Bitcoin mining costs less than 0.5% of global energy if BTC reaches $2M: Arcane

Bitcoin (BTC), the world’s most valued cryptocurrency, has the potential to become a significant energy consumer in the future, but only if it reaches several million dollars, according to new estimates from Arcane Research.

The crypto research and analysis company Arcane Research released a report on Monday that estimates the development of Bitcoin’s energy use towards 2040.

Authored by Arcane Research analyst Jaran Mellerud, the report points out that Bitcoin’s future energy consumption varies enormously depending on the future Bitcoin price along with factors such as transaction fees, electricity prices and others.

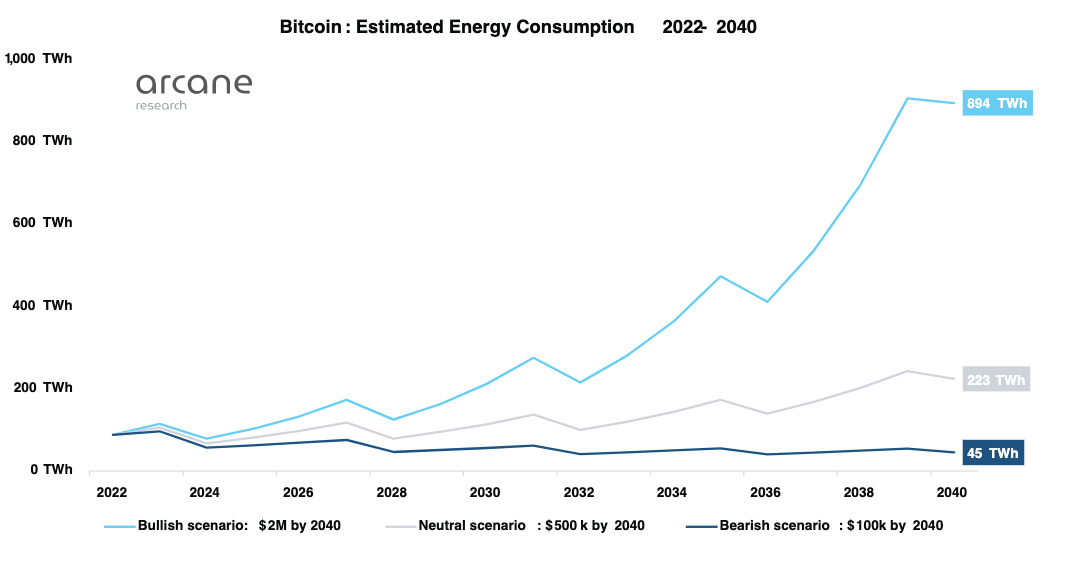

If the BTC price reaches $2 million in 17 years, Bitcoin could consume 894 Terawatt hours (TWh) per year, rising 10 times from current levels, the report suggests. Despite major growth, such energy consumption will account for just 0.36% of estimated global energy consumption in 2040, up from Bitcoin’s 0.05% share today, the analyst estimated.

“Currently, based on their energy consumption of 88 TWh and an average energy price of $50 per MWh, Bitcoin miners spend around 50% of their income on energy,” Mellerud noted.

Bitcoin’s future energy consumption will be much lower in less bullish scenarios. The BTC price must reach $500,000 by 2040 for Bitcoin to consume 223 TWh per year. If Bitcoin trades at $100,000 in 17 years, BTC mining will consume only 45 TWh per year, the report notes.

Bitcoin’s estimated energy consumption 2022-2040. Source: Arcane Research

The analyst went on to mention the significant impact of the Bitcoin halving, a quadrennial event that involves a 50% reduction in miners’ block rewards. According to the report, the BTC price must rise at a tremendous pace due to the halving, while the halving’s “dampening effect” may be offset by increasing transaction fees in the future. “Such an increase will only happen if there is a significant demand for using Bitcoin as a payment system,” Mellerud wrote, adding:

The Bitcoin price depends on market demand for Bitcoin as a store of value, while transaction fees are driven by the use of Bitcoin as a medium of exchange.

As a store of value and a medium of exchange constitute two of the most important functions of money, the report also suggests that Bitcoin’s energy consumption will only reach a significant level if Bitcoin succeeds as money.

As many BTC skeptics believe that such a scenario is unlikely, they should not worry about Bitcoin’s energy consumption, Mellerud suggested, stating:

I have good news for those of you who want to see Bitcoin’s energy consumption decrease: You can relax in your armchair, because your wishes will be granted if Bitcoin fails as a monetary system. And you think that Bitcoin will fail, right?

The Bitcoin mining industry has seen a major downturn in 2022 amid the ongoing cryptocurrency winter, with many major crypto miners opting to sell their BTC holdings to continue operations. Mining companies in the US have also faced pressure from regulators, with US lawmakers requesting energy consumption data from four major BTC miners.

Despite the increasingly bearish climate, many Bitcoin miners remain optimistic about Bitcoin’s short- and long-term price outlook. According to Canaan’s senior vice president Edward Lu, the mining industry is a “healthy and profitable business” in the long term.

![Analyzing Bitcoins [BTC] unprecedented rally and market reaction Analyzing Bitcoins [BTC] unprecedented rally and market reaction](https://www.cryptoproductivity.org/wp-content/uploads/2023/03/AMBCrypto_A_group_of_traders_and_investors_huddled_around_a_scr_fe125ed2-7b45-4c8d-b143-ad8cd263ce9f-1000x600-520x245.png)