Bitcoin: Out of Sight, Out of Me Could Be the BTC Miner’s Motto for Q4 Because…

Over the past few months, many miners have faced enormous challenges to sustain their profits and continue mining Bitcoin [BTC]. With increasing hashrate and skyrocketing energy prices, miners continue to face one difficulty after another. And one such miner happens to be Core Scientific.

________________________________________________________________________________

Here is AMBCryptos Bitcoin price prediction [BTC] for 2022-2023

________________________________________________________________________________

Where’s my mine?

One of the largest blockchain miners, Core Scientific, released a statement suggesting that it may have to explore bankruptcy. The mining organization expected its existing cash resources to be exhausted by the end of the year, possibly earlier. This may be an indicator of the fact that the top public Bitcoin miners may suffer the effects of the bear market.

As you can see from the image below, the top 10 public bitcoin miners represent 18% of the total hashrate of the entire Bitcoin network. With increasing energy prices and increasing hashrates, miners would be forced to sell their BTC to make money. This increase in selling pressure for Bitcoin could impact BTC negative.

Source: Messari

Despite the continuous selling pressure faced by miners, miner income generated by fees has witnessed some growth in recent days. According to data from on-chain data intelligence platform Glass nodes data, miner revenue generated by collected fees hit a one-month high on October 29. If the revenue generated continues to grow, the selling pressure on miners may ease.

Source: Glassnode

A look at the backside of mining

The Bitcoin miner’s earnings were also dependent on Bitcoin’s growth. According to data from Messari, Bitcoins realized that the volatility decreased tremendously during the last. Furthermore, this number fell by 67% since July, making BTC less risky for investors during the said period.

3/ Did someone say disconnection?

#Bitcoinits and #Ethereum30-day realized volatility continues to fall as equity volatility continues to rise.

Since peaking in early July, Bitcoin’s and Ethereum’s realized volatilities have fallen by 67% and 63%, respectively. pic.twitter.com/jmCiR7bT4c

— Messari (@MessariCrypto) 28 October 2022

Another positive indicator of Bitcoin’s potential growth could be that the overall Bitcoin supply in profit saw some growth. Furthermore, it also reached a one-month high of 29 October.

#Bitcoin $BTC Supply in Profit (7d MA) just hit a one month high of 10,555,234,130 BTC

See calculation: pic.twitter.com/oFE1OgF8jV

— glassnode alerts (@glassnodealerts) 29 October 2022

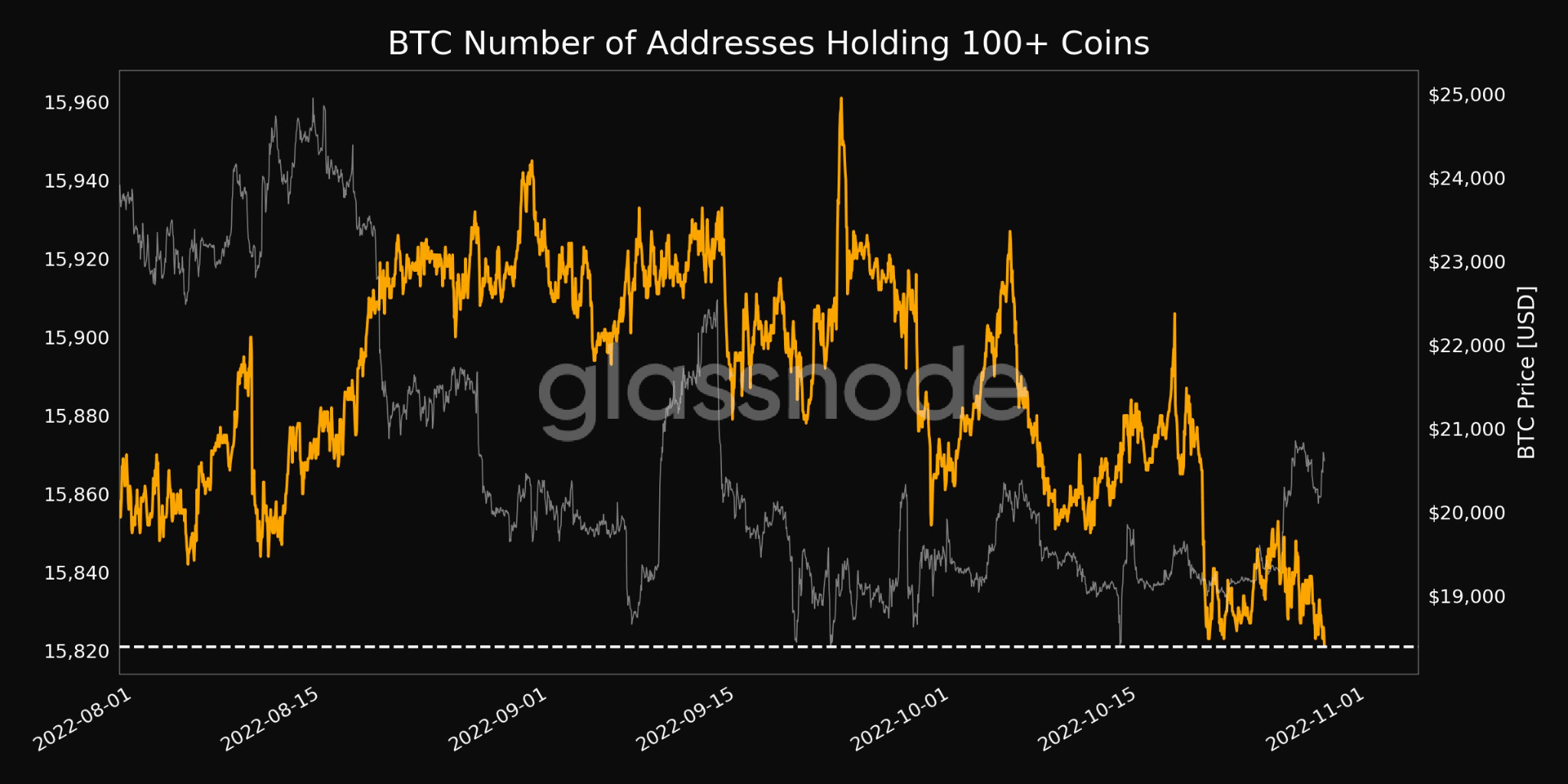

Despite these positive indicators, whales showed their disinterest Bitcoin. As shown in the image below, it can be seen that the number of addresses holding more than 100 Bitcoins has decreased. If major addresses continue to release Bitcoin, BTC’s prices will be negatively affected.

Source: Glassnode

At the time of writing, Bitcoin was trading at $20,770 and had risen by 0.2% in the last 24 hours according to CoinGecko.