Bitcoin Mining becomes much more difficult with high difficulty

The difficulty of the Bitcoin network has reached its highest level ever. However, asset prices are falling following a regulatory intervention in the US.

BTC mining problems are at peak levels, which means that it is now harder than ever to secure the next block.

Miners must perform 39 trillion hashes (39T) to find the next block. Difficulty is often referred to as a measure of competition between Bitcoin miners, or the computational power required to produce another block.

According to BitInfoCharts, mining difficulty has increased by 47% since the same time last year. This has put a lot more pressure on miners.

Bitcoin Mining Metrics Latest

Additionally, Bitcoin mining hash rates are also near peak levels. Bitinfocharts is currently reporting a hash rate of 300 EH/s (exahashes per second), just off the late January peak of 316 EH/s.

Furthermore, hash rates have increased by 50% since February 2022. This is good news for network security, but bad news for BTC miners.

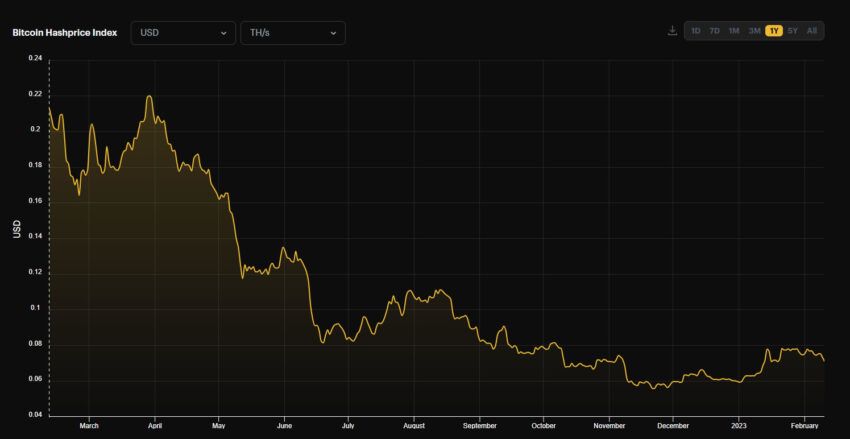

As a result of these increasing calculations, profitability in mining has fallen to multi-year lows. Since February 2022, mining profitability has dropped by 66% to current levels of around $0.073 per day per terahash per second.

Furthermore, the Hashrate Index refers to this metric as “hashprice.” The analytics platform reports that hashish prices hit a record low of $0.055 at the end of November 2022. During the peak of the bull market at the end of 2021, they were as high as $0.40.

Bitcoin miners are currently facing a triple whammy of low BTC prices, high difficulty and hash rate, and rising energy costs.

Bitcoin mining researcher Jaran Mellerud observed that some public mining companies have spent more than half of their revenue on administration. Those who have been more frugal in this area are more likely to weather the storm.

On February 9, the mining company CleanSpark published its results report for the first quarter. While revenue fell, the company was confident it would continue to expand with more mergers and acquisitions this year.

Furthermore, Hut 8 announced a merger with US Bitcoin Corp earlier this week.

Price outlook

Bitcoin prices have taken a hit today, putting even more pressure on miners. The decline came as the SEC cracked down on Kraken’s crypto-staking services.

BTC had fallen nearly 4% over the past 12 hours, falling to $21,870 at press time. Additionally, the asset has now lost 7% in the past week as the bears resume pressure on the markets.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.