On Sunday, November 20, 2022, Bitcoin’s difficulty increase erased the last decline of 0.20% recorded two weeks ago, when the difficulty increased by 0.51% at block height 764,064. The increase on Sunday has pushed the difficulty to another all-time high , from 36.76 trillion to today’s 36.95 trillion.

Bitcoin Difficulty Hits All-Time High Approaching 37 Trillion, Leading Crypto Asset’s Fiat Value Drops Lower

Today, it is 0.51% harder to find a Bitcoin (BTC) block reward than it was for the last two weeks or 2016 blocks processed. The 0.51% increase has driven the difficulty to a lifetime of 36.95 trillion, surpassing the previous record set on October 23, 2022. Difficulty increased during this retarget because block intervals were less than the ten-minute average, at nine minutes and 58 seconds. The average hash rate for the last 2016 blocks was around 264.3 exahashes per second (EH/s).

On Sunday, around 19:15 (ET), the global hash rate is around 261.29 EH/s, and eight days ago on November 12, 2022, at block height 762,845, Bitcoin’s hash rate reached an all-time high of 347.16 EH/s. The next difficulty adjustment will occur around December 4, 2022, and the current block generation time after the change is nine minutes and 26 seconds. The difficulty change is not good for bitcoin miners and BTC’s current fiat value is not helping miners either.

Hash Price Per Exahash Slides, Bitcoin Miners Distribute 8.25K Bitcoin To ‘Land Up’ Balances

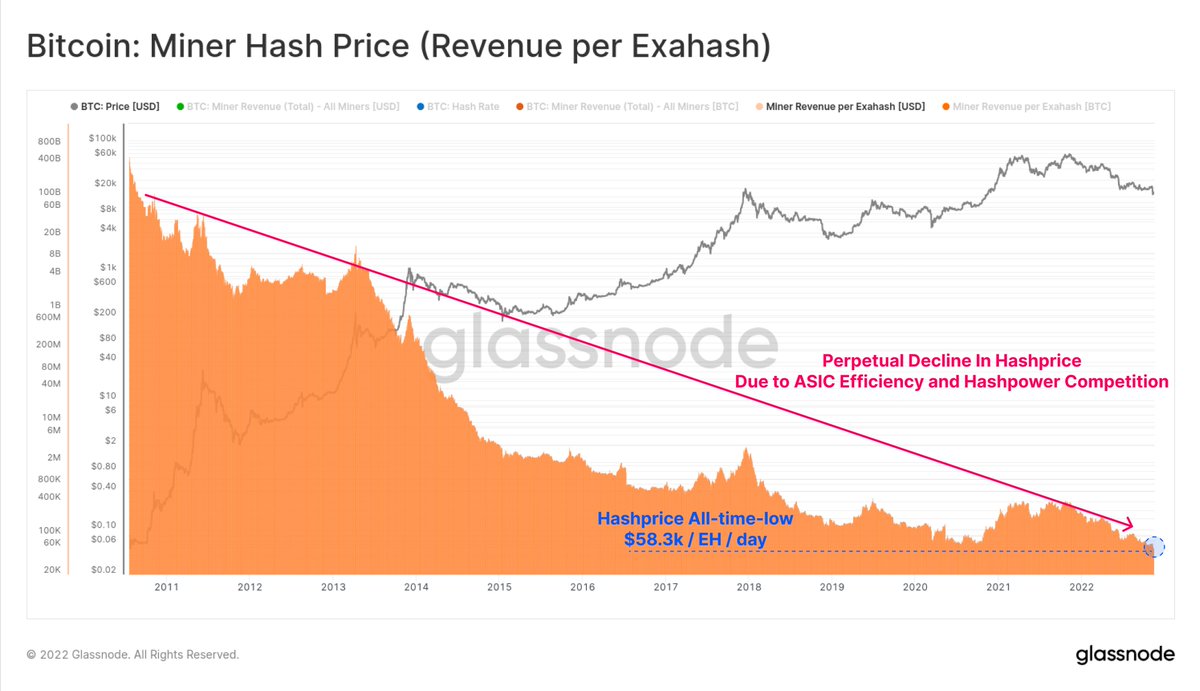

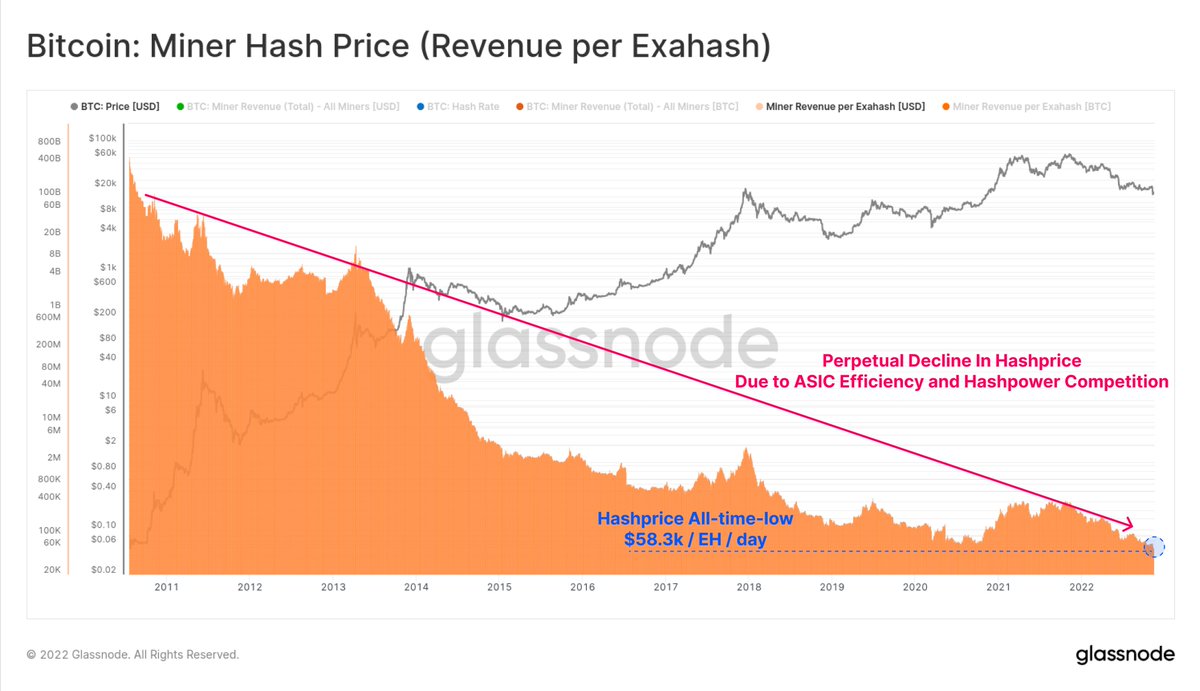

Bitcoin’s current value is more than 76% lower than the all-time high recorded on November 10, 2021. Onchain analytics firm Glassnode explained on November 18, 2022 that the bitcoin miner hash price has fallen to a lifetime low. “[Bitcoin] Miner hash price has plunged to a new record low of $58.3k per exahash per day,” Glassnode tweeted. “With [bitcoin] Prices are now down over 76% from their peak and the mining industry remains under enormous pressure,” the firm added.

Since Glassnode’s tweet, the hash price per exahash has dropped even lower on November 20th. “When news of the FTX fallout broke last week, bitcoin miners distributed an additional 8.25K [bitcoin] to strengthen the balance. This leaves around 78K [bitcoin] in mining taxes, and deletes all balance sheet growth in 2022,” says Glassnode added. Three-day statistics recorded on Sunday show that Foundry USA has been the top mining pool with around 71.76 EH/s or 27.36% of the global hash rate.

Foundry is followed by Antpool’s 46.43 EH/s, F2pool’s 40.40 EH/s, and Binance Pool’s 37.99 EH/s. Foundry, Antpool and F2pool are followed by Viabtc and Braiins Pool respectively. There are 13 known mining pools that dedicate hashrate to the BTC chain, and unknown hashrate otherwise known as stealth miners control 2.76% of the global hashrate or 7.24 EH/s. Miners were able to mine 435 bitcoin blocks which equates to 2,718.75 newly minted BTC worth $44 million, and the fees associated with those blocks.

Tags in this story

2016 Blocks, All time high, Antpool, ATH, Binance Pool, Bitcoin mining, BTC Mining, Changes, difficulty, difficulty change, Difficulty changes, difficulty eras, difficulty, Exahash, F2Pool, Foundry USA, glassnode, Glassnode Stats, Hashpower, Hashrate, Hashrates, Increases, Mining, Mining BTC, Mining Pools, Price per Exahash, Terahash, ViaBTC

What do you think about Bitcoin mining difficulty increasing by 0.51% on Sunday evening? Let us know what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.