Bitcoin Mining Set To Go Greener – Global X ETFs

The Bitcoin network’s security is derived from a process called Proof-of-Work (PoW) that is powered by advanced hardware and large amounts of electricity. In PoW mining, miners collect transaction data over a set period of time and attempt to summarize this data into an encrypted output that is accepted by the rest of the network. This process is computationally intensive and requires a significant amount of energy. Successful miners are compensated by the network with newly created bitcoin. However, PoW mining’s energy needs are not arbitrary. By requiring miners to spend resources updating the state of the shared ledger, tampering with historical data becomes extremely prohibitive.

Today, the global bitcoin mining industry uses the same amount of electricity as a small country like the Netherlands.1 Although the total power consumption is high, it does not tell the whole story. It is also important to consider the significant strides the mining industry has made to improve the energy efficiency of its operations, as well as the forces catalyzing the mining industry to adopt greater amounts of sustainably sourced electricity into the mining process.

Important takeaways

- Bitcoin miners compete to maximize their share of a fixed amount of minable Bitcoin. Miners are motivated to use efficient hardware and consume cheap energy to optimize profit margins.

- Advances in the efficiency of mining hardware have been impressive, but the pace of improvement is slowing. Utilizing the cheapest energy sources is becoming increasingly important to reduce operating costs.

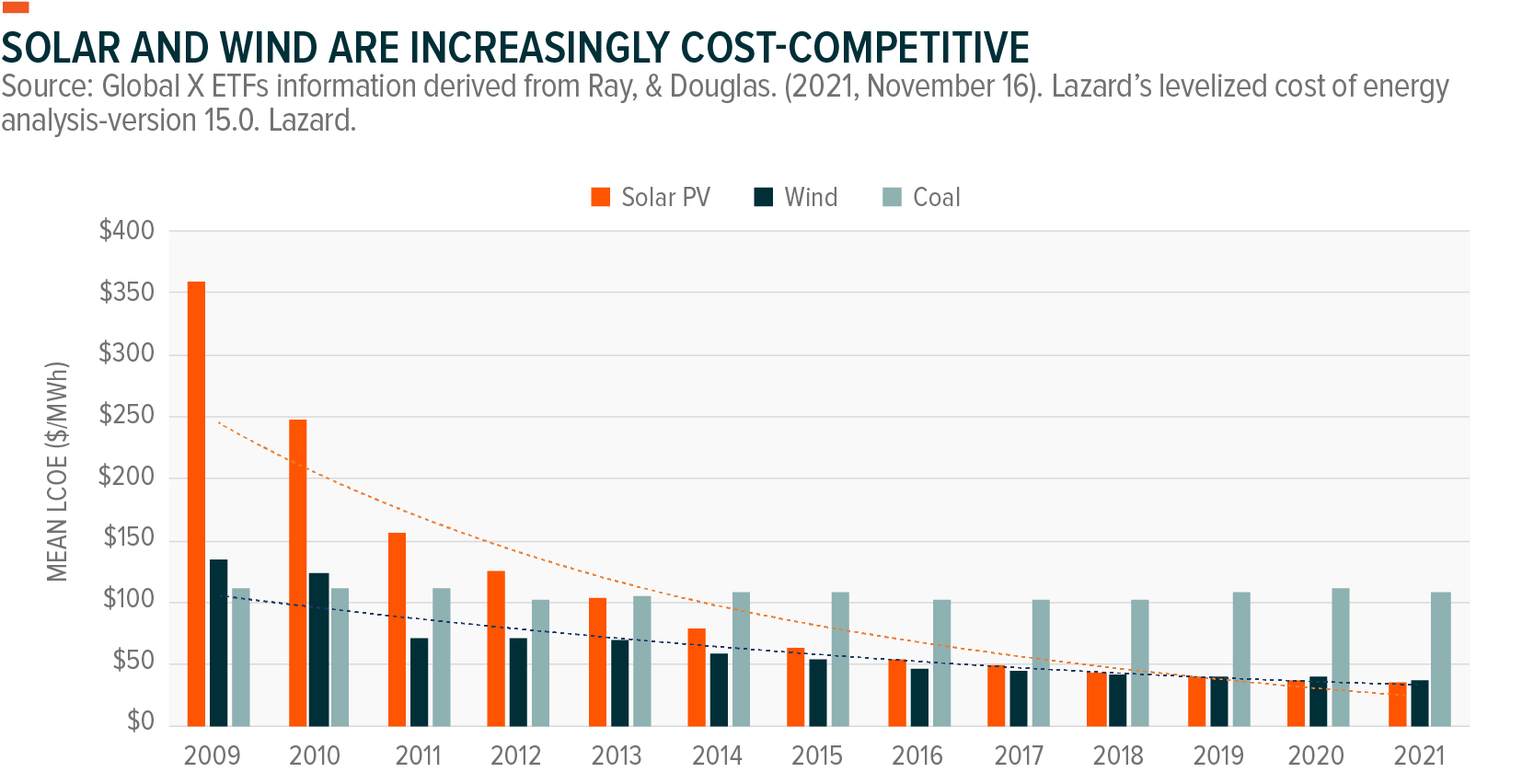

- Renewable energy sources such as solar and wind are becoming increasingly cost competitive. Adopting these energy sources in the mining process is a trend that is likely to accelerate in the mining industry, which could support a decrease in the Bitcoin network’s carbon footprint.

Miners operate ASICs to earn a share of Bitcoin rewards

Application-specific integrated circuits (ASICs) are specialized hardware devices used in the computationally intensive process of bitcoin mining. These machines are tasked with “solving” a block of data and adding it to the blockchain. ASICs do this by collecting transaction data across the network and pushing it through an encryption algorithm looking for an arbitrary output. This iterative process requires ASICs to make billions of guesses per second until the correct output is found.

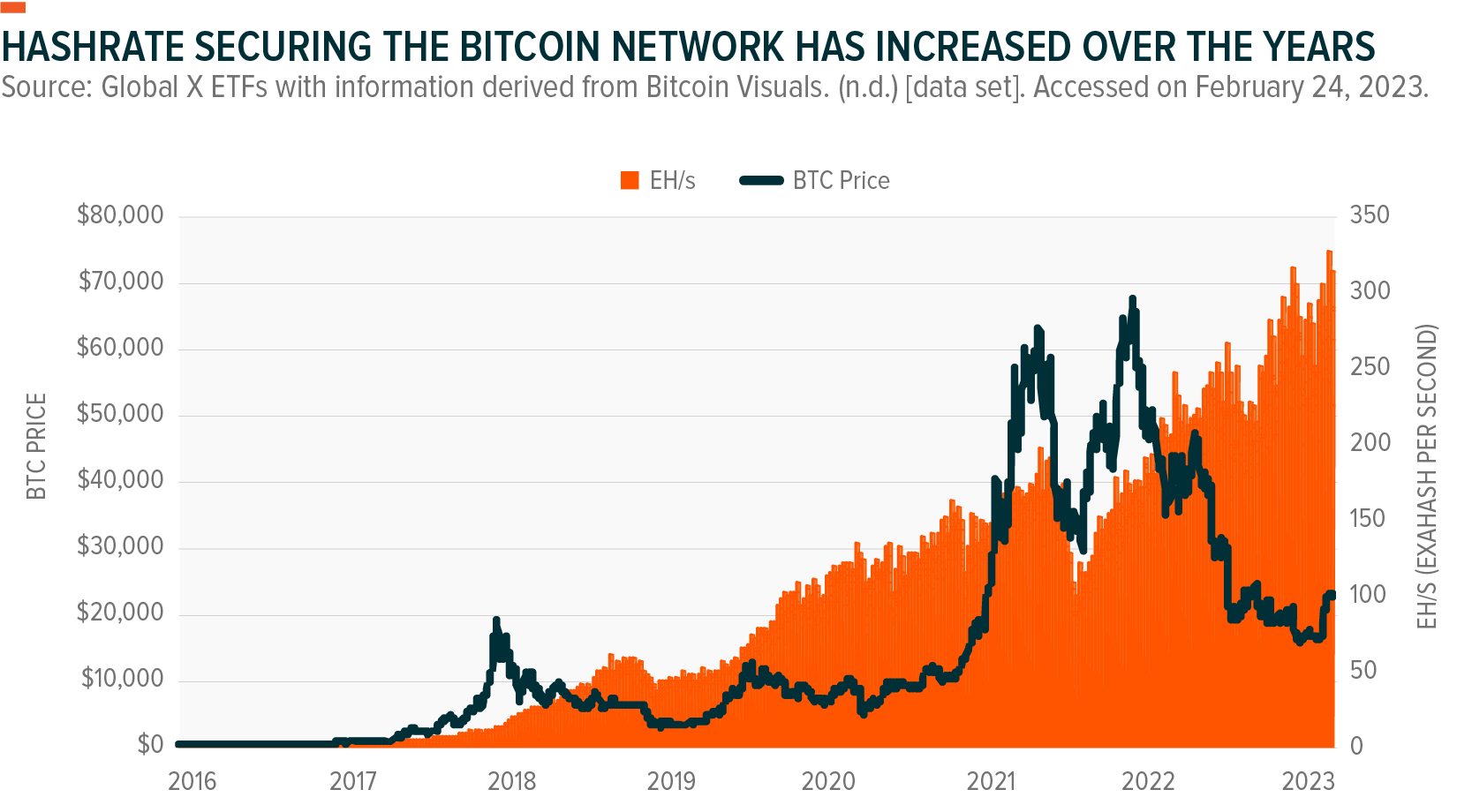

Each individual calculation made by an ASIC is referred to as a hash, and the number of hashes an ASIC produces per second is referred to as the hashrate. A single hash can be considered a ticket to solve a block and earn a bitcoin reward. A miner’s share of the network’s overall hashrate—the amount of computing power generated by all ASICs on the network—represents the bitcoin rewards the miner can expect to earn over a given period of time.

High competition requires miners to seek operational efficiency

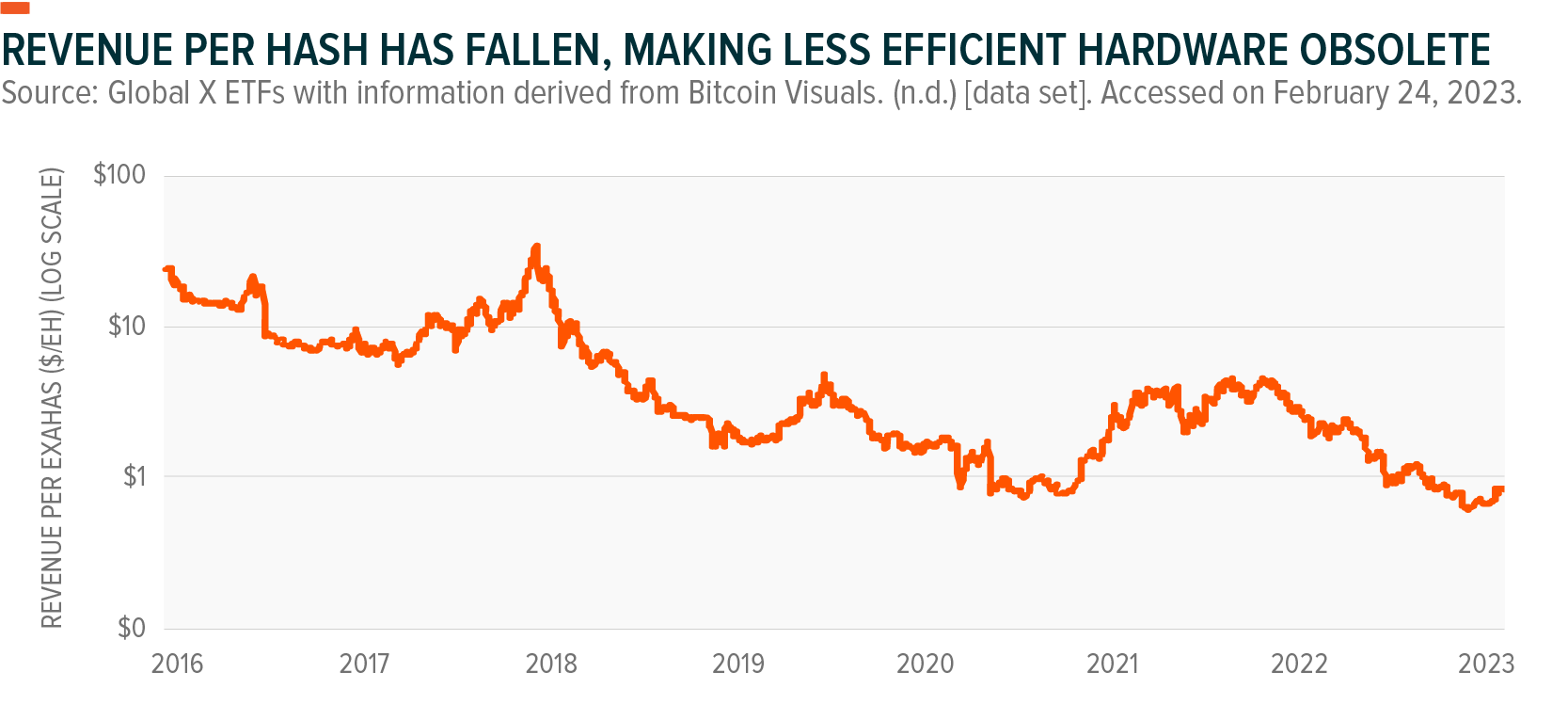

Bitcoin mining is highly competitive. As the network’s overall hashrate increases, mining operations that do not proportionally scale the hashrate become diluted and experience a decrease in expected bitcoin rewards. To remain competitive, miners are forced to continuously increase their hashrate, resulting in an arms race for the most powerful and efficient ASICs. The first chart below shows how the hash rate securing the network has increased over time, while the second chart shows how increasing competition has led to a decrease in the average revenue per hash.

To maintain profit margins in the face of these competitive forces, miners can either use more efficient mining hardware that maximizes hashrate per unit of energy consumed, or they can run their mining units with the cheapest energy available.

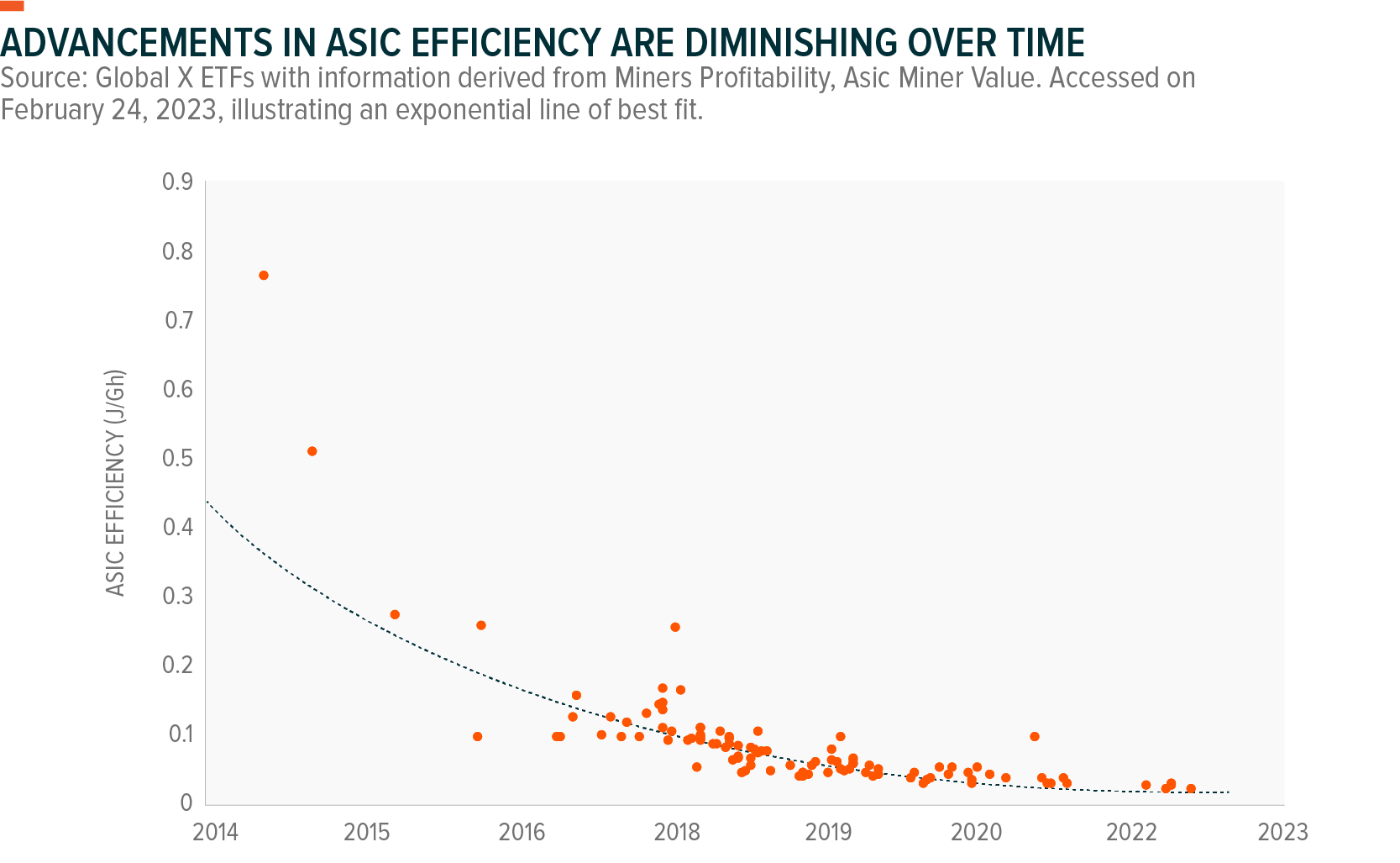

The importance of energy efficiency is growing as hardware advances slowly

The early days of industrial-scale bitcoin mining were defined by miners competing to maximize energy-efficient hashrate using the latest generation of ASICs. Rapid advances in semiconductor technology fueled this competition as ASICs saw exponential improvements in hash rate efficiency within a few years. Compared to their 2014 counterparts, today’s ASICs are approximately 36 times more energy efficient as measured by Joules of energy consumed to produce 1 gigahash (1 billion hashes) of computing power.2 However, the efficiency gains in ASIC technology are becoming increasingly marginal, as illustrated in the diagram below.

In the face of slowing ASIC progress, the dominance of hardware as the main determinant of a miner’s profitability is likely to decline. Instead, cost-competitive energy is likely to become an increasingly important input factor.

Economic adaptations motivate miners to adopt renewable energy

Miners are incentivized to operate in locations with the cheapest and most accessible energy available. Expanding operations in locations suitable for solar and wind farms is a compelling option. While these energy sources currently have reliability limitations, solar and wind energy have become more affordable than fossil fuel sources, as illustrated in the chart below.

The Bitcoin mining industry is taking note of the cost benefits of renewable energy. Recently, a number of industry-leading miners began a transition of their operations away from fossil energy sources. Among these, Marathon Digital moved operations from a coal-fired mining facility in Montana to more sustainable facilities, including a wind-powered facility in King Mountain, Texas in the third quarter of 2022.3 The Bitcoin Mining Council (BMC), a global forum of mining companies representing 48.4% of the worldwide bitcoin mining network, estimated that in the fourth quarter of 2022, renewable energy sources accounted for 58.9% of the electricity used to mine bitcoin, a significant improvement compared to 36.8% estimated in Q1 2021.4

Halves can be another catalyst for the use of renewable energy

In addition to competition, bitcoin halvings could also accelerate green energy adoption among miners. Halves occur every 210,000 blocks, roughly every four years.5 As the name suggests, halvings reduce bitcoin block rewards by 50%, reducing the revenue earned by bitcoin miners by almost the same amount if there is no change in the price of bitcoin. Expected in 2024, the next halving will reduce block rewards from 6.25 BTC to 3.125 BTC issued per block.6 With competition and halvings pushing miners to seek efficiencies wherever possible, bitcoin miners are discovering that environmentally sustainable practices may be the next frontier to explore.

Related ETFs

BKCH – Global X Blockchain ETF

Click on the fund name above to view current holdings. Stock is subject to change. Current and future holdings are exposed to risk.