On October 25, bitcoin miner Cleanspark announced that the firm’s hash rate now exceeds 5 exahash per second (EH/s), a milestone achieved more than two months ahead of the company’s original year-end goal. Cleanspark says it now aims to surpass 5.5 EH/s by the end of the year by increasing its miner hashrate target by 10%.

Cleanspark aims to achieve 5.5 EH/s by the end of 2022 after raising its target by 10%

Cleanspark (Nasdaq: CLSK) announced Tuesday that the bitcoin miner has surpassed its year-end goal of maintaining 5,000 petahashes per second (PH/s), which equates to 5 EH/s. The company intended to meet the 5 EH/s target by the end of 2022, and now plans to add another 10% hashrate to the guidance by the end of the year. The news follows the company completing the acquisition of Mawson Infrastructure Group’s Georgia-based bitcoin mining facility, a data center that came with 6,500 mining rigs.

Cleanspark is a miner that has managed to make it through the crypto winter and further used the downturn to the company’s advantage when it acquired miners at a “discount price” in July. Other bitcoin mining firms in 2022 have not fared as well, as liquidations and bankruptcies have rocked the mining industry.

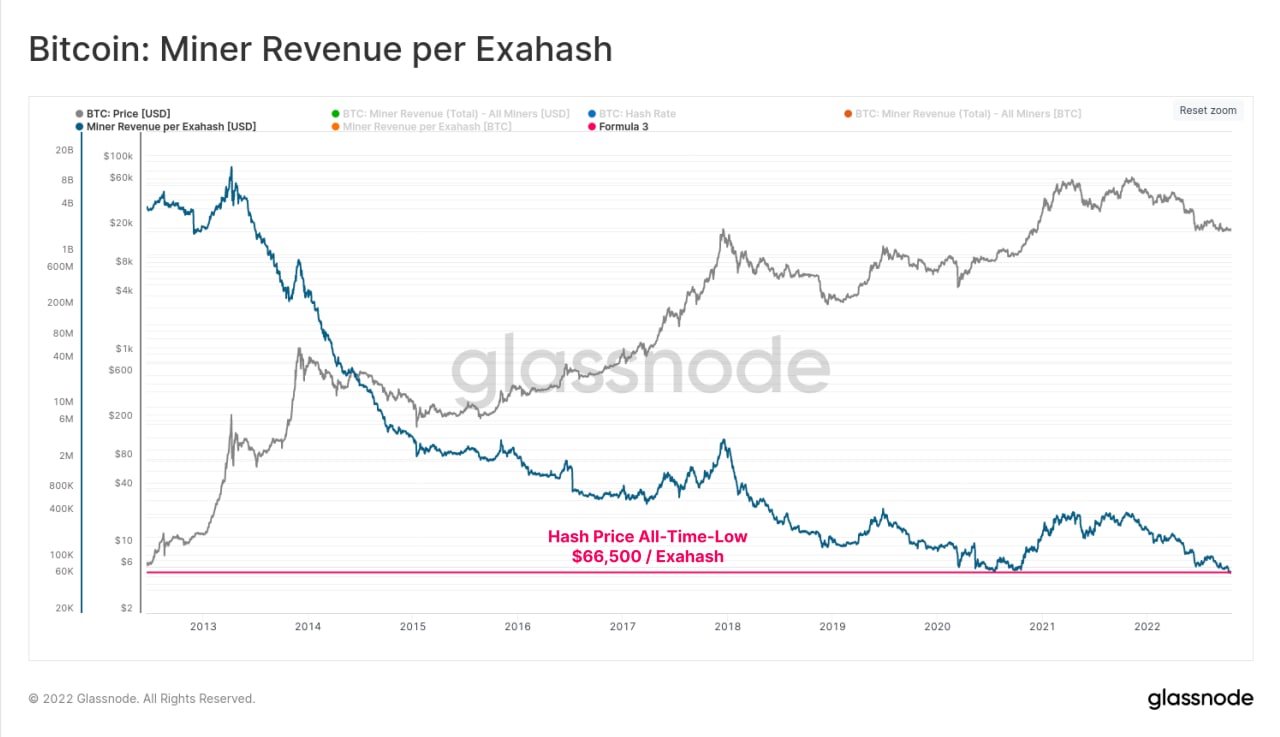

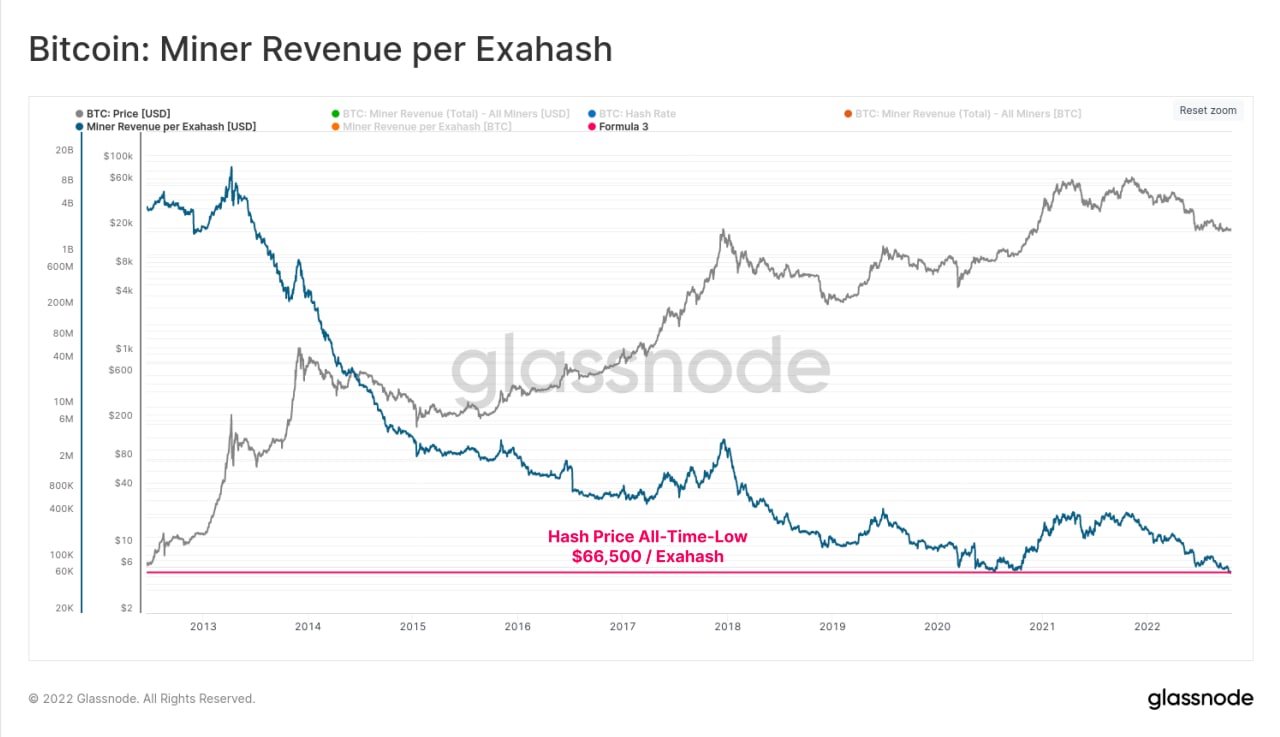

Furthermore, crypto analysis and market intelligence company Glassnode explained on October 25, via the firm’s Telegram channel, that profits from bitcoin mining have hit a low. Glassnode said:

The Bitcoin Hash price has reached an all-time low of $66,500 per Exahash. This means [bitcoin] miners earn the smallest reward relative to hash power used in history, likely putting the industry under extreme revenue stress.

Cleanspark CEO Zach Bradford said on Tuesday that his company was able to buck the crypto winter trend that has wreaked havoc on participants in the bitcoin mining industry. “Our hashrate growth in recent months has been helped along with the acquisition of the Washington and Sandersville facilities, but that only tells part of the story,” Bradford said in a statement Tuesday.

“This milestone reflects operational prowess and efficiencies that I believe are unparalleled in our industry. At a time when the sector is experiencing reversals in forward-looking expectations, we are bucking that trend,” the Cleanspark CEO added.

Meanwhile, as bitcoin (BTC) bucked the trend on Tuesday afternoon and surpassed the $20K region once again, stocks linked to listed mining companies such as CLSK have rallied against the US dollar. The 30-day statistics indicates that CLSK is up 10.54% since the last month, but six months period of time, CLSK is down 50.85% against the dollar.

A number of other mining company stocks such as MARA, RIOT, DMGGF, ARBKF and CORZ have all seen 24-hour percentage gains against the US dollar thanks to BTC’s rise on Tuesday. Bitcoin’s total hash rate on Tuesday, October 25 is around 240 EH/s after the network’s last difficulty of 3.44% two days ago.

Tags in this story

240 EH/s, ARBKF, Bitcoin, Bitcoin (BTC), Bitcoin mining, BTC Mining, Cleanspark CEO, CLSK, CORZ, crypto downturn, Crypto Winter, DMGGF, glassnode, MARA, mining bitcoin, Mining BTC, mining company, Mining Industry , on-chain market intelligence company , publicly traded mining companies , revenue per exahash , Riot , trend , Zach Bradford

What do you think about Cleanspark reaching 5 EH/s and increasing year-end targets by another 10% more? Let us know what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.