Bitcoin miners send 14K BTC to one block. Bullish news for the market?

After the official US inflation figures were published, bitcoin prices began to rise. Over the past month, however, BTC miners have increased their outflow.

A new set of tax policies aimed at preventing domestic cryptocurrency mining was unveiled by Kazakhstan, which remains a significant nation in the world of Bitcoin mining.

During a halt in worldwide activity and fire sales related to recent bankruptcy-related news, the prices of Bitcoin mining rigs are also said to have fallen to epidemic lows by 2020.

Most importantly, network operators in Texas have asked all Bitcoin miners to shut down to reduce the load on a power grid that is already congested.

Bitcoin Miners Inflow Reaches New NOTE

IT Tech reports that Bitcoin miners transfered over 14,000 BTC to a stock exchange in a single block. The transfer from the miner’s wallet to the stock exchange was noted as unfavorable for the market. According to their definition of mining pool wallets in their statistics, all pool members – including the specific miner – are included.

However, one user pointed out that these Bitcoin were not reflected in the spot market or derivatives. Glassnode reported that BTC Miners’ Netflow Volume on a 7-day moving average (MA) basis reached an all-time high (ATH) of $ 1,779,953. In the first week of January 2022, an ATH of $ 1,700,940 was recorded.

This outflow did not stop at the stock market wallet, according to Ki Young Ju, CEO of CryptoQuant. It probably ends up in a cold wallet. This can be used as an OTC agreement or as a custody service. In his opinion, the news is either bullish or neutral.

Miner has just moved 14k $ BTC:

Poolin participants → Unknown walletIt did not go to an exchange wallet, but more like a cold wallet. It may be to use a custodian service or an OTC agreement. This is neutral or bullish news.

Well received @IT_Tech_PL

Ki Ki Ju (@ki_young_ju) July 15, 2022

Related reading | Mid Cap Crypto Coins Leads In July, The Best Way To Be Winter?

Can the price rise?

In addition, open interest is increasing, according to IT Tech, and the market may soon experience growth. Bitcoin mining reserves have declined over the past two weeks, according to the study. However, this can be a significant sign of declining confidence in a price change.

Over the last 24 hours, the price of bitcoin has increased by more than 6%. BTC is currently trading at $ 20,953 on average. Its 24-hour trading volume is up 2% to $ 32.8 billion.

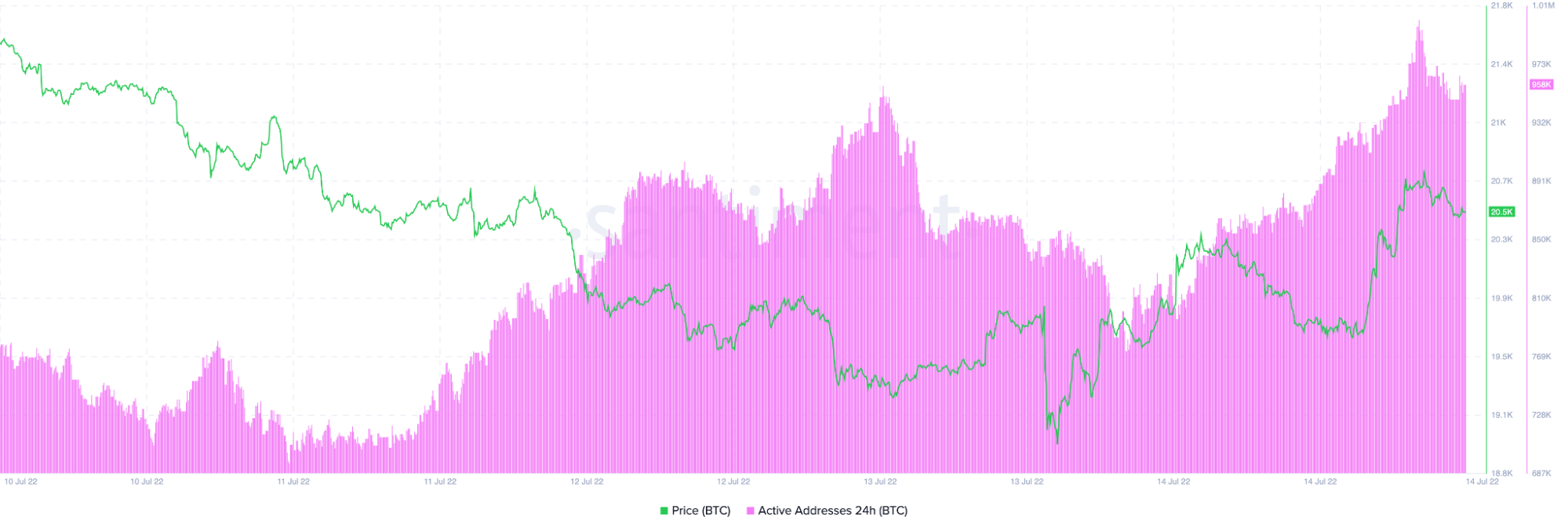

BTC active addresses have grown over the last 24 hours, says Santiment. The number was close to one million at the time of the press, compared to 860,000 on July 14th. This shows that the investor mood is rapidly improving.

Source: Santiment

The volume, which changed from 28.13 billion to 31.64 billion, is in a comparable scenario. For Bitcoin maximalists, the price increase over the last 24 hours on July 15 may be a sign of relief. In fact, at the time of writing, Bitcoin’s market value has increased from $ 376 billion to $ 395 billion.

BTC market cap surges. Source: TradingView

Meanwhile, Anthony Pompliano said in his analysis that the price of bitcoin is falling due to rising inflation. It may be true, he continued, that there is no strong hedge against the CPI.

Related reading | The Bitcoin price spends four weeks on top prices in 2017, what comes next?

Featured image from Pixabay, charts from TradingView.com and Santiment