Bitcoin Near $19K; the most ‘profitable’ mining GPU will pay you back in 3 years

Ether and other major cryptos spend much of the weekend in the red to end a turbulent week.

Good morning. Here’s what happens:

Prices: Bitcoin spent much of the weekend in the red and below $19,000; other cryptos are also falling.

Insight: The ‘most profitable’ mining GPU will not pay off much; investors would do better with a bitcoin mining stock.

Prices

- Bitcoin (BTC): $18,870 −0.5%

- Ether (ETH): $1,307 −1.1%

- CoinDesk Market Index (CMI): $941 -0.8%

- S&P 500 daily close: 3,693.23 −1.7%

- Gold: $1,652 per troy ounce +0.4%

- Ten-year Treasury yield daily close: 3.70% -0.01

Bitcoin, Ether and Gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the spot price for COMEX. Information on CoinDesk indices can be found at coindesk.com/indices.

Bitcoin pins near $19,000 as most cryptos spend the weekend in the red

By James Rubin

With a couple of short detours higher, bitcoin stayed below $19,000 through the weekend.

The largest cryptocurrency by market capitalization recently traded at around $18,800, down a little less than a percentage point over the past 24 hours. The decline capped a turbulent week with steep interest rate hikes by the US Federal Reserve and other central banks and shrinking economic indicators that increasingly point to recession.

“Bitcoin remained under pressure due to the macroeconomic environment, and we maintain that below $20,000 remains a strong accumulation opportunity for medium to long-term horizons,” said Joe DiPasquale, CEO of crypto fund manager BitBull Capital.

Post Merge Ether spent a similarly dismal weekend almost entirely in the red. The second largest crypto by market capitalization recently changed hands at around $1,300, down more than a percentage point from the previous day at the same time. ETH has traded lower in the 10 days since the merger, the technological shift of the Ethereum blockchain to a more energy-efficient, proof-of-stake protocol. Other major cryptos were mostly in the red with SOL and popular memecoin DOGE each down more than 2%.

The CoinDesk Market Index, which tracks the performance of 20 major cryptocurrencies, was largely unchanged at approx. 940. The Crypto-Fear & Greed index which measures investor sentiment has declined again from fear to extreme fear territory.

Stock

Crypto price declines matched stock markets and other assets — riskier and safer havens — closing down on a gloomy Friday. The technology-focused Nasdaq and the S&P 500, which has a strong technology component, fell 1.8% and 1.7%, respectively. These indexes have plunged five of the past six weeks due to ongoing investor fears about inflation and the economy. Cryptos have largely tracked stocks this year.

After chewing over the Fed’s hawkish 75 basis point interest rate hike and deteriorating housing numbers, markets will scrutinize US durable goods orders for September, the US Conference Board’s latest consumer confidence index and August, new home sales. Economic observers widely expect durable goods orders to be similar to last month’s total, and a drop in new home sales. On Friday, the University of Michigan will release its next consumer sentiment index, which measures, among other things, consumer attitudes toward business relationships and personal finances.

Meanwhile, the dollar’s recent surge has suggested that cryptocurrency prices are likely to continue to weaken, although CoinDesk’s Lawrence Lewitinn also noted in a Sunday column that cryptos, like stocks, have been more nuanced in their response to events.

For example, in the seven days following the release earlier this month of a disappointing consumer price index, the CoinDesk Smart Contract Platform Index (SMT), which includes ETH, ADA and SOL, fell nearly 20%, while the CoinDesk Culture & Entertainment Index. (CNE) – filled with NFT-related and metaverse coins like ApeCoin’s APE and The Sandbox’s SAND fell “only” 6.9%. (Lewitinn noted that the Smart Contract Index’s decline stemmed at least in part from ether’s post-merger decline)

“Crypto is still in its infancy compared to other asset classes,” Lewitinn wrote. “It has its own idiosyncrasies and prices move for other reasons than, say, the strength of the dollar.”

He added: “For traders, thinking about crypto in terms of segments means, among other things, coming up with more sophisticated ways to trade in a rising rates environment.

Despite bitcoin’s pesky behavior last week, BitBull’s DiPasquale optimistically noted that “the $18,000 level has continued to provide decent support.”

“If BTC does not break down in the coming days, we may see upward moves in October with $24k and $26k as initial levels to watch,” he wrote.

Biggest winners

| resource | Ticker | Returns | The DACS sector |

|---|---|---|---|

| Cosmos | ATOM | +3.7% | Smart contract platform |

| Chain link | LINK | +3.3% | Data processing |

| XRP | XRP | +1.5% | Currency |

Biggest losers

| resource | Ticker | Returns | The DACS sector |

|---|---|---|---|

| Terra | LUNA | -7.3% | Smart contract platform |

| Solana | SUN | -2.8% | Smart contract platform |

| Dogecoin | DOGE | -2.4% | Currency |

Insight

Mining GPUs will not generate much

By Sam Reynolds

Ethereum’s merger happened 12 days ago, writing the obituary for GPU mining. Days after The Merge, one graphics card manufacturer took the coming glut of cards (which are already not that profitable to produce) to go out of business.

Despite this, there are still proof-of-work tokens on the market. These are not exactly blue-chip tokens on the front of CoinGecko, but rather altcoins such as BitcoinGold, Neoxa (which has a market cap of $4 million) or Cortex.

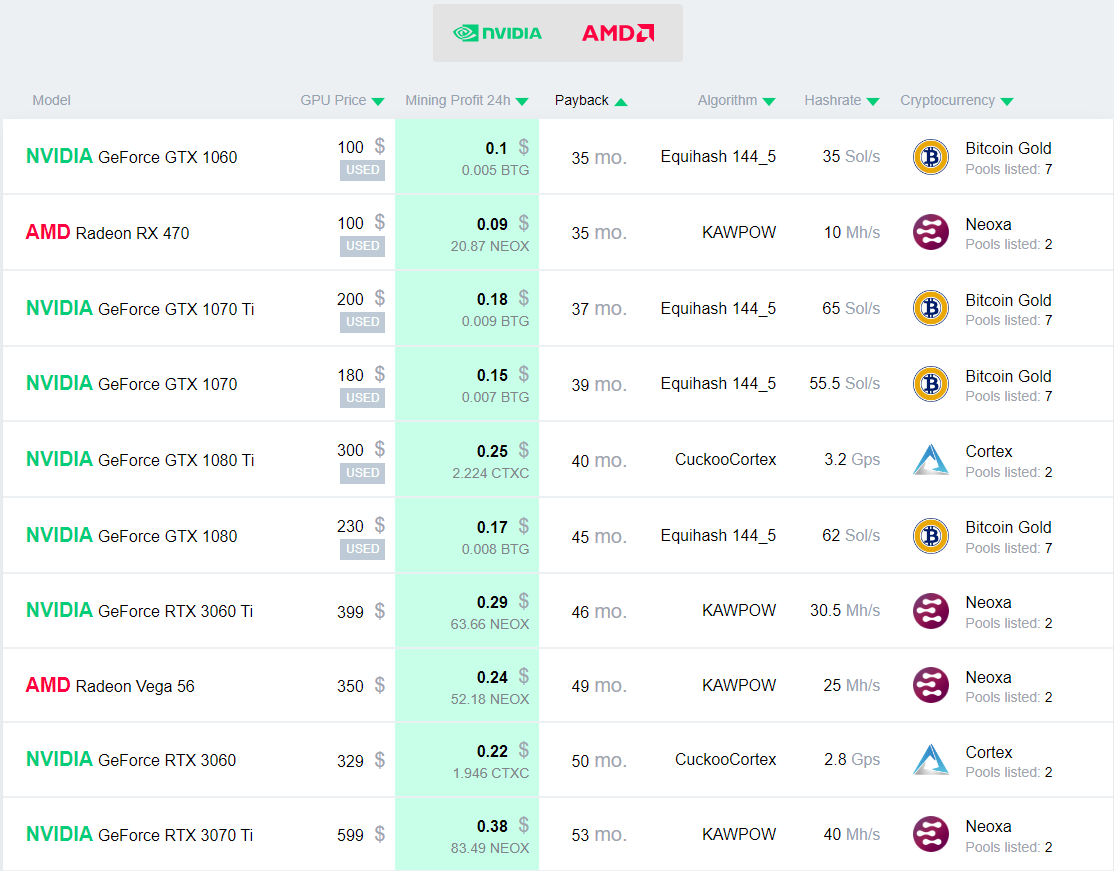

AMD/Nvidia (Whattomine)

But the numbers aren’t going to work for miners looking to pick up some now plentiful, used GPUs for mining. The best-case scenario, using the GeForce GTX 1060, which goes on the used market for $100, sees the card’s value recovered in mined crypto in 35 months or almost three years.

And it’s based on a lot of assumptions. It is not a straw move with the token. The card doesn’t break – a possibility with months of constant use – and the token’s value stays the same or increases (that’s asking for a lot in the crypto world).

Absent from these assumptions are power costs. Adding them to the calculation is beyond the scope of the tool from 2cryptocalc’s capabilities.

But what if you wanted to mine a semi-useful token? For that, consider WhattoMine, which gives us the ability to calculate mining profitability based on hashrate and power costs.

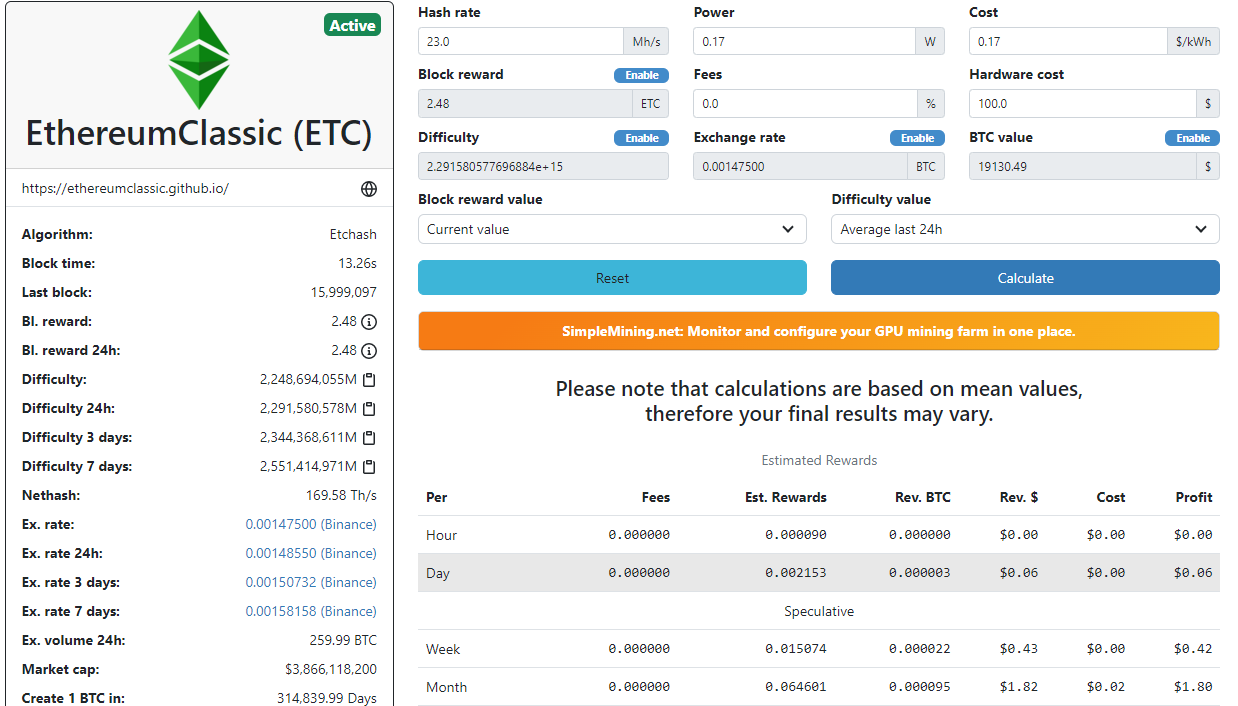

Our trusty GeForce GTX 1060 has a hash rate of 23Mh/s for Etchash, the algorithm used for Ethereum Classic.

ETC (Whattomine)

Run the numbers and it’s pretty grim. Using one card, and the average cost per kilowatt hour in the US of $0.17, the card earns $1.80 in profit per month. That means it will not break even for 55.5 months, or 4.62 years.

If this were scaled a hundred times, where the hash rate was now 2300 Mh/s, 100 of these cards would generate $182.6 per month in profit.

ETC (Whattomine)

Even with ASICs, specialized silicon built for mining, the math isn’t much better unless you have extreme scale. Data now shows that the most profitable ASIC miner for retail miners, Bitmain Antminer L7, generates $8 in profit per day as part of the Nicehash pool.

It is more profitable to only own shares in listed mining companies.

Important events

08:30 HKT/SGT(12:30 UTC): Jibun Bank Manufacturing PMI (Sept/Provisional)

13:35 HKT/SGT (05:35): Speech by Bank of Japan Governor Haruhiko Kuroda

15:30 H1HKT/SGT(7:30 UTC): Speech by Luis De Guindos