Bitcoin Price and Ethereum Prediction – Breakout This level can pump BTC by 10% today

Bitcoin price is trading bearish near $20,600 during the Asian session, after returning the $20,000 support level. Similarly, Ethereum has gained over 4% to $1,585 and is heading north towards the 78.6% Fibonacci retracement level.

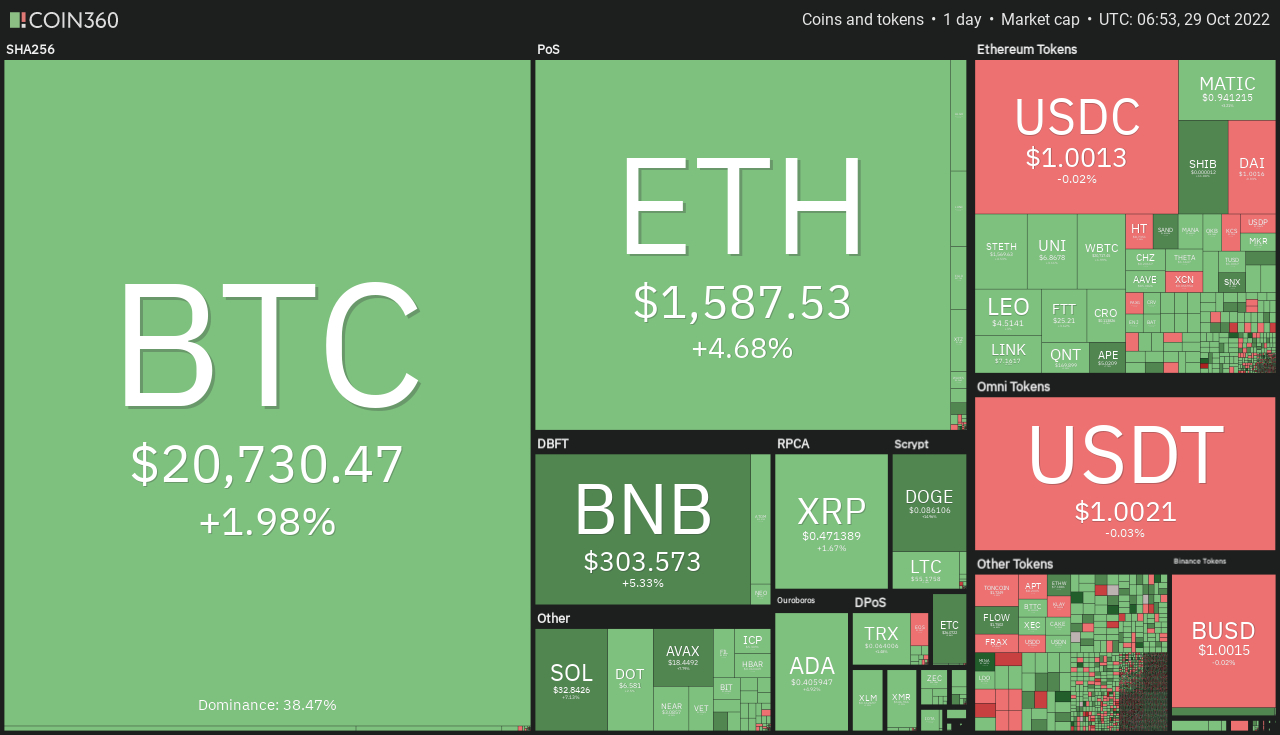

Early on October 29, major cryptocurrencies traded in the green as the global crypto market capitalization passed $1 trillion, up from $979.72 billion the previous day.

DeFi’s total volume was $4.00 billion, accounting for 4% of the crypto market’s total 24-hour volume.

Top Altcoin Winners and Losers

Mina (MINA), Dogecoin (DOGE) and Shiba Inu (SHIB) have been the best performers in the last 24 hours. MINA’s price has increased by more than 29% to $0.77, while DOGE’s price has increased by almost 15% to $0.086. At the same time, SHIB has gained more than 12% to trade at $0.000011.

TerraClassicUSD (USTC) has fallen more than 4% this week to $0.041. Casper (CSPR) has fallen more than 3% to around $0.042.

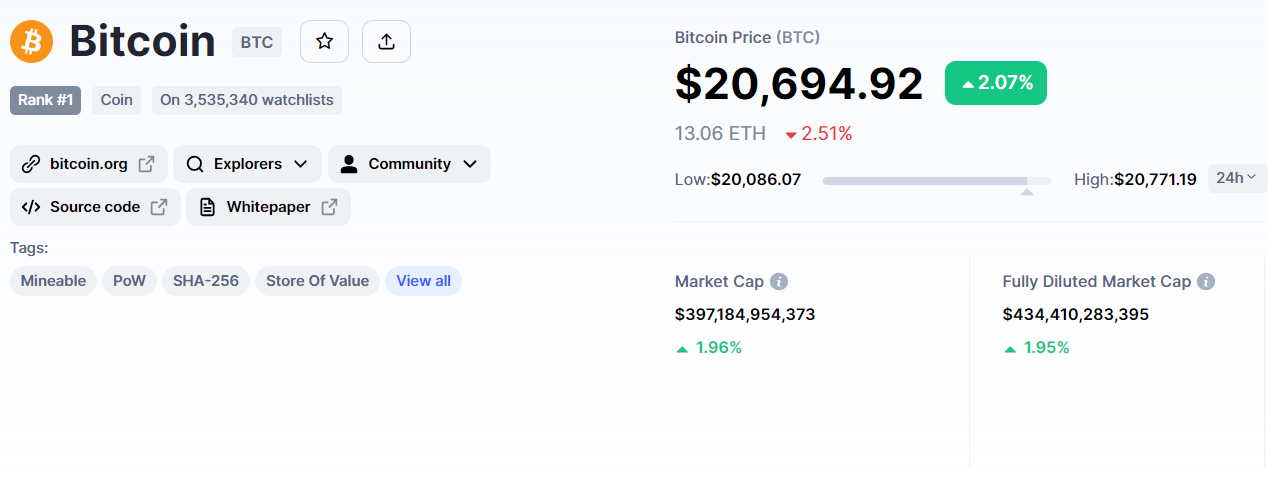

Bitcoin price

The current Bitcoin price is $20,686, and the 24-hour trading volume is $48 billion. Bitcoin has risen over 8% in the past seven days. CoinMarketCap currently ranks first, with a market cap of $397 billion, up from $388 billion yesterday.

Although Bitcoin showed a slight bearish correction yesterday, it is once again showing an upward trend. The BTC/USD pair is now consolidating in a broad trading range of $20,000 to $21,000, which is extended by the 38.2% to 61.8% Fibonacci retracement levels.

The RSI and MACD remain in a buy zone, supporting the chances of a bullish trend continuation. Additionally, the 50-day moving average also suggests buying above $19,750.

As a result, a breach of the 61.8% Fibo level has the potential to extend the buying trend to $21,900. If the current uptrend continues, Bitcoin could reach $22,500.

On the downside, Bitcoin’s immediate support remains near $19,900. Today, investors may look for a buy position above the $20,250 level and vice versa.

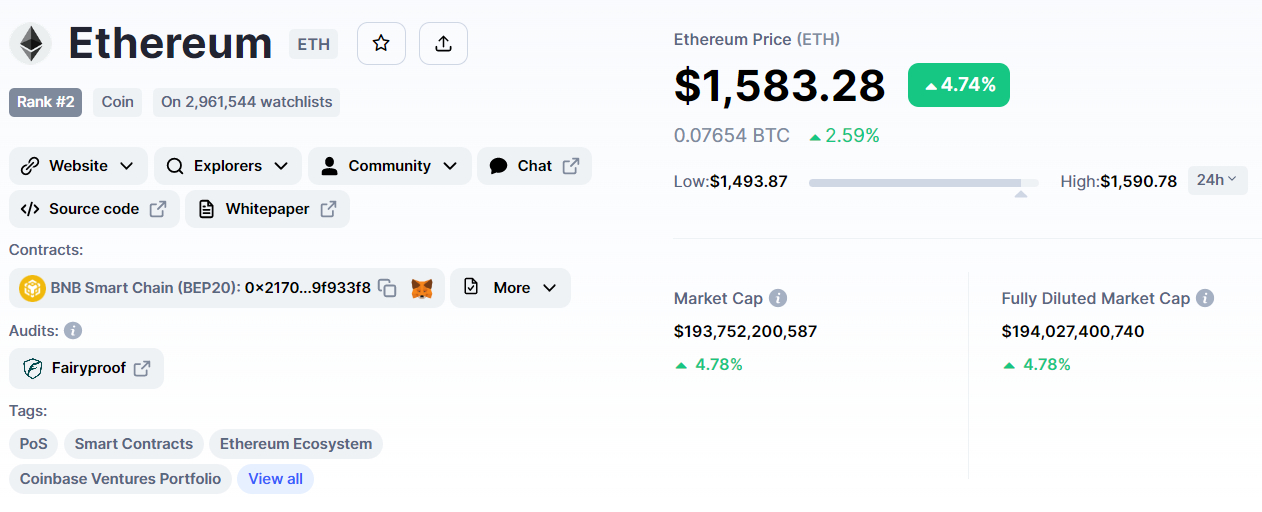

Ethereum price

The current price of Ethereum is $1,585, with a 24-hour trading volume of $19 billion. In the last 24 hours, Ethereum has pumped over 4%. CoinMarketCap currently ranks #2, with a live market cap of $194 billion, up from $184 billion yesterday.

On the technical front, the ETH/USD pair has completed a 61.8% Fibonacci retracement to $1,550 and is now heading above this level, suggesting the chances of a bullish trend correction. On a daily time frame, ETH has breached the previous high of $1,595, which is a signal of strong bullish power. If the price of ETH rises above $1,595, it may reach $1,655 or $1,700.

Leading indicators such as RSI and MACD are in the buy zone. As a result, the chances of a bullish correction remain strong above $1550. While support continues to hold at $1,404 today.

New crypto pre-sale

Dash 2 Trade is an Ethereum-based platform that aims to provide real-time analytics and social trading signals to its users; the amount raised so far is a significant vote of confidence in the platform.

Following the pre-sale, the company intends to launch its platform in the first quarter of 2023, with the D2T token expected to be listed on multiple exchanges.

In about a week, pre-sales for Dash 2 Trade have increased 3.1 million dollars, putting it on track to be one of the biggest token sales of the year. Dash 2 Trade presale is still live; you can buy D2T tokens for $0.05 USDT.

Visit Dash 2 Trade now

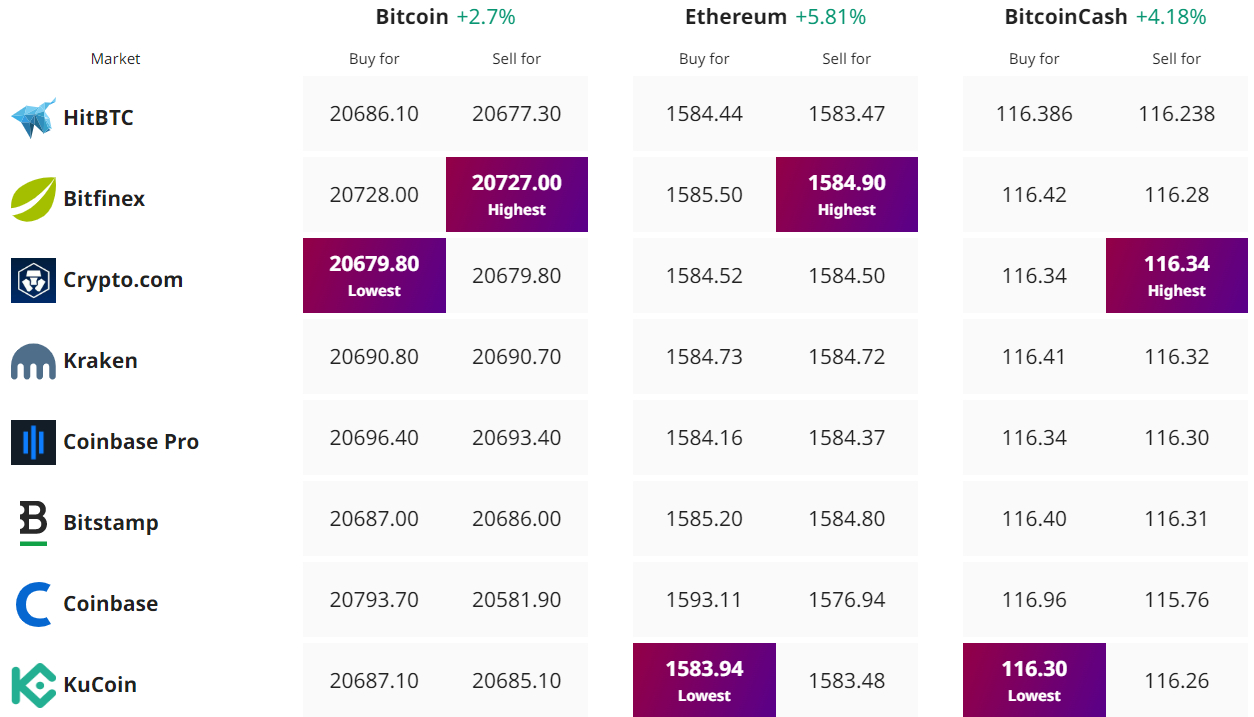

Find the best price to buy/sell cryptocurrency