Bitcoin options traders swing bearish as FTX fallout takes hold

The last few days have seen increased market volatility as the FTX saga blows up.

Binance’s offer to buy FTX gives the beleaguered exchange a lifeline. However, as made clear by Binance CEO Changpeng Zhao (CZ), the deal is subject to satisfactory due diligence.

Crypto Twitter is awash with speculation that once FTX’s books have been reviewed and cost-benefit analysis has been considered, CZ will pull out of the deal.

Meanwhile, analysis conducted with Glassnode data showed that Bitcoin derivatives markets have reacted accordingly.

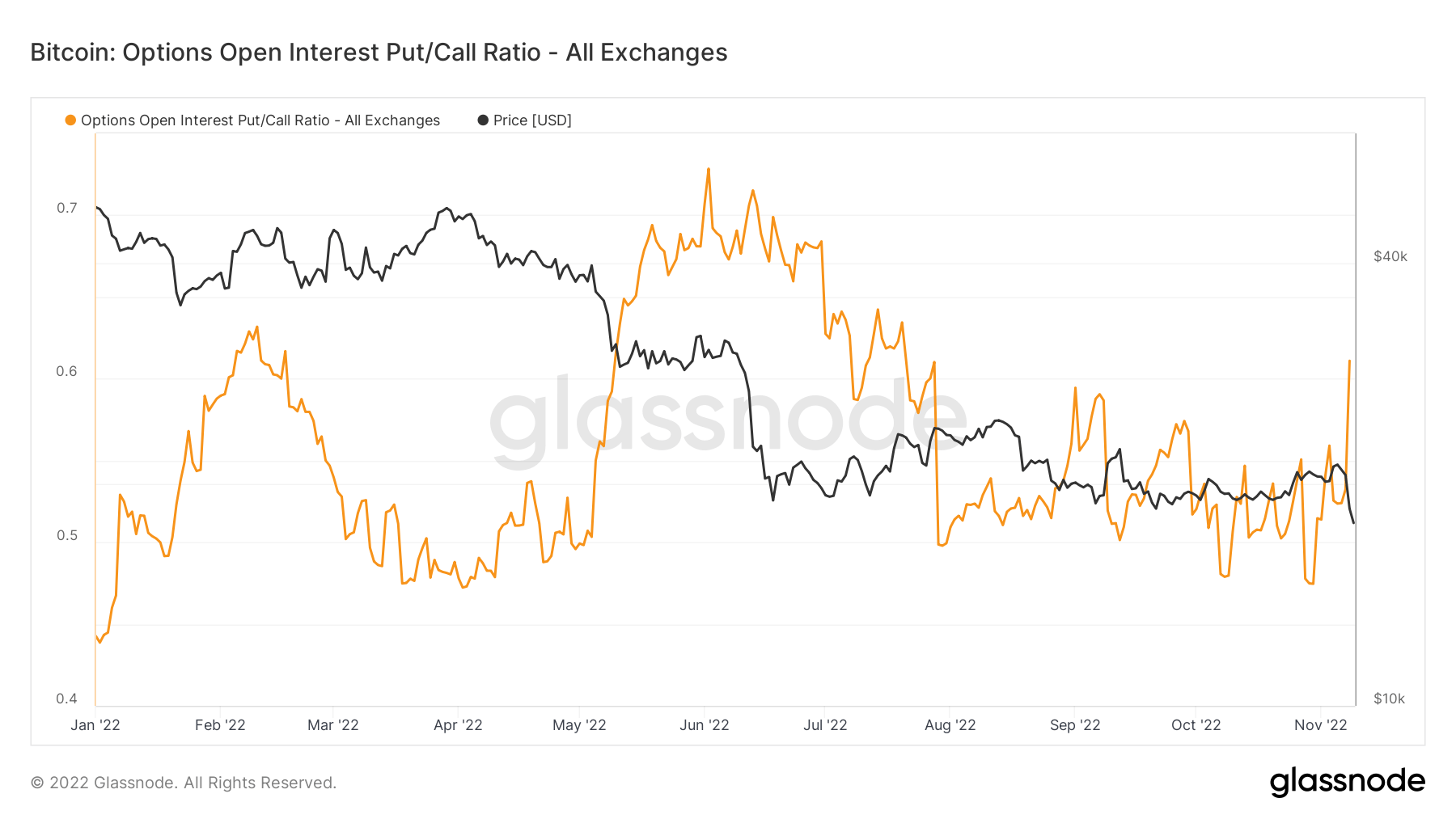

Bitcoin Open Interest Put/Call Ratio

A put is the right to sell an asset at a specified price within a specified expiration date. While a call refers to the right to buy an asset at a specified price within a specified expiration date.

Open Interest Put/Call Ratio (OIPCR) is is calculated by dividing the total number of open rates by the total number of open rate calls on a particular day.

Open interest is the number of contracts, either put or call, outstanding in the derivatives market, i.e. unsettled and open. It can be considered as an indication of cash flow.

The chart below shows the OIPCR surged higher as the FTX situation took hold. The swing towards buy positions suggests bearish market sentiment among options traders.

Crucially, OIPCR has not (yet) reached the extremes seen in June, during the Terra Luna collapse. Still, as an evolving situation, there is room to expand further.

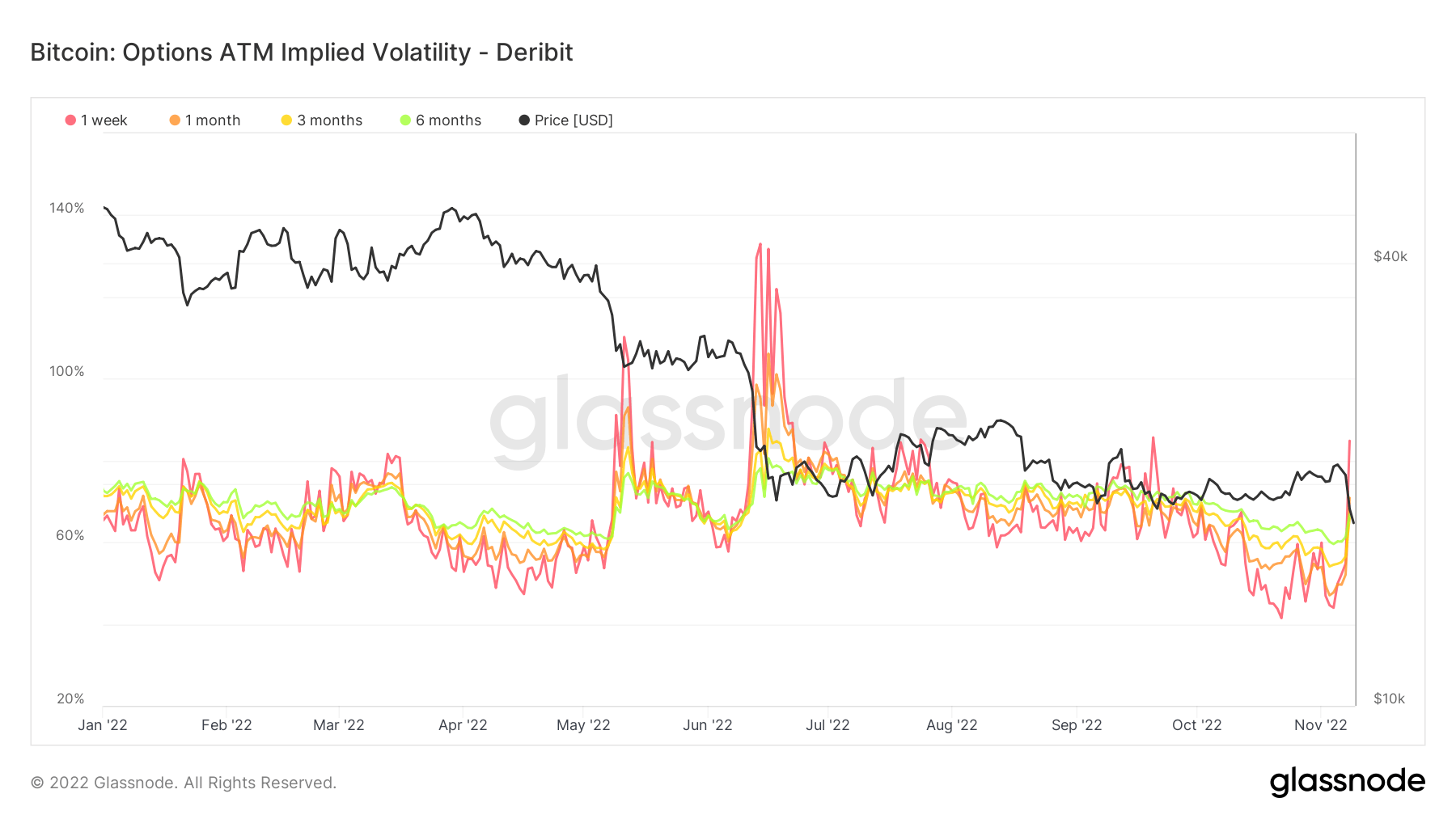

ATM implied volatility

Implied volatility (IV) measures market sentiment against the likelihood of changes in a particular asset’s price – often used to price options contracts. IV usually increases during market downturns and decreases during bullish market conditions.

It can be considered a proxy for market risk and is usually expressed as a percentage over a specific time frame.

IV follows expected price movements within one standard deviation over a year. The calculation can be further supplemented by defining IV for option contracts that expire in 1 week, 1 month, 3 months and 6 months from today.

The chart below shows a sharp reversal from previous bullish lows, suggesting options traders expect an uptick in volatility going forward.

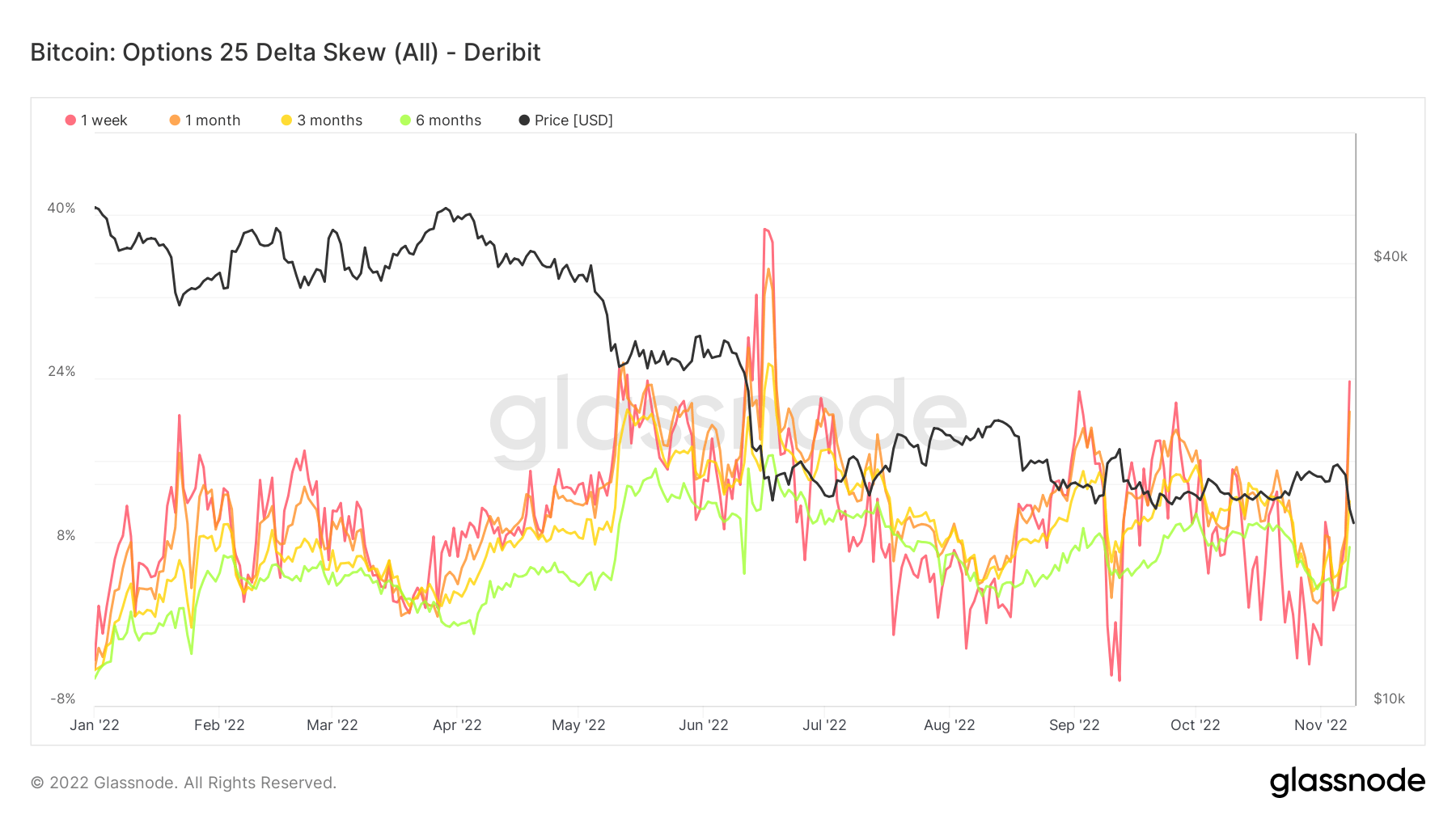

Options 25 Delta Skew

Options 25 The Delta Skew calculation looks at the relationship between put-to-call options expressed in terms of implied volatility (IV).

For options with a specific expiration date, this calculation looks at puts with a delta of -25% and calls with a delta of +25%, settled to arrive at a data point. In other words, this is a measure of the option’s price sensitivity given a change in the spot price for Bitcoin.

The individual periods refer to option contracts that expire respectively 1 week, 1 month, 3 months and 6 months from now.

The rise in the 25 Delta Skew shows that traders are scrambling for puts, marking a u-turn in sentiment confirmed by OIPCR data.