Bitcoin poised to explode to $80,000, analyst says

- Veteran crypto trader Tone Vays believes the Bitcoin bull run will start a year before the next halving in April 2024, pushing prices to $100,000.

- He expects the bond market and real estate market to collapse next year, after which all the money will flow into Bitcoin and crypto.

Over the past few weeks, the world’s largest cryptocurrency Bitcoin (BTC) has remained stable at around $19,200, showing less volatility. Market analysts are confused about which direction Bitcoin will make a move from here.

On the one hand, there are fears of recession amid tighter monetary policy initiated by the Fed to control rising inflation. However, few market analysts continue to be bullish on Bitcoin’s prospects in the coming months.

During a recent interview, crypto trader and analyst Tone Vays said that he expects Bitcoin (BTC) to climb 5x from its current position. That means Bitcoin has the potential to hit a six-figure mark in the next bull cycle. The veteran crypto trader expects Bitcoin’s next halving cycle to trigger a bull run next year. He further emphasized that he would be surprised if crypto assets do not touch $100,000 in 2023. During the interview with Kitco News, Tone Vays added:

I expect we will have a nice bull market next year because of the halving that is coming… The halving will probably happen a little earlier, people always underestimate it. Probably closer to March or April 2024. But the hype that the halving is coming will come much earlier.

So I expect we will have the full bull run, which may even be complete before the halving because it can exhaust itself. So I would be surprised if we don’t get close to that $100,000 sometime next year.

A reversal in crypto market sentiment

Due to the uncertain macro conditions, the broader crypto market sentiment has been skewed against the bears. From the current BTC price of $19,200, the fear and greed index points to an “extreme fear” zone.

The Bitcoin Fear and Greed Index is 23 — Extreme fear

Current price: $19,220 pic.twitter.com/SnxZWTNmDH— Bitcoin Fear and Greed Index (@BitcoinFear) 20 October 2022

But Vays believes that by next year market sentiment will shift towards the positive with a reversal in the crypto trend. “So many people expect more from a crypto winter. And when too many people are on one side of the market, it turns. And right now I see very pessimistic sentiment,” he added.

On the macro front, the investor said he sees money flowing back into crypto as bonds and real estate collapse after the peak. He stated:

I think there is going to be a big collapse in the bond market. There may even be a collapse in the real estate market. But I think that there will be a lot of speculative money flowing into the stock market and into the crypto markets.

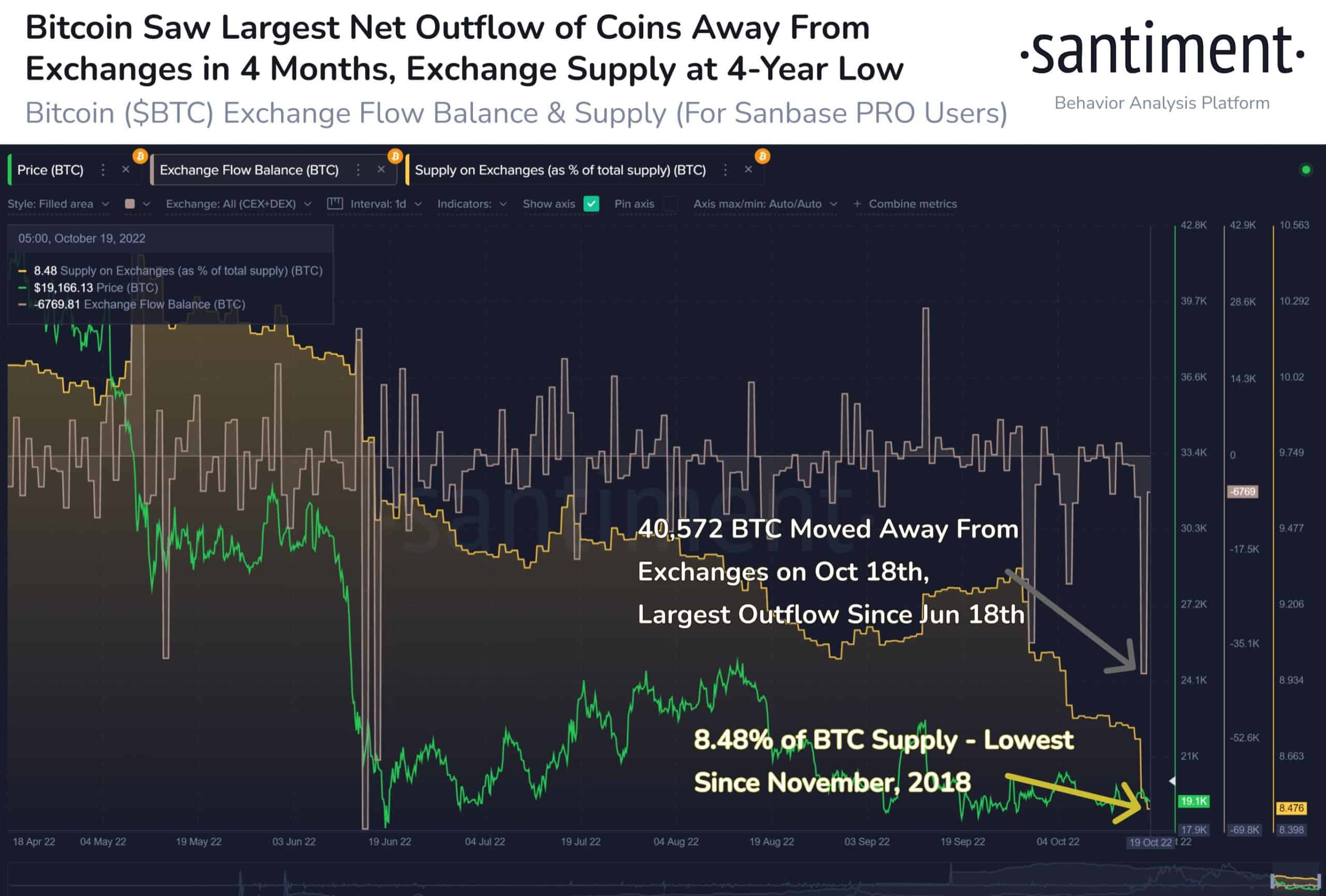

Furthermore, chain data shows that many BTC have moved from exchanges, suggesting new institutional purchases. On-chain data provider Santiment reported:

Bitcoin saw a massive wave of coins move off the exchanges yesterday, the largest daily amount (40,572 $BTC) in 4 months. The supply of coins on exchanges is down to 8.48%. When the supply of exchanges decreases, it reduces the chances of future sales.