Bitcoin mining difficulty observes the biggest drop since the China ban

Data shows that Bitcoin mining difficulty has just observed the sharpest plunge since the aftermath of the China ban.

Bitcoin mining difficulty sees the biggest downward adjustment since July 2021

According to data from research firms in the chain Glass nodeBTC difficulty has decreased by 7.3% in the last adjustment on the blockchain.

To understand the concept of mining difficulty, the “hash rate” must be looked at first. The hashrate is a measure of the total amount of computing power currently connected to the Bitcoin network.

When this metric goes up, it means that miners are connecting more mining machines to the blockchain right now. On the other hand, a slowdown means they are taking some of their rigs offline for the time being.

As the hashrate fluctuates up and down like this, so does the miners’ ability to handle transactions on the network. An increase means that miners can hash blocks faster thanks to the extra power, while a decrease indicates the opposite.

However, one feature of the Bitcoin blockchain is that it tries to keep the rate at which miners hash blocks almost constant. Obviously, changes in the hash rate take this speed away from the network standard.

So, to counteract such fluctuations, the network adjusts what is called the “mining difficulty”. This metric defines how difficult chain validators will find it to mine Bitcoin.

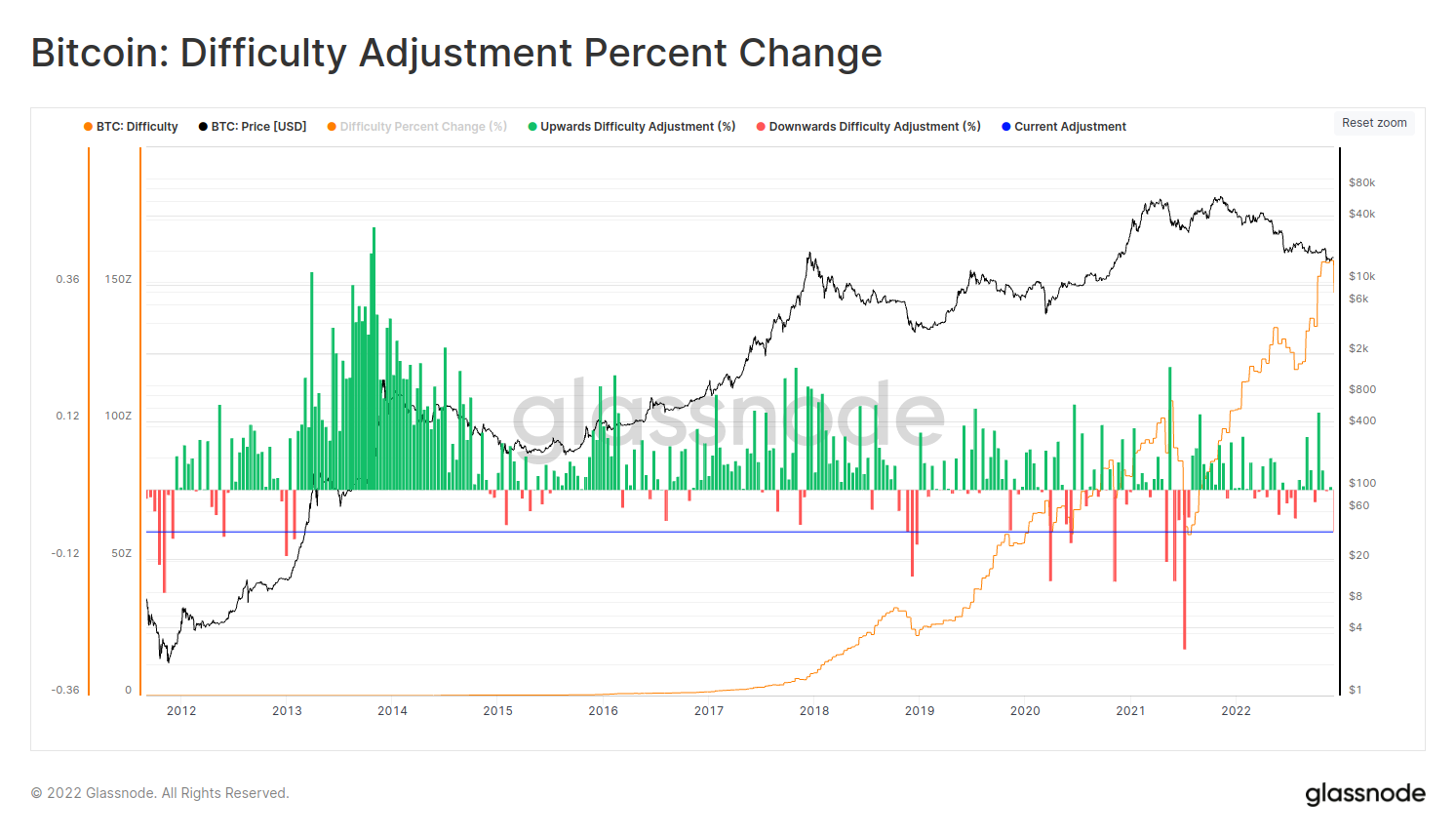

Here’s a chart showing how BTC difficulty has changed over the years:

The value of the metric seems to have rapidly gone down recently | Source: Glassnode on Twitter

As you can see in the graph above, Bitcoin mining difficulty was at an all-time high recently.

This was because the hash rate was also floating around ATH levels, so the network had to increase the difficulty to slow down the miners to the desired speed.

However, miners had already been struggling hard due to the hashish bear market, so the added difficulty made mining BTC no longer profitable for some of them.

Such miners then began to disconnect from the network in hordes, and the hash rate tanked. It is this latest sharp drop in the metric that has also led to a significant 7.3% drop in mining difficulty.

This latest sharp downward adjustment in difficulty is the highest on the Bitcoin chain since July 2021, when the hash rate collapsed in the wake of China’s mining ban.

BTC price

At the time of writing, Bitcoin’s price is hovering around $16.9k, up 3% in the last week. Over the past month, the crypto has lost 20% in value.

Looks like the value of the crypto has already come back down from yesterday's surge | Source: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com