Bitcoin outperforms Layer 1’s SOL, ETH, DOT, BNB, ATOM in December

In December, Bitcoin surpassed the native tokens of the Solana, Ethereum, Polkadot, Binance and Cosmos ecosystems, according to data analyzed by CryptoSlate.

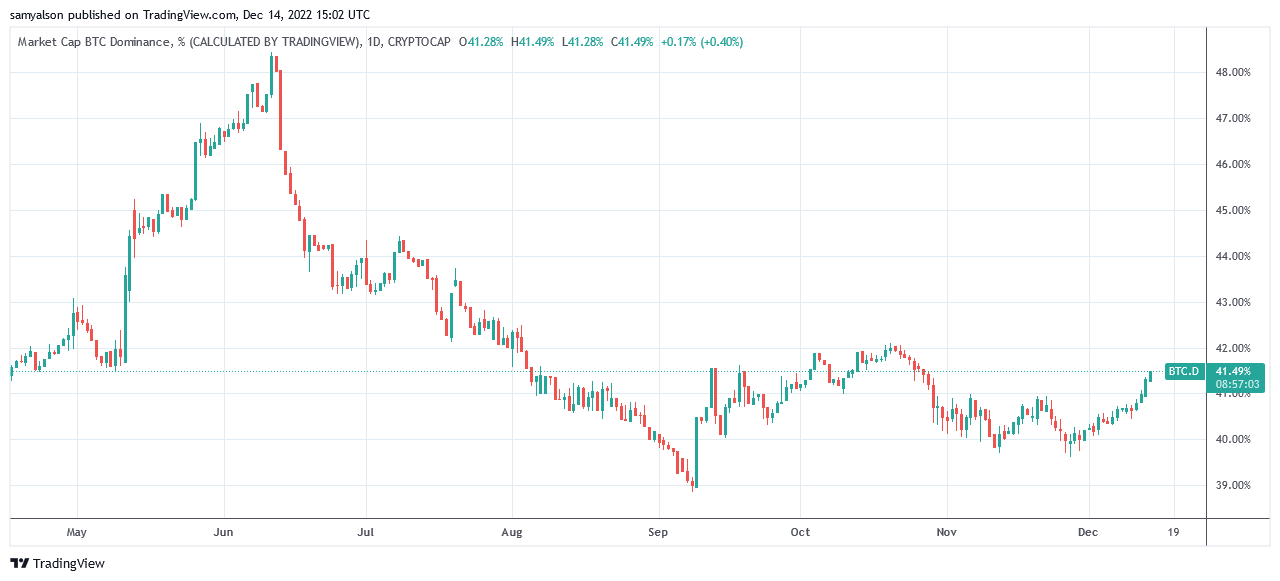

Bitcoin Dominance (BTC.D) has also started to move upwards this month. The chart below shows BTC.D starting December at 39.9% and gradually moving higher. The current reading is 41.5% – a seven-week high.

Bitcoin hits capital letters

Since the December open, Bitcoin has traded within a tight range between $16,790 and $17,400.

Following the release of better-than-expected US Consumer Price Index (CPI) data on December 13, BTC broke out of this range and rose to $18,000, but gave up some of those gains, ending the day at $17,800.

On December 14, the leading cryptocurrency has continued to build on its momentum, reaching a peak price of $18,130 so far. But with uncertainty prevailing, particularly regarding the macro outlook heading into the holiday season, none of this should be taken as a confirmed reversal.

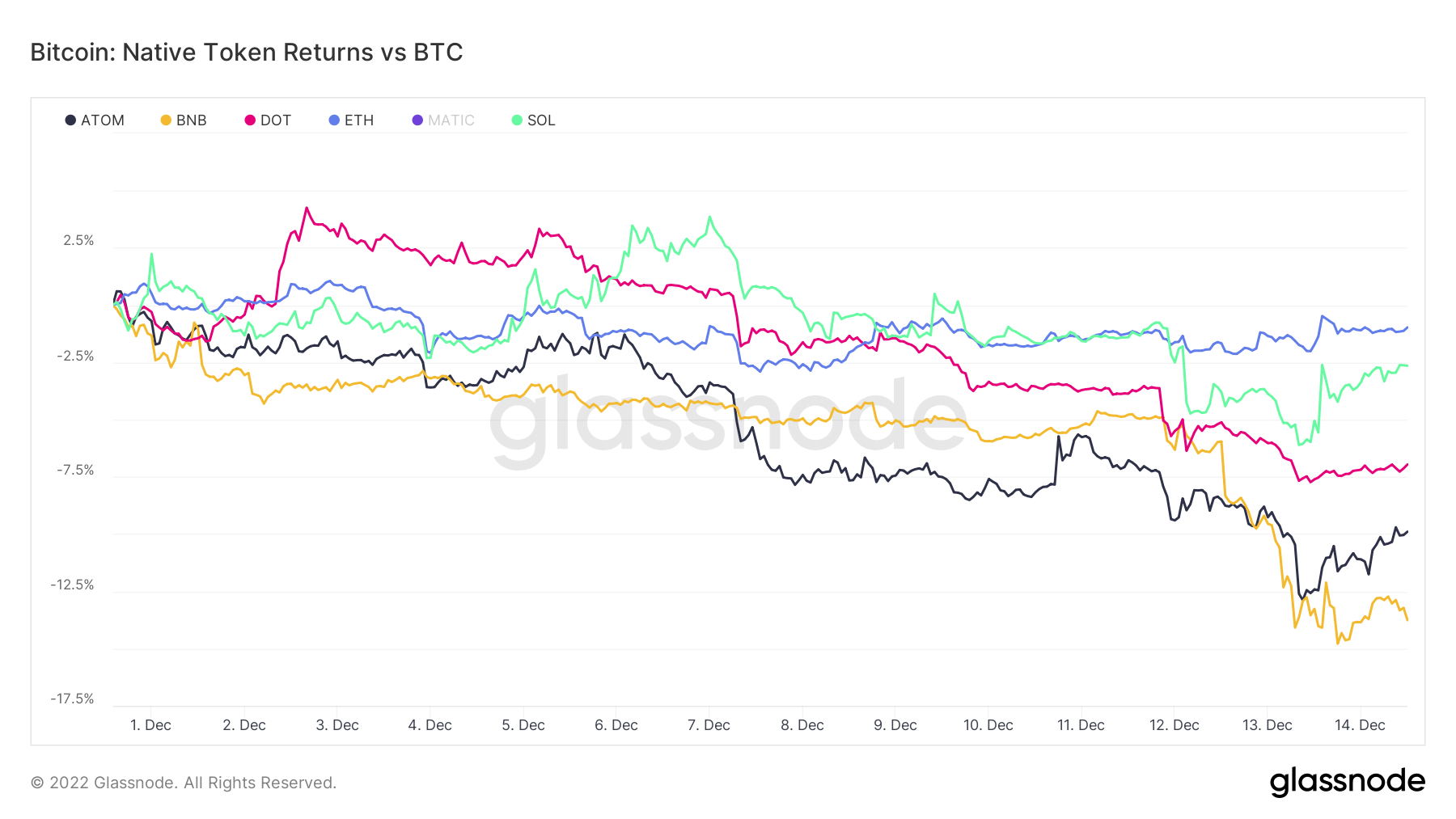

Nevertheless, BTC has outperformed Tier 1 of majors so far this month. Losses compared to Bitcoin for December came in at:

- Ethereum -1.0%

- Solana -2.9%

- Polka dot -7.2%

- Cosmos -11.2%

- Binance -13.6%

Binance’s performance deteriorated noticeably around December 12, when FUD surrounding its solvency sparked a run on the exchange.

Data from the chain showed that 6.5 billion dollars was withdrawn within the last 24 hours. Binance CEO Changpeng Zhao (CZ) responded by saying that it was good to “stress test” his company.

In an update, CZ said despite the massive outflows, recent activity was not in the top 5 for withdrawals. He added that the exchange is now seeing net deposits.

Small-caps go from best to worst performing cohort

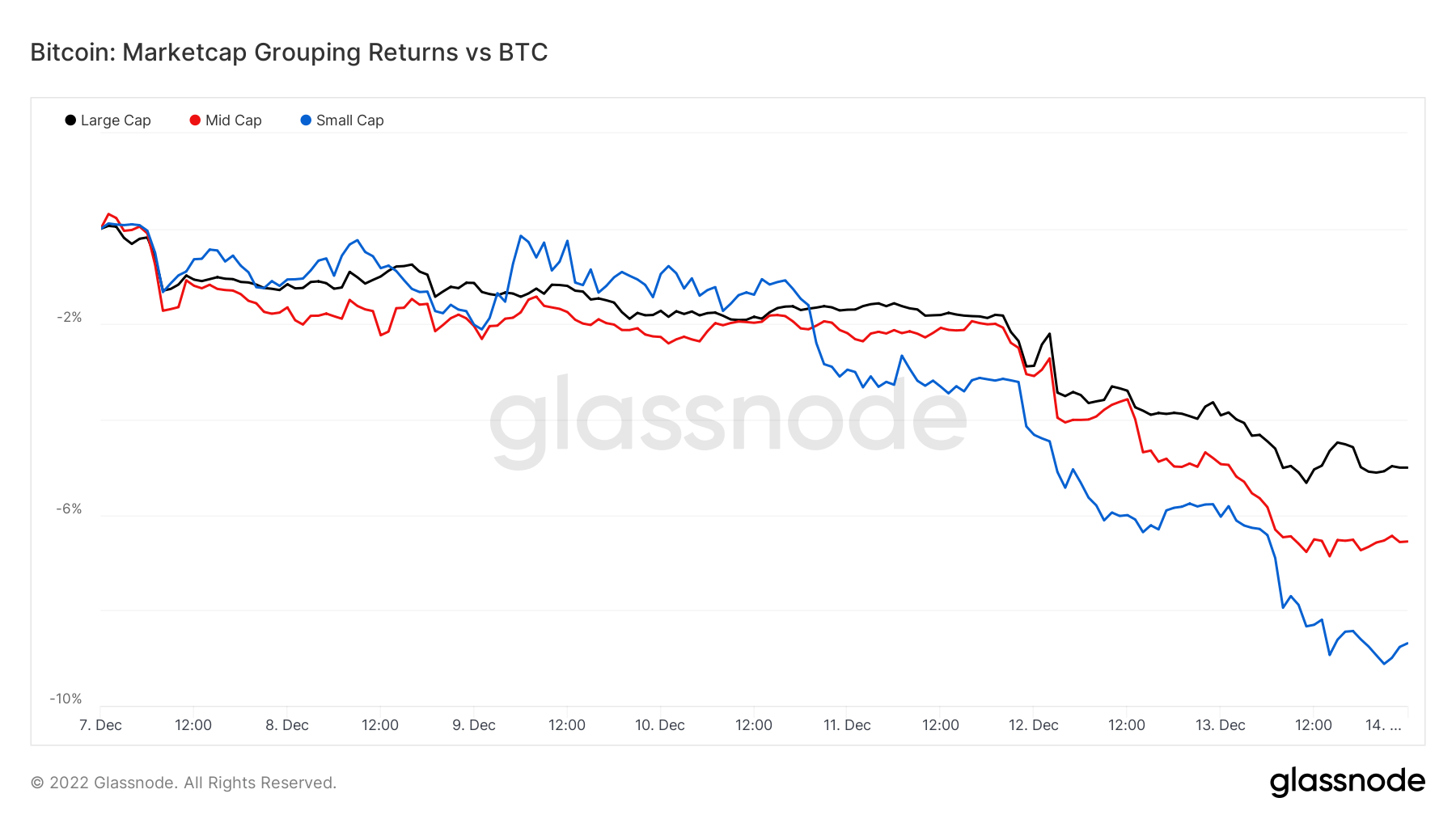

Analyzing the returns of large, medium and small companies against Bitcoin shows that all three groups have failed to outperform the market leader since December 7th.

The chart below shows small-caps challenging BTC, but loosening up around December 10th. Since then, small-caps have fallen to the worst performing cohort at -8.8%.

Against BTC, mid-caps returned -6.3%, while large-caps fared best at -4.8%.

Like Binance Coin (BNB,), December 12 marked a noticeable drop in performance for all three cohorts.