Bitcoin Price and Ethereum Prediction – BTC May Target $20,000 If Breaks Above This Level

Major cryptocurrencies were trading slightly higher early on October 23, with the global crypto market cap at $923 billion, up more than 0.5% from the previous day. In the last 24 hours, the total cryptocurrency market volume was $32 billion, an increase of 39%.

The leading cryptocurrency, Bitcoin, is consolidating near $19,216, after gaining less than 1% during the Asian session. BTC has formed a symmetrical triangle pattern and a breakout of this triangle will determine the price action going forward. Ethereum, on the other hand, is on the upswing, having risen more than 1% to trade at $1,313.

Top Altcoin Winners and Losers

The top performers in the Asian session were Bitcoin Gold (BTG), Aptos (APT) and Huobi Token (HT). Bitcoin Gold (BTG) is up over 11% to $18.35, while the price of APT is up over 29% to $9.59. Also, the Huobi Token price rose over 11% to $8.70.

Chain (XCN) price has fallen by more than 5% in the last 24 hours to $0.058. The price of Maker (MKR) has fallen more than 3% to around $990.

Fear and Greed Index signals extreme fear

Investors continue to avoid taking any chances and are instead buying gold and US dollars. One possible explanation for the recent market decline in cryptocurrencies is that the market’s fear and greed index currently reads “Extreme Fear”.

Because many cryptocurrencies are oversold right now, “Extreme Fear” is seen as a good time to enter the market and go long on an oversold coin. Perhaps that is one of the reasons behind the uptrend in Bitcoin and Ethereum.

BTC is now less volatile than the S&P 500 and Nasdaq

As reported by cryptocurrency analysis source Kaiko, Bitcoin’s volatility has fallen below that of the S&P 500 and Nasdaq. Cryptocurrency markets, the business argued, have become less sensitive to risky macro events, including high inflation, an appreciating dollar, rising interest rates, protracted war and the energy crisis.

The data suggests that cryptocurrency markets are less reactive to volatile macro events than earlier in the year, while equity markets have been highly sensitive.

In an interview, Clara Medalie, head of research at Kaiko, said:

Bitcoin volatility is at multi-year lows, while stock volatility is only at its lowest level since July. The data suggests that cryptocurrency markets are less reactive to volatile macro events than they were earlier in the year, while equity markets have been highly sensitive.

Bitcoin’s volatility has declined relative to the Nasdaq and the S&P 500, according to cryptocurrency analysis source Kaiko, as reported by CNBC. For the first time since 2020, Bitcoin’s 20-day rolling volatility is less than that of the two stock indexes, according to a report published by a cryptocurrency data firm on Friday.

At its meeting in November, the Federal Reserve will probably raise interest rates by 75 basis points for the fourth time in a row. But Mary Daly, president of the Federal Reserve Bank of San Francisco, said last Friday that policymakers should think about slowing the pace of future rate hikes.

Bitcoin price prediction and technical outlook

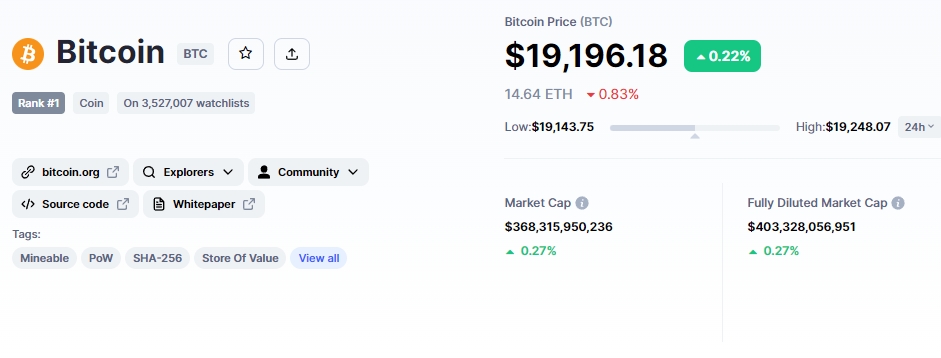

The current Bitcoin price is $19,206, and the 24-hour trading volume is $15 billion. Bitcoin has increased by less than 1% in the last 24 hours. CoinMarketCap currently ranks first, with a live market cap of $368 billion.

It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,186,937 BTC coins. Bitcoin is expected to face immediate technical resistance near the $19,300 level, where a symmetrical triangle pattern is also forming. Additionally, the 50-day MA maintains a bearish bias for BTC prices below $19,250.

A sustained move above $19,300 could open the door for bulls to challenge the next resistance zone between $19,650 and $19,950 in BTC.

On the other hand, a break below $18,920 support could push BTC towards $18,600 or $18,400 levels.

Ethereum prediction and technical outlook

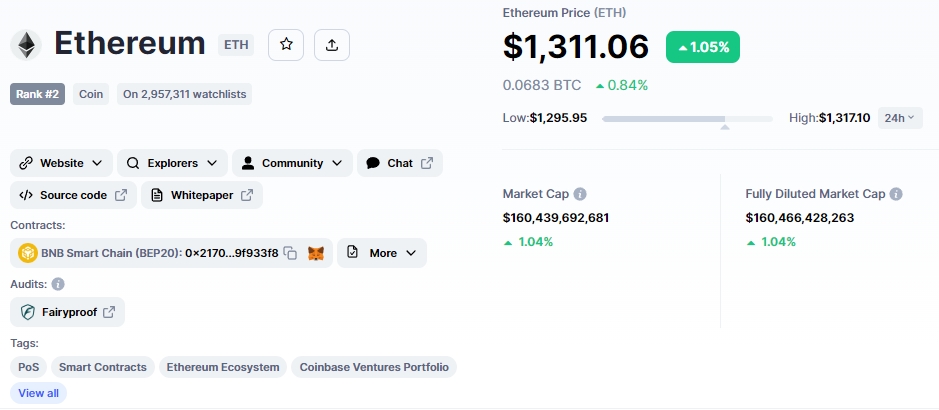

The current price of Ethereum is $1.311, with a 24-hour trading volume of $7.1 billion. Over the past 24 hours, Ethereum has risen over 1%. CoinMarketCap is now number 2, with a market cap of $160 billion.

The ETH/USD pair has formed an ascending triangle pattern, indicating near-term technical support around $1,292. However, immediate resistance is encountered at the $1,320 level. The 50-day moving average also lends credence to the bullish case for ETH.

Ethereum’s primary resistance levels at $1,320 have held well, but the cross above this could push ETH towards $1,340 or $1,385.

Leading technical indicators such as RSI and MACD remain above 50 and 0 respectively, indicating the chances of a continuation of the trend. On the other hand, a bearish breakdown of the $1292 level could bring ETH down to $1270 or $1240.

New Altcoin News

Along with Bitcoin and Ethereum, Dash 2 Trade is making headlines for its huge success in the pre-sale phase. Cryptocurrency traders will have access to real-time market data, insights and analysis via Dash 2 Trade, an Ethereum-based platform.

Following its launch on October 20, Dash 2 Trade pre-sales have already passed $1 million. Till now, it has raised approximately $1.3 million and is expected to pass many more important benchmarks in the coming hours.

Although it is difficult to predict the future, D2T seems to have a bright future based on its solid foundation.

Visit Dash 2 Trade now

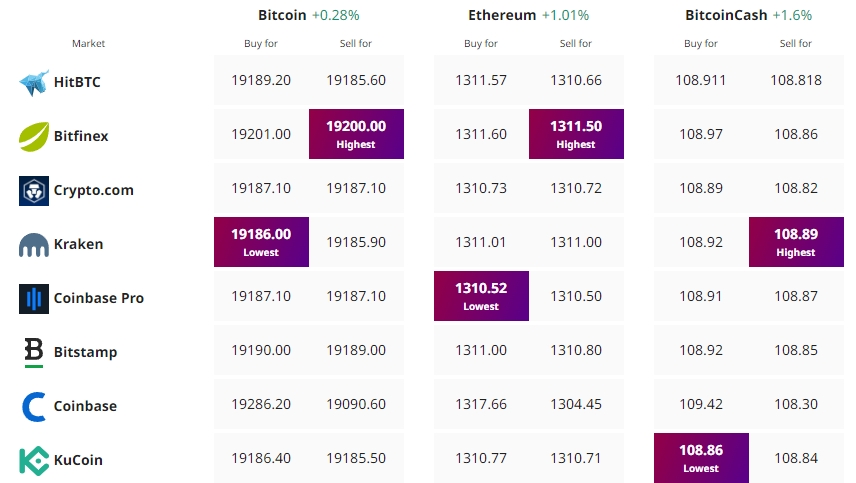

Find the best price to buy/sell cryptocurrency: