Bitcoin Mining Concentration In America – Bitcoin Magazine

This is an opinion piece by Shinobi, a self-taught Bitcoin educator and tech-savvy Bitcoin podcast host.

Since the mining ban came to China, there has been a massive migration of Bitcoin hash rate to the US. There have been many narratives and pushes by pro-US Bitcoiners to continue attracting more hashrate to the US, including pressure to create favorable regulatory environments for miners here in North America. This has been done under the assumption of the historical strength of US property rights, which is a large part of why US capital and equity markets are the largest in the world.

This is a huge miscalculation and is something that, if successful, will have a huge negative effect on Bitcoin in the long run. The whole game theory surrounding the security of Bitcoin mining is decentralization/distribution. From day one, it has been very clearly delineated that a majority (51%) or more of the Bitcoin hashrate can act maliciously in a way that seriously degrades or breaks the security of the entire system. They can orphan blocks from other miners, preventing them from participating in the system to earn money in Bitcoin. They can exclude transactions from parties they don’t want to execute, again orphaning the blocks from miners processing such transactions from the blockchain. They could selectively refuse to properly process Lightning channel closures, they could prevent pegs or pegs from sidechains. They can completely break the censorship resistance of the system and undermine the security of not only the base layer, but any secondary layer built on top of it to scale the system.

Miners themselves deciding to act maliciously isn’t the only form this particular risk takes. They have to set up their operations somewhere, which means – unless they’re able to operate illegally and invisibly off the grid, which isn’t practical on a large scale – they have to submit to the laws and regulations of the jurisdiction they create in Too Much of the total hash rate of the network in a single jurisdiction represents a security risk to the network as a whole. Consider how much of the hash rate currently runs in the US, and how much of that is public companies, registered co-hosting facilities, easily locatable businesses, and people with enough hash rate at home with a power signature that can easily is identified by a supply company. All of these hash rates are subject to US government enforcement with varying degrees of severity. And by vary, I mean, anything but individual home miners can probably be trivially accomplished in a single week.

As of December 2021, the Cambridge Bitcoin Electricity Consumption Index shows a 38% hash rate for the US network. That is 13% away from the minimum required to engage in disruptive activity on the network. Bitcoiners should not encourage action and legislation to tip this even closer to that tipping point. The United States government is the largest empire in the world, we literally run the world’s reserve currency, which is already facing major problems in the world just because of the political fallout in response to decades of a foreign policy centered almost entirely around benefiting America at the expense of harming countless other nations in the world.

Bitcoin is another existential threat to that reserve currency and to the benefits of the rest of the world relying on it. Things are constantly painted as if America is a shining beacon of freedom in the world that will embrace Bitcoin because of it, and in some ways America is that beacon, but in other ways it is eerily similar to the totalitarian state of China under the thumb of the CCP. The US government has every incentive to attack or capture Bitcoin as China does, even more so when it comes to the threat that Bitcoin represents to the US Dollar. Bitcoin is a fundamental threat to the world order that the American Empire has established. If the government sees an opportunity to neuter that threat, they will take it.

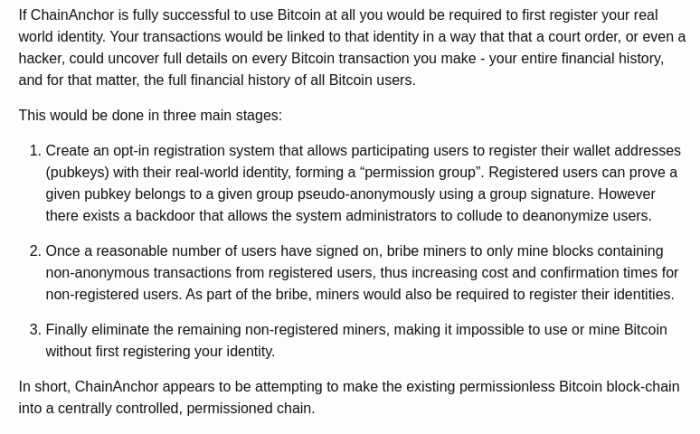

Carrying out such attacks is not a simple intellectual exercise where the government also has no idea or plans on how to do anything. IN 2016 MIT designed a system called Chain Anchor. The whole goal of the system is literally to perform a 51% attack to permanently castrate Bitcoin’s censorship resistance:

Read all of this carefully. Now consider the FATF regulations that have dragged on and been slowly rolled out in recent years. The travel rule. Almost all major exchanges in this ecosystem are actively working on protocols to allow them to exchange personally identifiable information with each other, or at least commit to it, when they engage in a transaction on behalf of one of their users that goes directly to a other stock exchange. It wouldn’t be opt-in – it’s a mandate, even worse than the proposal in Chain Anchor. European politicians have even danced the line with proposals publicly to extend such KYC requirements to non-custodial wallets.

Now consider the current dominance of ESG narratives in relation to Bitcoin mining. There is talk of (and literally regulations enforcing it in some places) preferential treatment of renewable energy-powered mining. In general, these involve financial incentives in the form of tax breaks/subsidies for operations. These types of non-Bitcoin financial deals, and in the future even direct payments potentially, are an exact form of bribing miners. They financially incentivize them to act in a certain way outside of the Bitcoin protocol itself.

These actions are slowly normalizing the idea of miners trading with such protocol-external incentives in mind. Public mining companies don’t get such deals without identifying themselves, consumers don’t get rack space on a co-hosting facility without KYCing themselves. All of these are the requirements for the Chain Anchor to creep in slowly.

All that remains is the necessary hash rate required to fully enforce whitelisted use of Bitcoin and exclude non-compliant miners from the system, and bam, Chain Anchor’ has effectively neutered Bitcoin and made Bitcoin a whitelisted and approved system. At that point there is no other option but hope that new miners can be manufactured and brought online to overwhelm this attacking majority, which is a long shot given how centralized ASIC design and manufacturing really is.

Other than that, the only option is to change the PoW algorithm. This is, I think, even in the face of such an attack, highly unlikely. It calls into question the whole idea of a neutral system, and arbitrarily destroys the value of both malicious and non-malicious miners’ investments. Additionally, looking again at the centralization of ASIC production, there is nothing to prevent it from being done again once this attack has been demonstrated to be possible. Nutting the previous generation of ASICs in a fork also prevents honest miners from trying again. What happens if another fork occurs because the attack is pulled again? They risk once again sinking a large amount of capital into a hardware investment that is rendered worthless by responding to the attack.

I don’t think Bitcoin can recover from such an attack. People will either soak it up, and value it for what it simply is as a scarce economic asset devoid of real censorship resistance, or it will fail outright. If a socially coordinated game is required to keep it functioning in a censorship-resistant manner, that undermines the value of a neutral censorship-resistant system that does not require such social coordination to function. Either it dies, or it limps on like a neutered scarce asset.

For Bitcoin to truly function as a censorship-resistant system, it must avoid ending up in that situation in the first place. Bitcoiners should not cheer for such hashrate concentration in a single jurisdiction, and try to further encourage it by lobbying industry and politicians to make things even more favorable for miners to concentrate in a single location. Mindless patriotism and hyper-focus on “Make America Great Again” like that is not good for Bitcoin — in fact, it’s actively dangerous for it.

If Bitcoin is to succeed, it must succeed as a system distributed safely and securely around the world, not heavily concentrated in America because “America is awesome.”

This is a guest post by Shinobi. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.