Bitcoin Price and Ethereum Prediction; Economic slowdown concerns for 2023

On Sunday, Bitcoin is trading sideways, maintaining a narrow range of $17,000 to $17,350 level. Likewise, Ethereum has risen above the $1,250 level, a support level extended by an ascending triangle pattern.

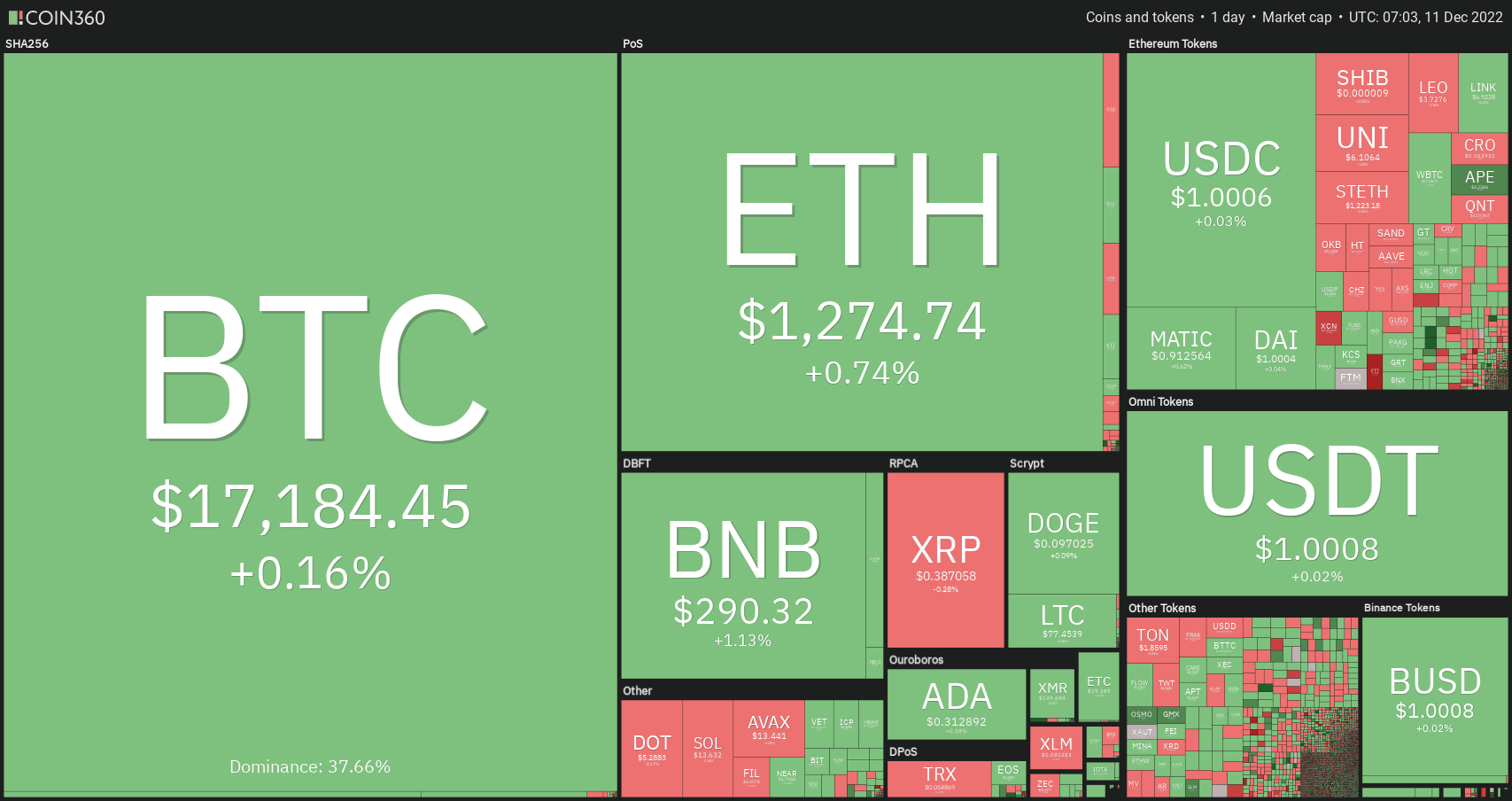

Major cryptocurrencies were trading in the red early on December 11 as the global crypto market capitalization rose 0.9% to $855.49 billion the previous day. In the last 24 hours, the total crypto market volume has decreased by 31.20 percent to $23.76 billion.

Let’s take a look at the top 24-hour altcoin winners and losers.

Top Altcoin Winners and Losers

Osmose (OSMO), ApeCoin (APE) and Stacks (STX) are three of the top 100 coins that have gained value in the last 24 hours. OSMO’s price has risen nearly 12% to $1.01; APE’s price has risen more than 7% to $4.23; STX’s price has risen almost 4.65%.

Three of the top 100 coins that have lost value in the last 24 hours include Chain (XCN), Celo (CELO) and Uniswap (UNI) are down about 5% to $0.0360, while CELO is down about 4% to trade at $0.5960 . Meanwhile, the UNI price is down more than 1% to $5.10.

Economic slowdown concerns for 2023

As investors reduce exposure to potential losses in anticipation of next week’s newsworthy events, Bitcoin’s price is showing no signs of life. The US Congress will hold its first hearing on the FTX collapse on December 13, with the Senate Banking Committee following the next day.

Sam Bankman-Fried, the former CEO of FTX, has agreed to appear before the panel on Friday in response to the subpoena. Due to their regulated nature, cryptocurrencies are likely to be affected in the long term by the investigation, which is expected to last several weeks.

The outcome of the Federal Open Market Committee (FOMC) meeting scheduled for December 14 also has investors’ attention. Markets appear to have already priced in a 50 basis point rate hike in response to Fed chief Jeremy Powell’s “pivot” comments from last month, but investors fear a recession in 2023 because of the bank’s past mistakes.

Elon Musk, CEO of Tesla, warned on Friday, “if the Fed raises interest rates again next week, the recession will significantly worsen.” In response to Musk, Northman Trader founder Sven Henrich warned that next week’s rate hike would anchor a recession and cause further market turmoil.

Grayscale Claims SEC Filed First Brief in Bitcoin Futures ETF Lawsuit

In response to crypto asset manager Grayscale Investments’ lawsuit against the US Securities and Exchange Commission over the rejection of its application for a spot bitcoin exchange-traded fund, the SEC has reportedly filed its first legal brief.

In a statement released Friday, the company described the filing of the amicus briefs as “the next milestone in our continued action.” The company had previously delivered its opening brief on 11 October.

Grayscale’s response to the SEC filing reiterated the allegations from the first brief, accusing the SEC of “creating an uneven playing field for investors by accepting Bitcoin futures-based ETFs while consistently denying spot Bitcoin ETFs.”

The ongoing developments at the SEC Grayscale are putting downward pressure on cryptocurrency prices.

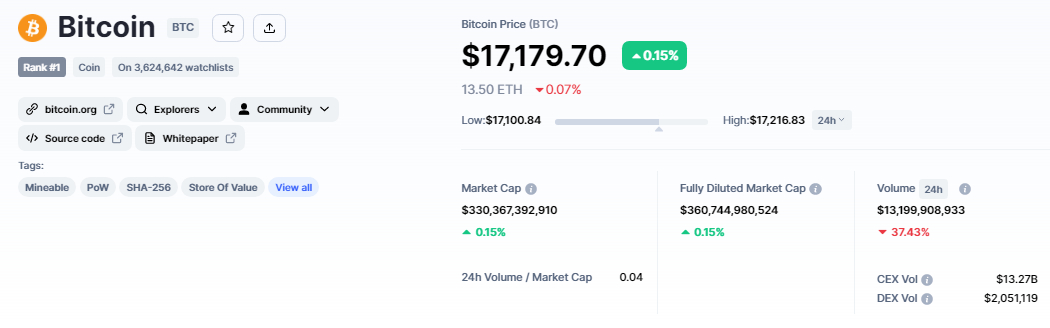

Bitcoin price

Bitcoin’s current price is $17,179, and its 24-hour trading volume is $13 billion. The BTC/USD pair is up nearly 0.15% in the last 24 hours, while CoinMarketCap currently ranks first with a market cap of $360 billion, down from $360 billion yesterday.

Given the lack of volatility, the technical aspect of Bitcoin has largely changed as it trades in a narrow range. On the 4-hour time frame, Bitcoin has formed an ascending channel, which supports the bullish trend; therefore, BTC may face resistance near the $17,400 level.

A bullish breakout above the $17,400 level could take Bitcoin to the $17,650 level, and a bullish crossover above this level could take Bitcoin to the $18,150 level.

A bearish crossover below $17,000, a level extended by the 50-day simple moving average, could start a selling trend that could last to $16,650.

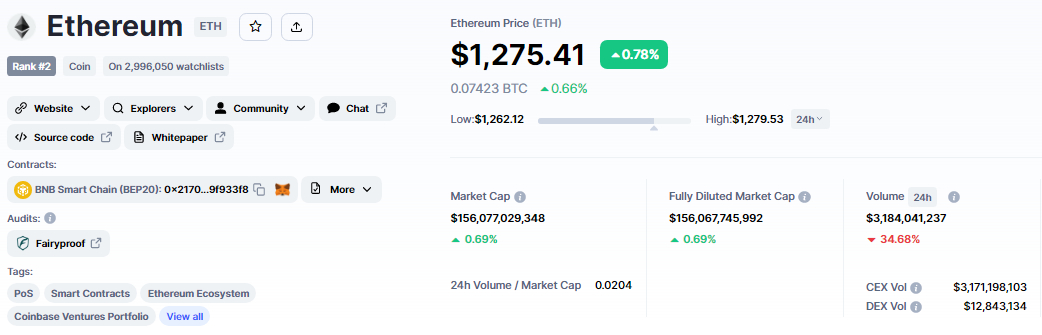

Ethereum price

The current price of Ethereum is $1,275, with a 24-hour trading volume of $6 billion. Ethereum is up nearly 0.80% in the last 24 hours, and CoinMarketCap is currently number two, with a market cap of $156 billion.

On the 4-hour chart, Ethereum has bounced off a support level at $1,220 and crossed above the 50-SMA line at $1,250, which now acts as a support.

On the upside, the immediate resistance level for ETH is $1300 and a break above this level could expose ETH to $1340.

IMPT pre-sale ends in 20 hours

IMPT is a new Ethereum-based network that rewards users for doing business with environmentally friendly companies. IMPT has raised more than $18.2 million since its initial public offering in October, with 1 IMPT currently trading at $0.023.

Due to its extraordinary success, IMPT.io, a pioneering carbon offsetting and trading platform for carbon credits, will will end its token presale on December 11th.

Visit IMPT now

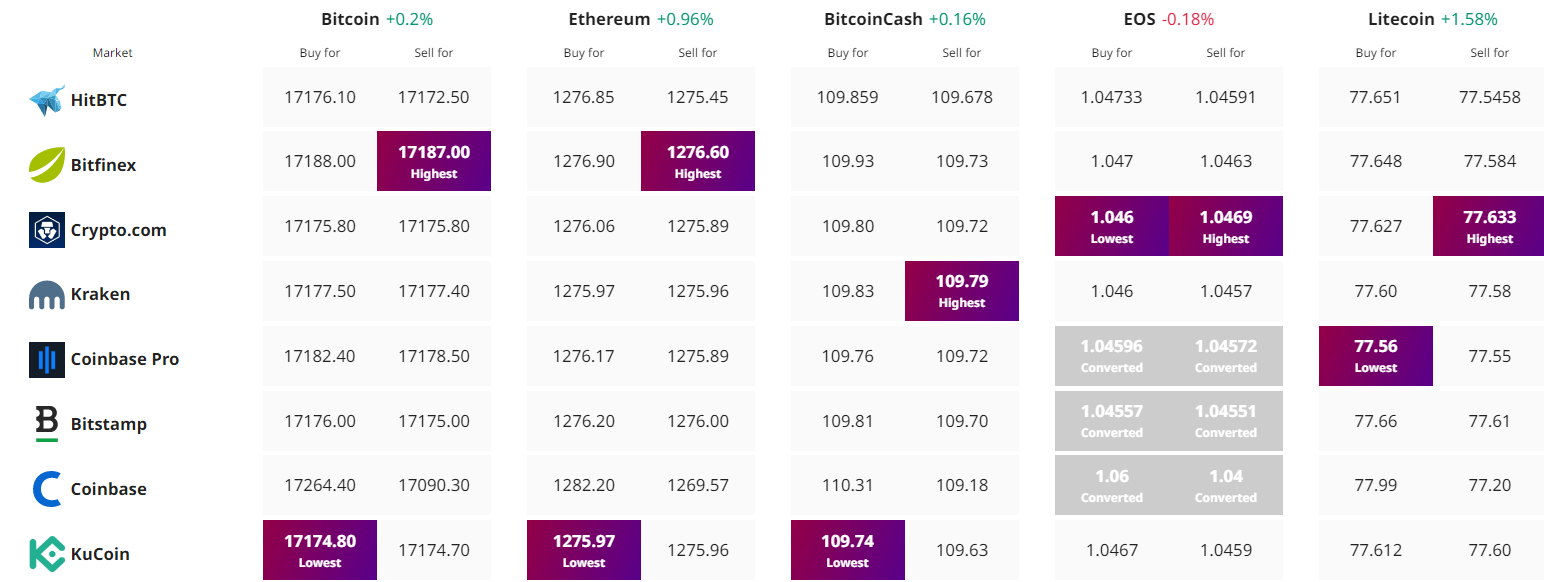

Find the best price to buy/sell cryptocurrency