Bitcoin Price and Ethereum Prediction: BTC and ETH Fall 3%

The cryptocurrency market has experienced a slight setback as both Bitcoin (BTC) and Ethereum (ETH) experienced a nearly 3% drop in their prices.

As the week unfolds, investors and traders are closely watching market trends, seeking insight into possible future movements of these leading digital assets.

In this price prediction, we will delve into the factors influencing the market, analyze the latest price action and explore expert predictions to help you predict what to expect in the week ahead for the crypto market.

Unforeseen change in Bitcoin’s key calculation and its effects on price trend

A remarkable change in one of Bitcoin’s (BTC) crucial indicators, which can significantly affect its price movement, has recently been discovered according to fresh data.

This surprising development has piqued the interest of investors and analysts as they try to unravel the implications for the cryptocurrency’s path.

Moreover, certain reports indicate that the FTX collapse has contributed to a gradual transformation in the behavior of BTC holders.

Coins that have been unused since the event gradually become part of long-term holdings.

A surprising twist in Bitcoin’s active address pattern

Bitcoin, like many financial assets, shows trends and patterns that can provide valuable insight into price fluctuations.

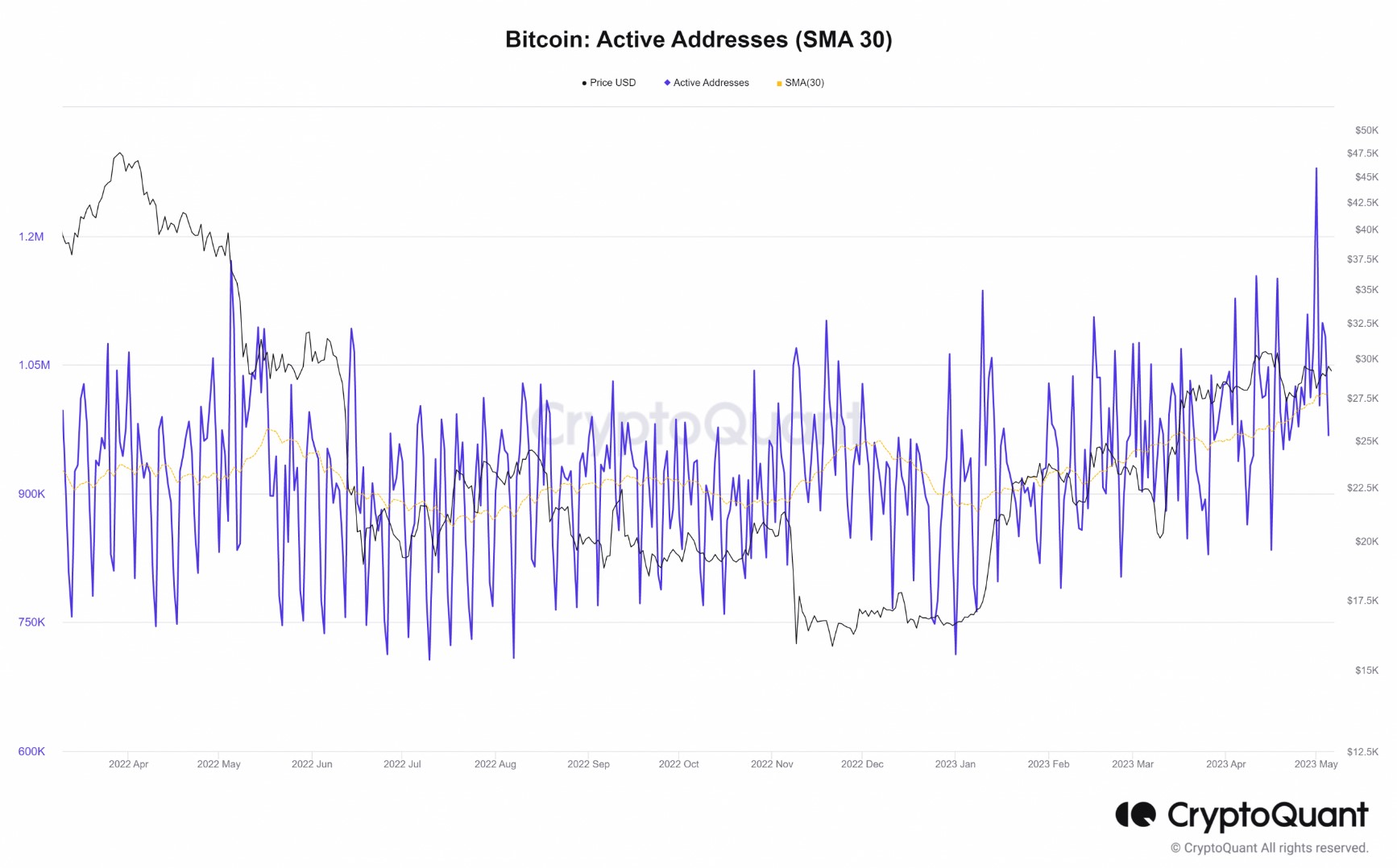

Fresh data from Cryptoquant has revealed an intriguing change in the pattern of Bitcoin’s active addresses.

The chart shows that Bitcoin’s price usually rises after a hash rate drop when the number of active addresses exceeds a certain threshold.

For most of this year, the calculation for active addresses ranged from 900,000 to 1.1 million per day.

However, this pattern changed on May 1, when the active address count rose to a new record of nearly 1.3 million – the highest number in over a year.

This increase in active addresses implies a potential change in market dynamics, igniting curiosity and speculation among traders and analysts.

The impact of these developments on Bitcoin’s price remains to be seen, but they certainly add an element of intrigue to the ongoing market analysis.

Ethereum’s burn rate rises as retail interest grows and developers discuss the Deneb upgrade

Ethereum recently experienced a significant burn of 10,000 ETH within 24 hours, as reported by Delphi Digital.

Token burn is a process where ETH is sent to an inaccessible “burn address”, which reduces the total supply and potentially lowers inflation, benefiting long-term investors.

Glassnode’s data indicates an increase in retail interest in Ethereum, with an increasing number of addresses holding over 0.1 ETH.

In addition, the Ethereum network saw an increase in transfers, resulting in an 11-month high in average gas fees paid to validators.

This development led to an increase in the total number of validators from 572,635 to 645,192. Developers are now discussing potential improvements for the upcoming Deneb upgrade.

Bitcoin price

Bitcoin is currently showing a mild bearish trend, trading at $28,900, down nearly 3%. Building on its previous daily gains, the BTC/USD pair is approaching the $30,000 milestone.

The technical aspects of Bitcoin remain stable, with BTC trading largely in line with our Bitcoin price prediction.

On the four-hour chart, Bitcoin remains above the 50-day exponential moving average, which serves as an important support level around $28,700.

This level has been significant resistance for BTC throughout the week. However, closing candles above $28,700 increases the likelihood of a bullish reversal for BTC.

Bitcoin may face immediate support near the 27,600 level, as indicated by a trend line on the 4-hour chart.

Should the price break through this key 27,600 level, BTC could be on its way to the next support level at 27,200.

On the other hand, if BTC succeeds in surpassing the $29,600 threshold, the price could potentially climb to $30,400.

Buy BTC now

Ethereum price

The current Ethereum price is $1,911 and ETH experienced a small decrease of around 2.5% in the last 24 hours.

It currently ranks #2 on CoinMarketCap, with a live market cap of $229 billion.

On Sunday, Ethereum, the second leading cryptocurrency, is trading with a sideways bias, maintaining a narrow range between $1,875 and $1,965.

The uptrend line is supporting the ETH/USD pair near $1,870, and closing candles above this level has the potential to trigger a bullish bounce-off.

On the upside, the ETH/USD pair has a potential to go after $1,960 or even higher towards $2,020.

On the other hand, support continues to hold around $1,875.7 and a break below this level opens up further room for selling down to the $1,800 mark.

Buy ETH now

Top 15 Cryptocurrencies to Watch in 2023

Stay updated with the latest ICO projects and altcoins by regularly exploring the expert-curated list of the 15 most promising cryptocurrencies to watch in 2023, as suggested by industry specialists at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

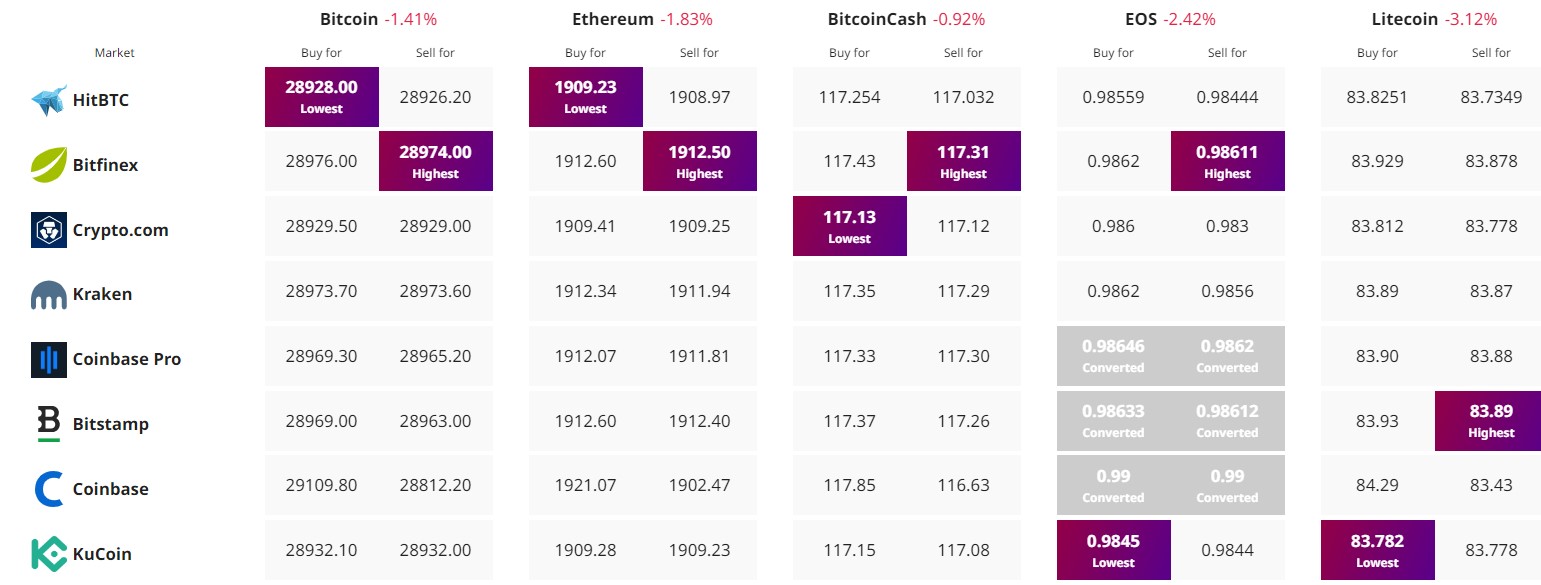

Find the best price to buy/sell cryptocurrency