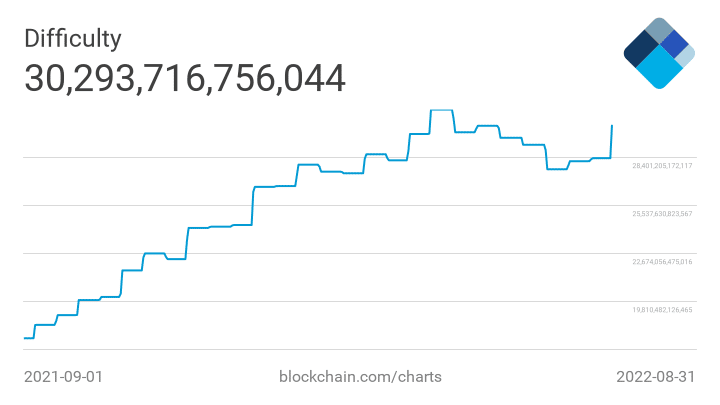

Bitcoin Mining: Difficulty Increased by 9.26%

The latest increase in Bitcoin mining difficulty was the highest since January.

The increase happened yesterday, and it went from 28.35T to 30.97T.

The current level is not the highest ever, but it is not far from the all-time high of 31.25T in mid-May before the cryptocurrency markets collapsed due to implosion of the Terra/Luna project.

Since then, the difficulty had dropped as low as 27.69T just after mid-July, but has since returned to growth.

This growth is again due to the increase in hashrate, or total computing power used of all Bitcoin miners in the world.

The dynamics of BTC mining hashrate in 2022 is very curious.

Hashrate Values and Bitcoin Mining Difficulty

After the beginning of the bear market in the second half of November 2021, the hashrate continued to rise despite the halving of BTC’s value, until reaching an initial high in early May, over 250 Ehash/s for the first time in history.

With the collapse of crypto markets in mid-May, and Bitcoin’s price fell below $30,000, the hash rate fell slightly, to the following low of 188 Ehash/s in early June. However, it then immediately rose again and made an all-time high on June 8, 2022, at over 253 Ehash/s.

Due to the further decline in the price of BTC, which also fell well below $20,000 in June, the hashrate ended up falling to 170 Ehash/si in mid-July, before rising again, so that by August 26 it had risen again to 246 Ehash/s.

Difficulty dynamics inevitably follow closely, because this serves to prevent high hashrates from reducing block time too much, or low hashrates from diluting it too much. In fact, the Bitcoin protocol is designed to always maintain an average block time of around 10 minutes, no matter what happens.

Thus, the recent level of difficulty is not surprising at all, while what is surprising is the increase in hashrate that occurred after the price collapses in May and June, partly because these are months when the cost of electricity increased.

This causes the average profitability estimation to drop sharply, down to $0.08 per THash/s per day. In March it was at $0.25, while even in November 2021 had risen to $0.45. However, both November’s $0.45 and March’s $0.25 should be considered high levels, while today’s levels can be considered relatively normal.

Ethereum mining in the run-up to the merger

It should also be kept in mind that many Ethereum miners are preparing to quit, because after the mergerETH will no longer be minable, so they can invest the capital usually used to refurbish machines to buy more machines to mine BTC.

As a matter of fact, look at hashrates graphsand difficulty, it certainly seems that Bitcoin miners see the future as rosy for them.