Bitcoin Overturns Cardano, Solana to Take Second Place in NFT Sales

Ethereum has dominated the NFT space. Other blockchains such as Solana, Polygon and BNB Chain have ticked alongside. However, the list now has a new entrant, Bitcoin.

Bitcoin ordinals debuted in January 2023 and have been an evergreen topic of discussion ever since. On the one hand, people from the industry have been happy to welcome NFTs to Bitcoin. On the other hand, skeptics have discussed how Ordinals unlock a world of dangers for the Bitcoin network, including malware attacks and skyrocketing transaction costs.

Ordinary inscriptions are quite similar to NFTs. However, they come with a slight twist. They are digital assets inscribed on a Satoshi, the lowest denomination of Bitcoin. The network’s SegWit and Taproot upgrades that took place to improve the privacy and efficiency of the network opened the doors for Satoshi inscriptions.

According to data from Dune Analytics, over 153.6k Ordinal Inscriptions have been created to date. In parallel, users have posted $40,913,300 in fees so far.

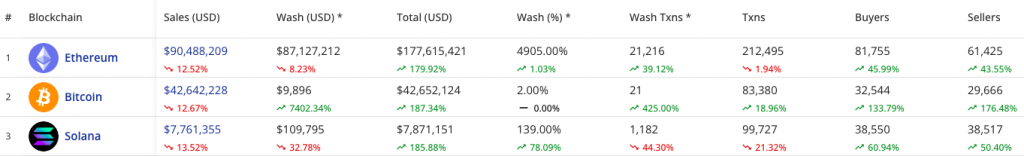

Due to the increased activity, Bitcoin has already climbed up to the second position on the NFT selling front. In the past week, $42.6 million worth of NFTs were sold on the Bitcoin blockchain. The aforementioned increase was accompanied by an increase in the number of buyers and sellers. Specifically, the reflected values of 32.5k and 29.6k at press time. Ethereum’s promoted more than twice as much NFT sales in the same period. The number of buyers and sellers on the platform also doubled.

Also Read: Dogecoin, Litecoin Transactions ‘Spike’ After Ordinals Intervene

“Flipping” on the horizon?

Bitcoin’s rise to dominance in the NFT space, on the other hand, is single-handedly attributed to the Ordinals protocol. In just a couple of months, Bitcoin has managed to reach the second position. This obviously opens up the “flipping” narrative.

However, it is not something that will happen overnight. NFTs on Ethereum have been around for quite some time, and several prominent projects have networks based on the protocol. Factors such as the high fees have been overlooked in the past. However, it should not be forgotten that the same is a double-edged sword, for it works in parallel as a proxy for the increased use.

Another factor that must be considered is laundry trade. Put simply, this type of trading manipulates the price, as an entity sells and buys the same tokens at the same time. By doing so, they create a false impression of market activity without bearing risk or changing their market position. As shown below, the wash sale on Ethereum has decreased by 8% in the last week. However, on Bitcoin they have risen by 7402%. But in terms of size, the number is almost negligible for Bitcoin [2%] gives it an edge. On the other hand, the same amounts to 4905% on Ethereum.

The macro picture

On other protocols such as Solana, Polygon, BNB Chain and Cardano, sales have been mixed. During the last week it has shrunk on the first two protocols, while on the other two it has risen.

Although Cardano’s numbers have improved by 15% over the past week, it should be noted that it currently occupies 8th place. NFTs were introduced on Cardano after the Alonzo update in 2021. Therefore, given Bitcoin’s rapid rise in the rankings, it can be argued that Ordinals have proven to be a better game changer than Alonzo on the NFT front.