Bitcoin Price and Ethereum Prediction: BTC Faces Challenges Below $30,400

Bitcoin, the world’s most popular cryptocurrency, faced a temporary drop on Tuesday as its value fell slightly from $30,500 to $29,300. However, this decline was short-lived and Bitcoin quickly bounced back, rising back to the $30,000 mark and recovering from earlier losses.

This is because investors are once again feeling optimistic about assets retaining their value, although concerns about the banking sector have eased somewhat. Despite the recent ups and downs, Bitcoin remains a popular choice among investors looking for a safe and reliable way to invest their money.

Ethereum, another popular cryptocurrency, has made significant gains against Bitcoin since the Shanghai upgrade. The value of ETH has continued to rise and it recently reached the $2100 mark, which is an impressive feat.

However, this sudden rise in value also faced some resistance, and Ethereum then pulled back a bit to the $2,095 level.

It is worth noting that the Shanghai upgrade was seen as a major contributing factor to Ethereum’s recent success. Therefore, the upgrade has significantly improved the functionality and efficiency of the Ethereum network, making it more attractive to investors looking for a reliable and efficient way to invest in cryptocurrency.

China’s Q1 GDP growth and potential crypto partnerships impact BTC prices

China’s GDP grew by 4.5% in the first quarter of 2023, driven by an increase in consumption and retail sales as the government eased its COVID-19 restrictions. This growth exceeded the previous quarter and was the fastest in the past year.

However, the increase in GDP was attributed to a resurgence in consumption as people returned to malls and restaurants. This news has had a positive impact on overall market sentiment and could potentially lead to an increase in Bitcoin prices.

China’s growth has a major influence on global markets because it is one of the world’s largest economies. An increase in consumption and retail sales in China suggests that demand for goods and services is on the rise, which could lead to increased demand for Bitcoin and other cryptocurrencies.

Furthermore, the potential partnership between state-linked banks in China and regulated crypto firms in Hong Kong also contributed to the positive sentiment surrounding BTC prices. The involvement of these banks suggests that China is exploring opportunities in the crypto space, despite a ban on crypto activities in mainland China.

Senator Elizabeth Warren Blames Bitcoin Mining for Rising Energy Prices, Crypto Community Disputes Claim

Senator Elizabeth Warren has blamed Bitcoin mining for causing energy prices to rise in American households. However, the crypto community disagrees, with many disputing the claims.

Bitcoin podcasters Stephan Livera and MicroStrategy founder Michael Saylor both contradicted Warren’s statement, with Saylor explaining how Bitcoin mining can actually help reduce energy bills. Some in the crypto community have tried to bring Elon Musk into the conversation, as he has been active in combating disinformation campaigns.

Thus, this was seen as a negative factor that could limit further gains in BTC prices.

Bitcoin price

The current Bitcoin price is $30,266, and the 24-hour trading volume is $19 billion. Bitcoin has increased by 2.30% in the last 24 hours. The BTC/USD pair is trading with a bearish bias and is likely to find immediate support near the $29,200 level.

A bearish break below this $29,200 level has the potential to send BTC/USD prices towards $28,750, and additional selling could push BTC down to the $28,230 level.

On the upside, the BTC/USD pair is likely to face immediate resistance near $29,800, and further buying could take BTC towards the $30,600 level.

Buy BTC now

Ethereum price

The current price of Ethereum is $2,090, with a 24-hour trading volume of $8.7 billion. Over the past 24 hours, Ethereum has lost less than 0.30%. The price of Ethereum began a downward retreat from the $2,120 barrier level. ETH fell below $2100, but like Bitcoin, bulls remained bullish above $2045.

Ether is currently trading above the $2,050 mark as well as the 100-hour SMA. Currently, the next resistance is near $2.115.

On the H1 chart of the ETH/USD pair, a critical contracting triangle is being built with resistance around $2,115. If the ETH/USD pair fails to break through the $2,125 resistance mark, it may fall.

On the downside, immediate support is near the $2,070 level and the 100-hour simple moving average. The next key support level is around $2,050, below which the price of Ether could drop significantly.

In this case, the price could retest the $2000 mark. Further losses could drive the price as low as $1,925.

Buy ETH now

Top 15 Cryptocurrencies to Watch in 2023

Stay updated on the latest ICO projects and altcoins by consulting the expertly curated list of the 15 most promising cryptocurrencies to watch in 2023, as recommended by industry specialists at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

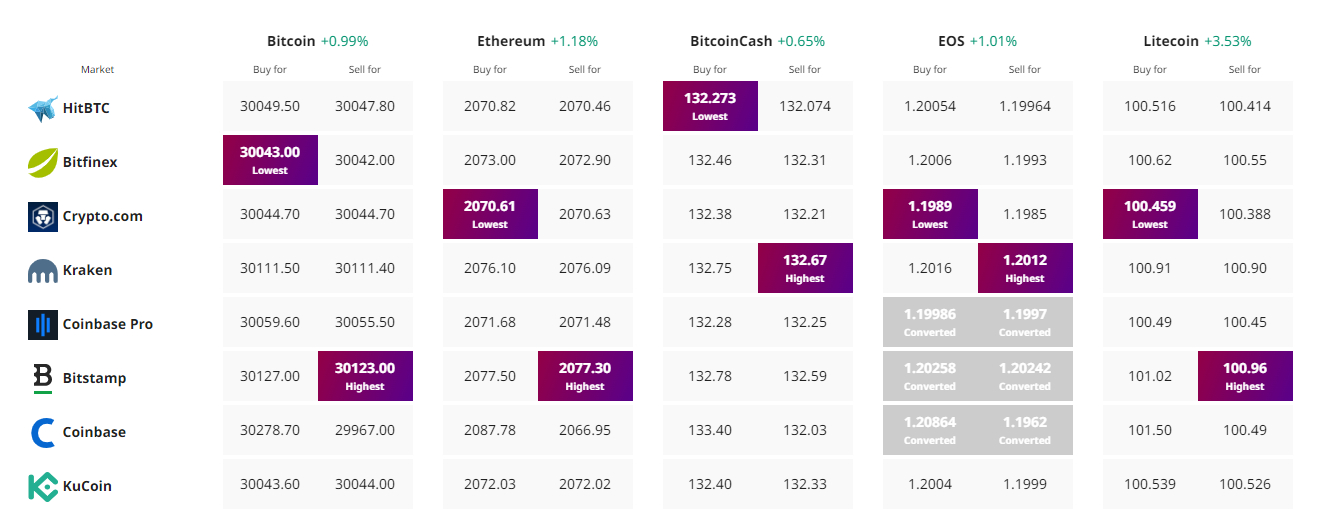

Find the best price to buy/sell cryptocurrency