Bitcoin: Maybe it’s an inflation hedge after all

Taste Nawarat

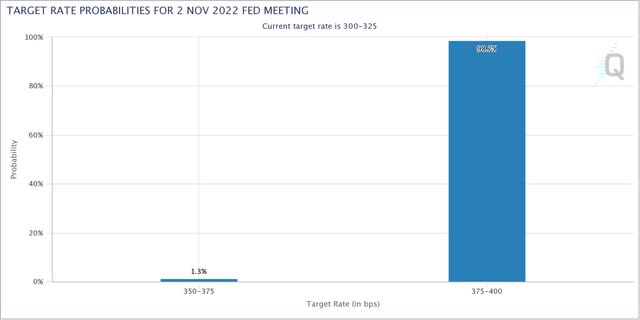

Yesterday, the BLS released the latest measures of consumer price inflation, and it wasn’t pretty. Overall CPI came in at 8.2% year-on-year with core CPI at 6.6%. Each of these numbers exceeded expectations. This is worrisome because the Federal Reserve has increased interest prices 75 bps at a time through the summer months and are expected to do so again in a few weeks:

CME

It is the central bank’s hope that this next increase will be the one that achieves what others have failed to achieve; namely reflect a meaningful reduction in data for consumer price growth. The response to the CPI reading in August was a massive sell-off across broad risk markets that took down equities, metals and crypto. This selloff was the market apparently catching on to the idea that the Fed could not justify a rate hike at the last FOMC meeting. Given that, it stands to reason that yesterday’s higher than expected CPI reading would have resulted in the same response, but that did not happen.

While it has given back some of the gains from yesterday’s pop, Bitcoin (BTC-USD) is still ahead of where it was before the CPI reading at 8:30 AM on Thursday. This raises the question of whether the top crypto by market cap is really an inflation hedge after all. Bitcoin has gone through a number of narratives in recent years:

- It is a medium of exchange

- It’s digital gold (inflation hedge)

- It is energy

To most people, each of these tales is probably absurd, but I think there is one that may actually have some weight. If we accept that the market is looking ahead, then it is not unreasonable to give Bitcoin some credit for showing off the high CPI readings of the last year and a half.

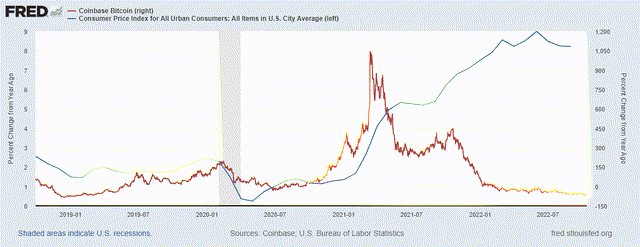

PEACE

This is the year-over-year change in Bitcoin with the CPI. Because of the extremes we see in Bitcoin’s changes, I’ve placed BTC’s change on a second y-axis. If Bitcoin really is an inflation hedge due to the fixed supply, I think this would indicate that it was the high inflation of the last year and a half.

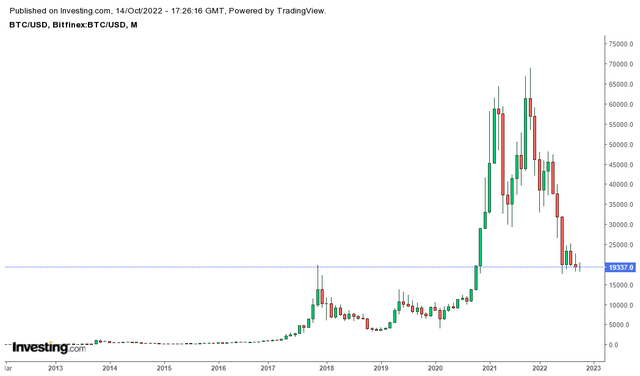

It is possible that Bitcoin is purely a speculative trinket with no utility, no intrinsic value and no future. I disagree with each of these assumptions. But it is also possible that Bitcoin actually acts as an inflation hedge when we take a much broader view of history. Although we don’t necessarily see it right now, Bitcoin has been claimed dead after the bubble pops several times, but it’s still here and every cycle to this point has brought a higher high and a higher low.

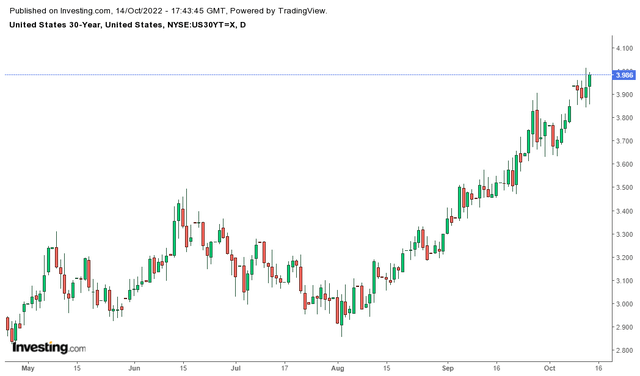

investing.com

This brings us to the key questions: why is Bitcoin still holding $19k when the macro environment suggests it should have fallen hard again yesterday?

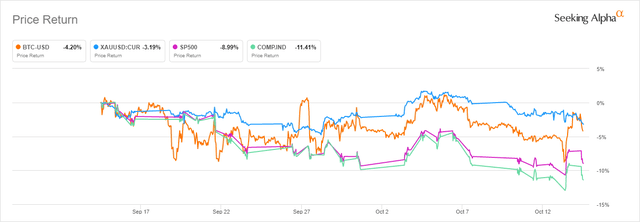

Seeking Alpha

Furthermore, why is Bitcoin behaving more like gold than stocks in the last month? I think it’s fair to wonder if Bitcoin is beginning to anticipate a policy change.

Fed Pivot? I think so

Over the past few weeks, we have started to see more indications from global institutions that there will be pressure on the Fed to stop raising interest rates. The UN called on global central banks to halt interest rate hikes and warned that continued hikes would risk harming developing countries:

In its annual report on the global economic outlook, the United Nations Conference on Trade and Development said the Fed risks causing significant damage to developing countries if it continues rapid rate hikes.

We saw a very similar sentiment shared by the IMF when Managing Director Kristalina Georgieva reportedly acknowledged that the Fed’s policies are having an impact elsewhere in the world:

Georgieva urged the Fed to be extremely cautious in its policy and to be aware of the contagion effect on the rest of the world

More recently, Janet Yellen raised concerns about liquidity issues in the Treasury market:

Treasury Secretary Janet Yellen cited concerns about the potential for a breakdown in U.S. Treasuries trading as her department leads an effort to prop up the crucial market. “We are concerned about the loss of adequate liquidity in the market,” Yellen said Wednesday in response to questions after a speech in Washington.

And those concerns appear to be justified as demand for US debt has been weak:

On Wednesday afternoon, the US Treasury Department auctioned 10-year paper to the value of 32 billion dollars. Demand was weak to say the least.

investing.com

The US 30 year yield is now just under 4% and still rising. The central bank isn’t buying it and foreign investors don’t seem to be either. Something has to give.

There is zero doubt in my mind Bitcoin benefited from monetary policy being locked down. The Robinhood traders of the world chasing meme stocks and things like Dogecoin (DOGE-USD) with stimulus checks had nowhere else to spend them. Bars and other attractions were closed. The currency had to go somewhere, and a lot of it went to stocks and crypto. That tailwind probably isn’t coming back anytime soon. But to dismiss the growing network adoption of Bitcoin as just another speculative frenzy would be short-sighted in my view.

Conclusion

Bank of New York Mellon (BK) is the latest financial institution to give Bitcoin a stamp of approval, as it will allow customers to hold it. Bitcoin is a limitless, permissionless asset that has actually protected investors against inflation if your time horizon is long enough. Gold, of which I am a huge personal advocate, is not going anywhere. These two things are, and always have been, complementary. The key is to time your entries in these assets correctly. It would be easy to say that Bitcoin has performed terribly in a high inflation environment because everyone who bought it for $60k is underwater. This is true.

However, you can apply that exact logic to gold as well, which, like Bitcoin, led consumer price inflation from the past year and a half and has performed terribly since March. The dollar has been strong. It has eaten everything in its path. It includes foreign currency, metal, crypto and stocks. But the dollar’s run is almost over in my view. There is pressure from the rest of the world for the Fed to stop hiking, and I think the central bank will commit earlier than many others do. The Bank of England has already proven that inflation can be fought until it can’t. If you think the market is looking ahead, I think that tells you something right now.