Bitcoin Price Analysis: Slight recovery occurs after recent declines at $16,706

The latest Bitcoin price analysis reveals that the price has been following a downward movement for the past few days as the bears have been constantly chasing the lead and the bearish pressure is weighing on the price function. The short-term trend line is also bearish as a regular price decline has taken place over the past three days. The price has been lowered to the $16,706 level as a result of the latest bearish strike. Further price drops are to be expected in the coming hours as well.

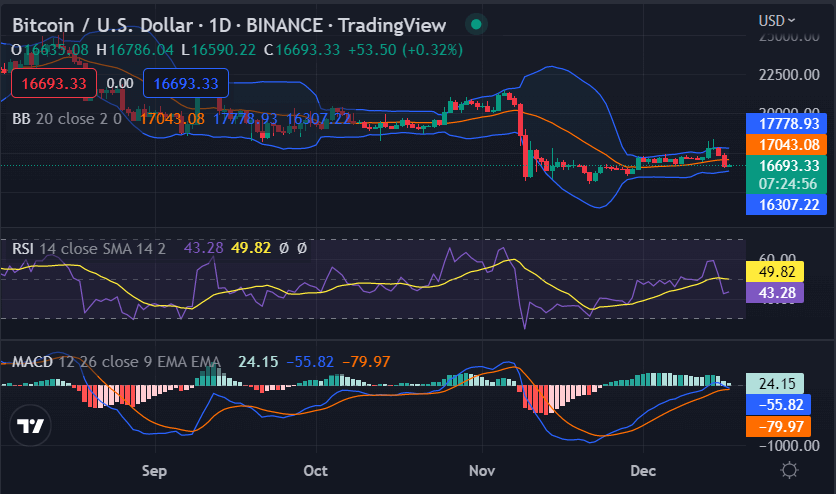

BTC/USD 1-Day Price Chart: Cryptocurrency Value Falls Up to $16,706 Degrees

From the Bitcoin price analysis on an intraday chart, it can be observed that BTC prices have consolidated between $16,584 and $16,985 over the past few hours. The digital asset is currently trading at $16,706 and is likely to remain in range for some time. From the Bitcoin price analysis on a daily chart, it can be observed that the BTC price has been in a continuous downward trend. The digital asset opened today’s daily trade at $16,905, but the bears came in to push prices down to $16,706.

The RSI (Relative Strength Index) indicator on the intraday chart is currently at 49.82, indicating that the digital asset is in oversold zone. The MACD (moving average convergence divergence) indicator on the intraday chart is currently in the bearish zone, but it is close to the center line.

The Bollinger Bands indicate that BTC prices are likely to remain range bound for some time. The upper Bollinger band is at $16,985 and the lower Bollinger band is at $16,584. These levels are likely to act as immediate resistance and support levels for the digital asset.

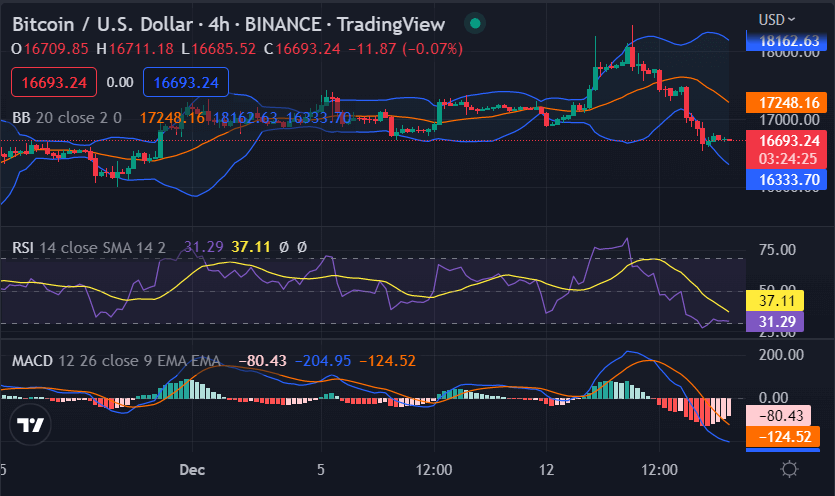

Bitcoin price analysis on a 4-hour price chart: Bearish trend line intact

The Bitcoin price analysis on a 4-hour timeframe reveals that the bears are increasing their grip on the market. The digital asset has formed a bearish trend line on this chart and is currently trading below this trend line. The price is below the 200-day moving average ($17,248) and the 50-day moving average ($16,693).

Most of the indicators show a downward trend. The RSI (Relative Strength Index) indicator on the 4-hour time frame is currently at 37.11, indicating that the digital asset is in oversold zone. Now the Bollinger band average is at $16,705 points, while the upper Bollinger band rests at $17,248 and the lower Bollinger band is at $16,333. Meanwhile, the moving average convergence divergence (MACD) curve can be seen forming a deep bearish divergence above the current price action

Bitcoin price analysis conclusion

Bitcoin price analysis confirms that the price has undergone a sharp decline during the day. The BTC/USD price is now touching the $16,706 mark, which is the lowest, and it can be expected to move down to further lows in the coming hours. However, the price has reached the support zone, and there are chances that the price may bounce back from here if buyer’s support comes into play.

While you wait for Bitcoin to move forward, check out our price estimates on XDC, Cardano and Curve.