Bitcoin Maximalists Don’t Trade Against Bitcoin – Bitcoin Magazine

This is an opinion editorial by Will Schoellkopf, author of “The Bitcoin Dog,” and host of “It’s So Early!” Bitcoin podcast.

When it comes to stacking the stakes, the ends don’t justify the means.

It seems to me that some so-called Bitcoin Maximalists think it’s OK to be a Bitcoin Maximalist–ish or to be almost a Bitcoin maximalist. As a Bitcoiner who believes in freedom, who am I to judge? Still, anyone who is almost, but not quite, a Bitcoin maximalist should pause and reflect on whether they really believe their path from fiat to bitcoin is fostering a world of hyperbitcoinization if done “by any means necessary.”

Author’s Note: My goal is not to attack anyone personally. I will use specific people’s tweets for my examples, but my intent is to respectfully challenge bad ideas, not attack people. Healthy debate about ideas in good faith helps Bitcoin, so I hope they understand. They may be of sound moral character, but a toxic Bitcoin maximalist must call out their actions that can prevent hyperbitcoinization.

The bad ideas are:

- Trade altcoins to buy more bitcoin.

- Removes laser eyes to expand focus elsewhere.

- Removes laser eyes due to an overweight focus on BTC/USD price.

To be a Bitcoin maximalist, you don’t need to store a large percentage of your net worth in bitcoin. On the contrary, it is very important to make sure you have enough fiat to pay your rent! But for the almost maximalists they will say that the vast majority of their cryptocurrency holdings are in bitcoin. This is not maximalism. This is diversification of a crypto portfolio.

If you truly believe that only one tool can ultimately monetize the world, then as a Bitcoin Maximalist you know that the only thing worth holding is bitcoin. Also, if you admit to others that you are dealing with other cryptocurrencies privately, you are sending mixed messages. To be a toxic Bitcoin maximalist, you cannot ignore your own advice and buy altcoins as well.

(Source)

Will Clemente may say he only trades alts so he can stack more bet, but that hurts the suckers on the other side of the trade who give up bitcoin for his altcoins. He will have given the venture capitalists running these altcoins what they want: exit liquidity. Toxic Bitcoin maximalists do not give the false impression that altcoins have sufficient activity on the chain, have many active participants or are used for transactions. They don’t give ICO-funded venture capitalists the satisfaction of dumping their liquidity on unsuspecting users without a goal or purpose. Instead of wasting their time on technical analysis and looking at charts for altcoins, toxic Bitcoin Maximalists want to further hyperbitcoinization.

(Source)

As Anthony Pompliano wrote in a recent edition of “The Pomp Letter”:

“The truth is that it is very difficult to be an independent person who thinks critically if your identity is tied to a financial asset. How can you seriously evaluate an asset if you have it on your biography? Are you really willing to change your mind if you receive new information if your whole identity is tied to something? Could be. But it definitely makes it harder. As I told a friend months ago, it’s hard to see with laser eyes.”

The whole point of Bitcoin Maximalism is that you don’t change your mind because you recognize Bitcoin as a zero-to-one invention. Toxic Bitcoin maximalists use laser eyes because they know there is no way to further decentralization other than proof-of-work bitcoin. While it may be worth learning how proof-of-stake ether and other tokens form consensus, it cannot be ignored that they are fatally flawed compared to bitcoin. There will never be a new decentralized blockchain that can serve as money for the world! Pomp said it’s “hard to look at with laser eyes,” but it appears he can see greater value sliding mattresses to his followers instead of promoting Bitcoin!

(Source)

In addition, prominent bitcoin traders like Dylan LeClair has removed the laser eyes, but even though LeClair doesn’t buy or sell altcoins, he has given up “laser ray to $100k”. This signals not only a lack of confidence in the bitcoin price, but in bitcoin in general. He may be aligned with the Bitcoin Maximalist point of view, but he is not going to be a toxic maximalist since he is not keeping his laser eyes on, knowing that the value of Bitcoin will continue to grow over time. Also, turning laser eyes on/off further compares bitcoin to the stock markets and its bull and bear cycles. Bitcoin is not an equity. It is a once-in-civilization monetary revolution for the world.

(Source)

(Source)

As Bitcoin Gandalf says, “Bitcoin is not an investment.” Bitcoin is a means of saving, a saving technology! Don’t take your eyes off the timing chain. When you store the value of your hard work, your energy, your life force in bitcoin, you will finally be financially free! Don’t wait for bottoms that you will probably mistime to try to catch. Follow the advice I gave my daughter and save bitcoin diligently!

(Source)

I had asked CryptoDogSkyNet (now BitcoinDogSkyNet) why he buys altcoins and he ended up abandoning his task, but you can learn without buying and selling. You can even create your own NFTs to learn how to implement them on Bitcoin, but don’t be tempted to buy as a way to learn. Learn by building, don’t give away your efforts. There is only one blockchain decentralized with the biggest network effects being money, and Bitcoin Maximalists know which one it is!

(Source)

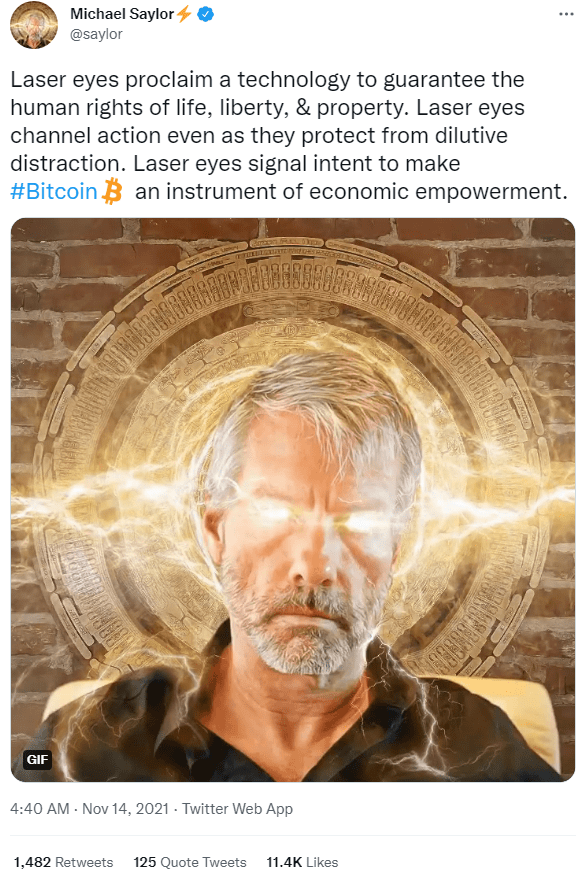

As Michael Saylor says: “Laser eyes herald a technology that guarantees the human rights of life, liberty and property. Laser eyes channel action even as they guard against diluting distraction. Laser eyes signal intent to turn Bitcoin into an instrument of economic empowerment.” Fix the money, fix the world.

(Source)

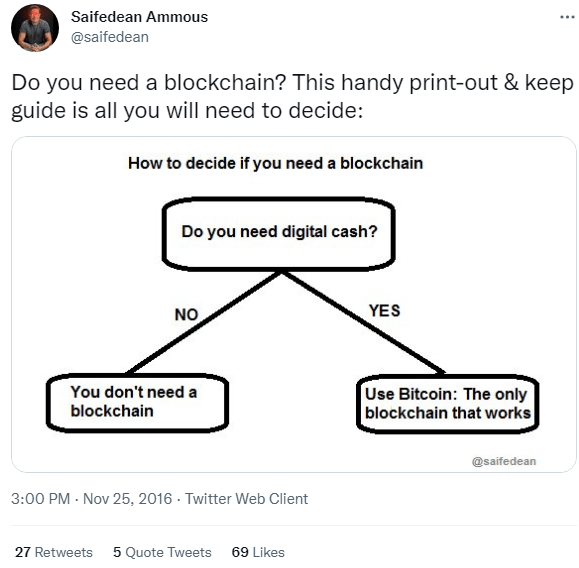

Dr. Saifedean Ammou’s simple flowchart helps remind us of all the reasons why we needed a blockchain. The sole purpose of the most inefficient database ever created is digital cash, and the blockchain to use is the only one that works: Bitcoin.

(Source)

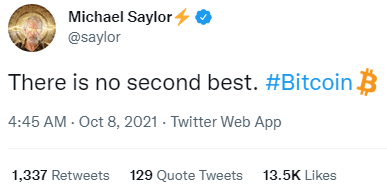

While Saylor’s quote is famous, it has done a disservice to the near-Bitcoin maximalists. They need to hear the full quote:

“Which is the best crypto asset?”

“Well, Bitcoin is the best crypto asset.”

“What’s the next best?”

“There is no second best. There is no second best crypto asset. It’s a crypto asset, and it’s called Bitcoin.”

Don’t get confused. There are no other crypto assets. There are no other blockchains that can reliably enforce decentralized digital property rights. The ends do not justify the means. Don’t be a hypocrite. Don’t give liquidity to altcoins to buy more bitcoin and stop trying to time the bottom. Lucky bet, be humble. Rise towards a hyperbitcoinized future and embrace toxic Bitcoin maximalism!

This is a guest post by Will Schoellkopf. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc. or Bitcoin Magazine.