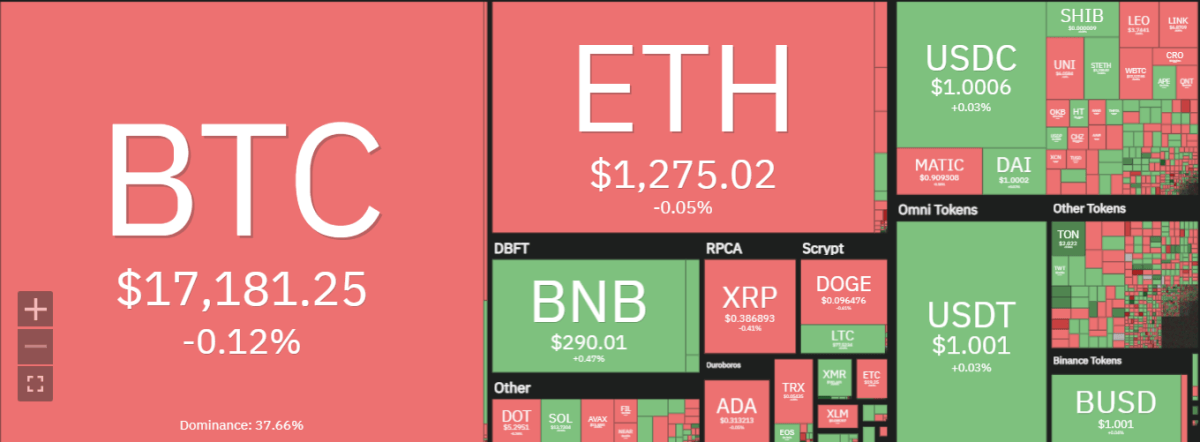

Bitcoin Price Analysis: BTC Struggles to Break 50 MA $17.9k and 100 MA $18.7k Resistance Levels

Bitcoin price analysis shows that BTC is still struggling to break above two key resistance levels: the 50-day moving average at $17.9K and the 100-day moving average at $18.7K. Bitcoin is changing hands at $17,172.43, a level where it has remained for the past few days.

The nearest resistance level is at the $17,300 mark, followed by $17,500. The 20-day and 50-day moving averages are also positioned around this level, providing further resistance to any bullish move. If bulls manage to overcome these resistance levels and close above $17,500, this could result in a mini-rally for BTC that could last for a few days. However, given the extremely low trading volume and momentum of Bitcoin recently, it is difficult to predict the outcome of such a move with the current low volatility.

On the downside, support has been found at the $16,800 level. If the price breaks below this support, more bearish pressure could be felt in Bitcoin and the rest of the cryptocurrency market.

BTC/USD 1-Day Technical Analysis: Still in Control

Bitcoin price analysis shows a bearish trend in the last 24 hours. BTC has been trading sideways within a range between $17,202.09 and $17,120.68. The bears have dominated most of today’s trading sessions, as BTC continues to face significant resistance at the 50-day moving average level. The RSI is currently in neutral territory, suggesting that the bulls may regain control soon. However, the bigger picture shows that Bitcoin is still stuck in a bearish trend and could continue to fall if it fails to close above $17,500 soon.

A Fibonacci retracement is a technical tool that can be used to measure the size of a potential pullback in an asset. Bitcoin’s recent pullback from the $18k level has been relatively small and the Fibonacci retracement tool shows that Bitcoin is still far from completing its correction phase. However, the $17,000 level appears to be the bottom of this correction. A break below this level could result in a bearish move, as the 50-day moving average has also turned into resistance at $17,400.

Based on the technical chart, it appears that Bitcoin is still stuck in a tight range between $17,000 and $17,300. While the short-term outlook suggests that there is a chance for BTC to climb back above $17,500, the long-term trend suggests that the bears are in control.

Bitcoin price analysis on a 4-hour chart: $17,500 is the key resistance

On a 4-hour time frame, Bitcoin price is still trading below the moving averages and facing stiff resistance at $17,500. The RSI indicator is just above 50, suggesting that there may be more upside left for BTC in the near term. However, it looks like Bitcoin will face some selling pressure once it reaches $17,500. The MACD indicator also suggests a potential downside for BTC as the trend remains bearish in this time frame.

Bitcoin price analysis conclusion

Bitcoin price analysis shows that BTC is still stuck in a bearish trend even though it has found support at the $17,000 level. Unless there is a strong bullish breakout above $17,500 soon, Bitcoin may continue to fall in the coming days.

While you wait for Bitcoin to move forward, check out our price estimates on XDC, Cardano and Curve.