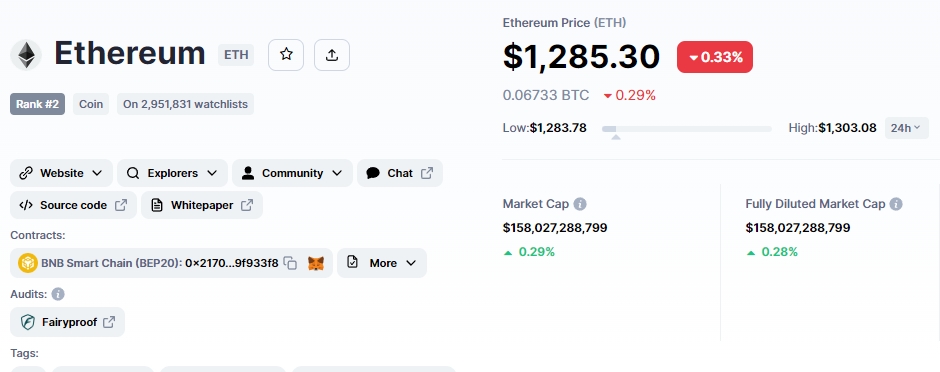

The current price of Ethereum is $1,287.17, with a 24-hour trading volume of $8.5 billion. Over the last 24 hours, Ethereum has risen 0.28%. With a market capitalization of $158 billion, CoinMarketCap is currently number two. It has a circulating supply of 122,771,325 ETH coins and no maximum supply.

The Ethereum price prediction remains bearish as ETH has broken through a symmetrical triangle formation at $1,303 and candles closing below this level are likely to push the price down. Ethereum may move back to retest the crucial $1,300 level; failure to break above this level confirms the continuation of the decline.

On the downside, ETH’s immediate support remains at $1260 and a break below this level could result in selling ETH around $1220. An increase in selling pressure could push ETH below $800, but this is unlikely because the $1005 level will provide significant support along the way.

IMPT – The Green Alternative Crypto

Tamadoge, a meme coin, is gaining ground, gaining more than 33% in the last 24 hours to trade at $0.04143. OpenSea is now selling the ultra-rare Tamadoge NFTs, with a starting price of 1 WETH. Tamadoge has become the third largest meme coin in the crypto space.

After only 9 days of the presale, the project’s native currency, the IMPT token, has already raised an incredible $3.9 million, having sold 217 million tokens.

Although the blockchain-based carbon credit market began its auction during a bear market for cryptocurrencies, demand for the marketplace token remained high.

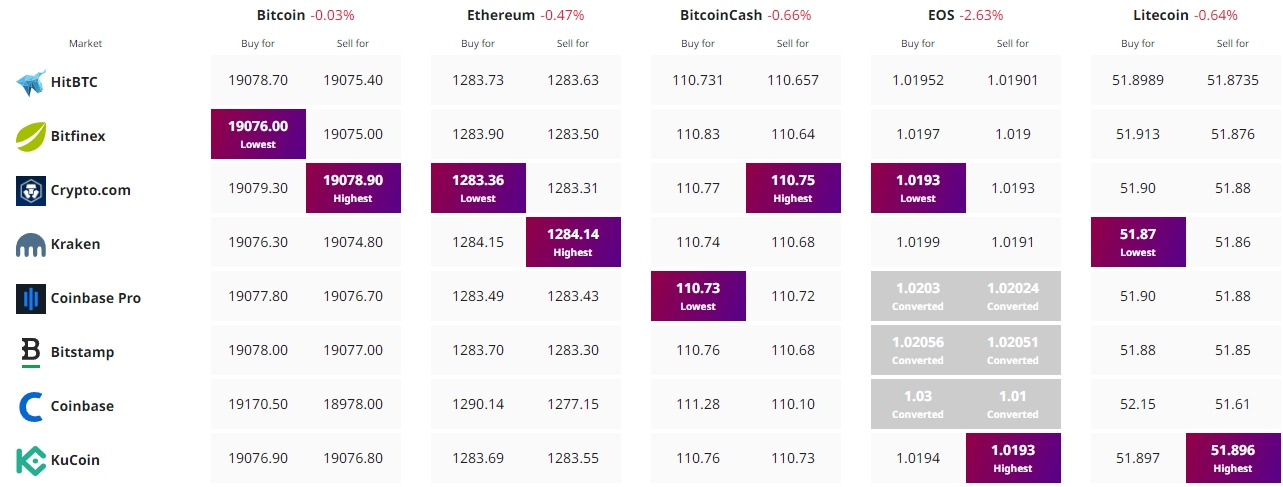

Find the best price to buy/sell cryptocurrency: