Bitcoin may be on the verge of another selloff as BTC hits this four-week low

Bitcoin bulls managed to maintain their dominance over the cryptocurrency over the past two weeks. This was a healthy relief for BTC investors who were hoping for more upside. However, investor concerns began to resurface, especially now that the cryptocurrency could be seen approaching its short-term upper range.

Here is AMBCrypto’s price estimate for Bitcoin [BTC] for 2022-2023

According to a recent Glassnode observation, the amount of Bitcoin supply in losses recently fell to a new four-week low. This suggested that much accumulation took place in October, and this strong demand contributed to the recent rally. Could this be a sign that investors can expect the recent declines to mark the support area for the rest of 2022?

#Bitcoin $BTC Supply in loss (7d MA) just hit a 1-month low of 7,656,969,279 BTC

The previous 1-month low of 7,657,118,480 BTC was observed on November 1, 2022

See calculation: pic.twitter.com/UsQNBpqrfW

— glassnode alerts (@glassnodealerts) 6 November 2022

The recent upside meant that investors who bought near the lower range were already able to make significant profits. In other words, there could be plenty of exit liquidity, especially if a new wave of bearish selling pressure were to take place.

Bitcoin bears are regaining momentum

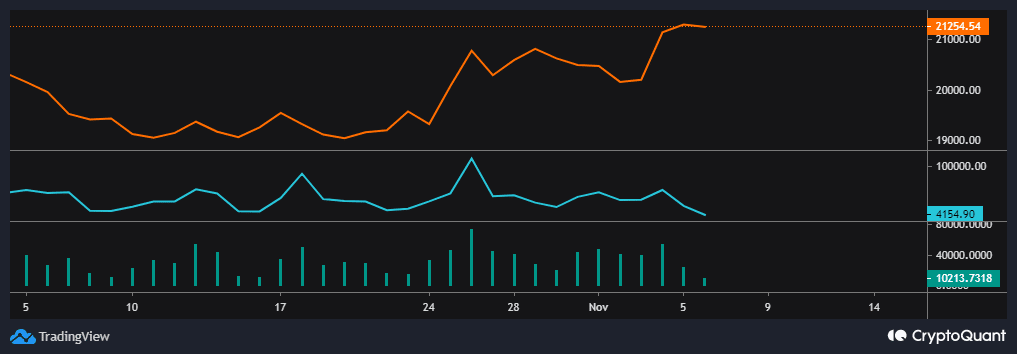

A look at Bitcoin’s exchange flows revealed an interesting observation that could determine its trajectory this week. BTC exchange supply saw significant upside in the last three to four days. Meanwhile, currency outflows fell significantly over the same period.

Source: CryptoQuant

The higher BTC exchange inflows indicated that the selling pressure was increasing. Lower exchange outflows can be seen as a sign that demand is picking up. It could also be a sign that Bitcoin could experience some downside this week.

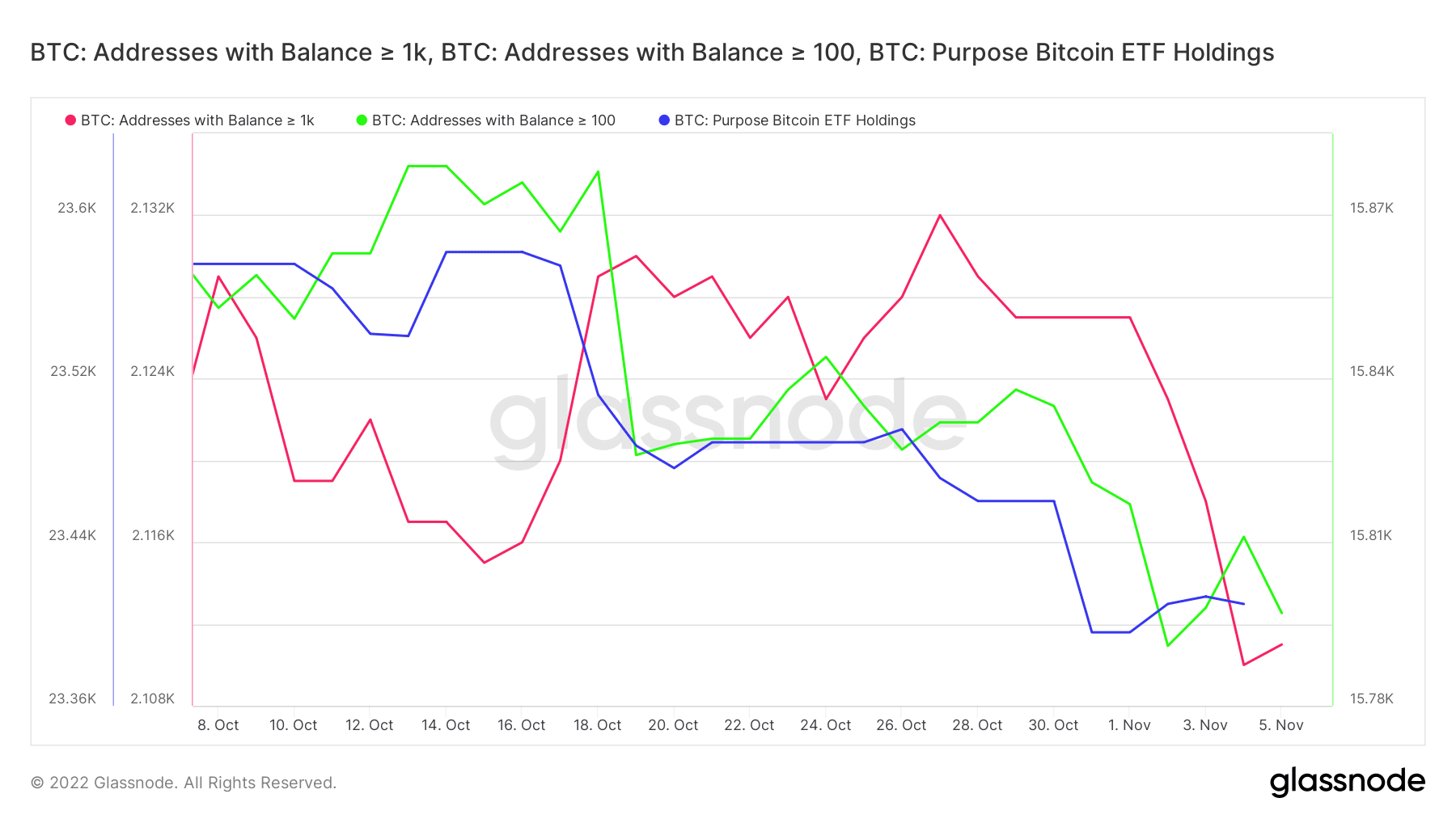

In terms of demand for Bitcoin, we observed an increase in Purpose Bitcoin ETF holdings at the beginning of the month. Addresses with between 100 and 1000 coins also recorded a significant increase until November 4th. However, the same showed some outflows in the last two days.

Source: Glassnode

Addresses with more than 1000 BTC coins have been sold since the beginning of October. However, an increase in address balances within this category was observed in the last two days. This may have facilitated the rise in the same two-day period.

The above observations underscore the mixed opinions in the market as some whales bought and others sold. Thus making it difficult to determine BTC’s next move. However, price action can provide a fair solution.

Moving on to better prospects

Bitcoin has been moving within a rising price channel for the past two weeks. The latest price action also retested the current two-week resistance area. This resistance combined with the observed increase in stock inflows and fall in stock outflows may indicate incoming selling pressure.

Source: TradingView

Furthermore, BTC observed a higher relative strength in the last two days. Nevertheless, the Relative Strength Index (RSI) still has some room left before Bitcoin can be considered overbought.

Although there is still room for some upside, recent observations suggest otherwise. The observed increase in currency supply suggests that BTC may experience a return of selling pressure.